Trading agricultural commodities offers the potential to generate returns by investing in one of the most crucial sectors of the global economy. The benefits of investing in the likes of corn, cotton, wheat, and soybeans extend past capital returns, as gaining exposure to the sector offers an opportunity to diversify a portfolio that might otherwise be too heavily weighted towards other assets such as stocks. Trading agricultural commodities is very much like trading any other asset, but there are some unique features of the sector which investors should take time to research and understand.

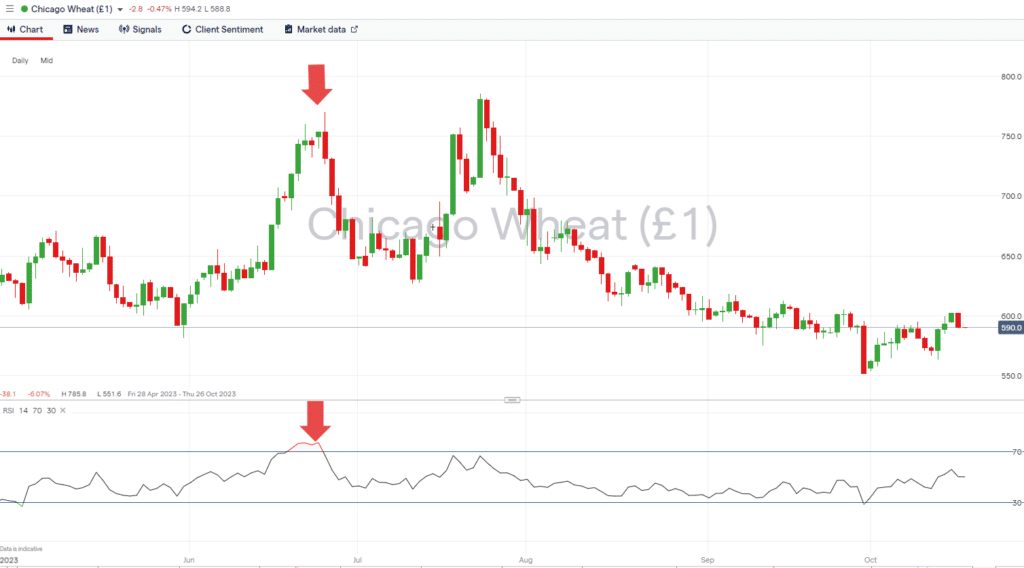

Wheat price chart – 2023

Source: IG

The good news is that once you’ve completed your research and identified a trading opportunity, it’s easy to open an online account with a broker and speculate on the price moves in various agricultural commodities. Setting up an online account takes minutes, and the process is designed to be as user-friendly as possible. Whether you’re an experienced investor or a beginner looking to run a buy-and-hold style strategy or speculate on short-term price moves, the first task is identifying which of the agricultural commodity precious markets in which you want to invest.

Agricultural Commodities Explained

Agricultural commodities are the unprocessed products of farms, ranches, nurseries, and forests cultivated or raised for sale on the open market. They differ from other assets in that they can be seen as essential goods (with inelastic demand) because everybody has to eat.

Trading in agricultural commodities is conducted on a range of specialist exchanges located around the world. They include the Chicago Board of Trade (CBOT), the New York Mercantile Exchange (NYME), the Intercontinental Exchange (ICE), the Tokyo Commodity Exchange (TOCOM) and the London Commodity Exchange (LCE). Prices recorded on these exchanges represent the heart of the market. It is where the major participants in global trade buy and sell. Data from the exchanges feeds into the trading dashboards of retail investors worldwide who can trade instruments such as CFDs (Contracts for Difference) that track price moves in the underlying market.

Given the importance of the supply chain of agricultural commodities, government agencies and other organisations reserve the right to intervene to ensure appropriate supply levels; however, the mechanics of trading agricultural commodities are the same as when trading any other asset, such as gold, forex, or stocks.

Using fundamental and technical analysis can establish a view on whether any of the agricultural commodities are over or undervalued. Fundamental analysis incorporates research based on actual world events such as trade deals and harvest yields. Establishing the fair value price of a commodity involves considering supply-side factors, such as the time it takes to grow a crop and demand-side factors, such as consumer habits and income levels.

