The United States Dollar/Swedish Krona currency pair (also referred to as USDSEK and USD/SEK) is considered an exotic pair. In this article, we will examine how USDSEK is performing.

USDSEK Key Stats

- 2021 high: 9.1828

- 2021 low: 8.1242

- YTD high: 10.7626

- YTD low: 8.8971

- YTD % change: 17.16%

USDSEK Forecast

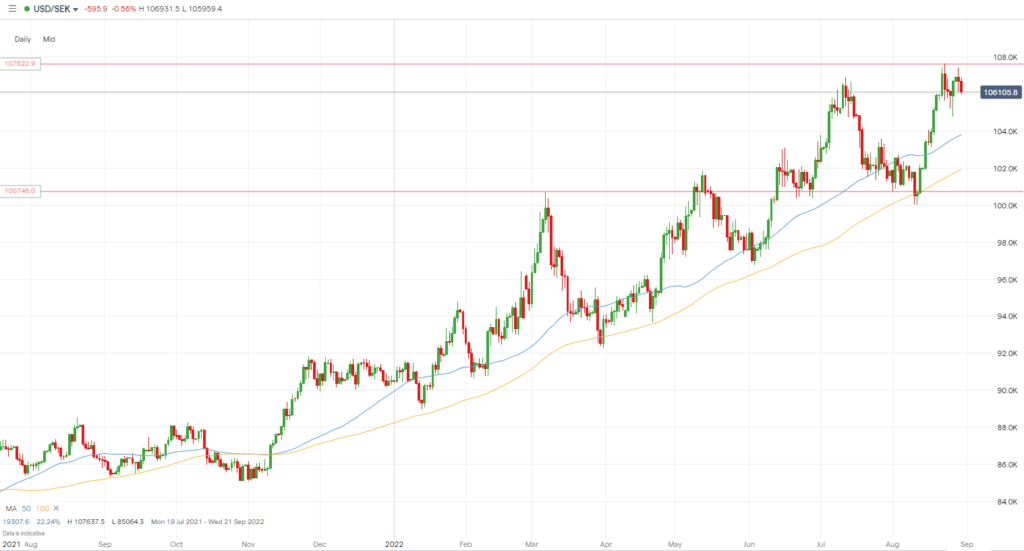

The USDSEK has surged significantly since June on the daily chart, but if we move to a weekly chart, we can see it has been climbing since February 2021. It is now at levels not seen since 2002, which provides us with a reason to be cautious. While the current market environment suggests a move higher is not out of the question, technical analysis shows that the recent move may be overstretched, and we may see a significant pullback first. As a result, in the near term, we expect a move lower, before price tests those 2002 highs once again.

USDSEK Fundamental Analysis

Fundamental analysis cannot be underestimated. It is essentially the driver of any significant moves in forex. Therefore, it can be used to develop a directional bias over both the long and short term. In addition, it is essential to analyse aspects such as economic activity and monetary policy as well as significant data releases. Analysing the macroeconomic environment is used by many successful traders and continues to do so.

During times of economic instability, the USD is one of the go-to currencies. The strength of the US economy has branded it as the reserve currency. As a result, it has earned the title “king dollar.”

For the USD, you must keep an eye out for the major economic data releases that occur each week and month. Factors and data such as payroll data, GDP, retail sales, non-farm payrolls, and much more are all drivers of the US economy. These releases help central bankers, the government, traders, investors, economists, and others gain a fresh perspective on the current health of the US economy. These data releases can also impact the price of the USD and other currencies.. As of now, inflation has been a critical issue in the US, although it moved lower to 8.5% at the last reading, indicating the Fed’s rate hike program is having an impact. Given the global economic uncertainty and the Fed raising rates, it’s obvious why the dollar has recently had a major bull run.

The Swedish Krona moves heavily on its monetary policy. Its central bank is one of the oldest banks to date. The SEK is also impacted by the currencies of other Nordic countries, such as the Danish Krone or the Norwegian Krone. Despite Sweden being a small economy, the SEK is considered a safe haven due to its tech-savvy workforce and numerous multinational corporations. Therefore, any global uncertainties, such as inflation worries or recessions, can cause a rise in the SEK. However, recent years have seen overall weakness for the Krona as the country maintains negative interest rates at -0.25%. This is unlikely to change as the bank persists with negative rates as they remain confident.

USDSEK Technical Analysis

The USDSEK has been in an uptrend since June, with the 100 MA providing an excellent trendline. Therefore, a pullback to the 100 MA is probably something to watch for as a signal to go long. On the weekly chart, level 10.0746 is key level for traders to use as another potential area for a pullback. Furthermore, 9.6931 would be an area to watch as a move back towards this level may signify the end of the current bullish move.

When looking at the upside, initially, its recent high of 10.7626 in recent weeks will be the first resistance level to watch out for, with the price potentially looking to break above the area and continue its surge. However, given that it is currently at levels not seen since 2002, a push higher from here may take some time to develop.

Trade USDSEK with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.