It’s also possible to incorporate technical analysis into a strategy which aims to get the most out of the agricultural commodity sector. That approach uses historical price data to predict which direction price might next head. It uses statistics, price data, and charts to create indicators pinpointing times to buy or sell agricultural commodities.

Wheat price chart with RSI ‘sell’ signal – 2023

Source: IG

Oil Seeds

Oil seeds are crops which are grown for their high oil content. After the raw material has been processed, various products, including oils and meals, can be extracted and sold. Demand for the extracted oils is high and inelastic due to their use in food production, with the meal often used as feed for livestock.

The group comprises four primary markets: soybeans, palm oil, canola, and cotton. Cotton’s inclusion in this category highlights how agricultural commodities resist easy classification. Still, established market conventions are in place, so traders can easily locate the market and trade a desired product.

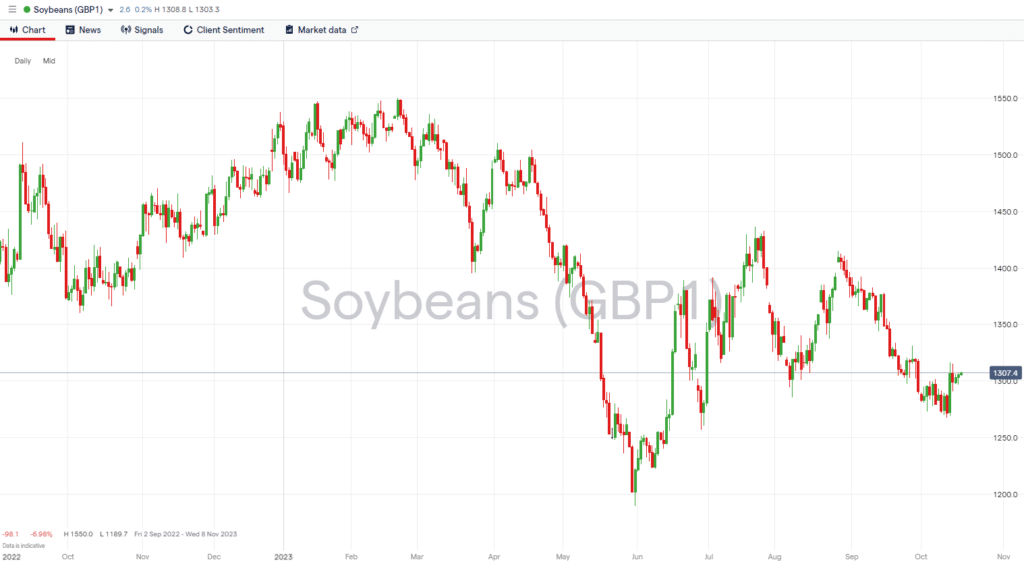

Soybeans price chart – 2022 – 2023

Source: IG

Like other commodities, oil seeds can be traded around the clock. The major exchanges are located in different time zones, so as one closes, another opens, which means prices fluctuate on a 24/5 basis. Peak trading times, when most traders are active, are typically between 2 pm and 4.30 pm London time, as this is when the European and US exchanges are open simultaneously. It is an essential factor to consider because higher trade volumes can be associated with lower trading costs and increased price volatility – which is attractive to day traders. Because major participants are placing orders, it can also be seen as a time when the clues offered by trading activity are ‘stronger’. New trends formed during this period may be more likely to be confirmed than those formed when trading volumes are lower.

Grains

The grains group of commodities includes wheat, oats, barley, rough rice, and corn. They are grown for consumption by humans and livestock and are increasingly used as biofuels.

There is a relatively high correlation between the price of oil seeds and the cereals group of commodities. To some extent, they can serve similar purposes, so if one group member, for example, soybeans, becomes more expensive in relation to the rest of the sector, there is some scope for another, such as canola or wheat, to be seen as an acceptable alternative. That is particularly true when the products are being used as animal feed.

Oats price chart – 2022 – 2023

Source: IG

Dairy

Dairy commodities include milk, butter, whey, and cheese. Trading activity in these products dates back to the formation of the Chicago Butter and Egg Board in the 19th century. Today, the core market is the CME in Chicago. Trade volumes in these markets are lower than in others, such as wheat and cotton and not all retail brokers offer markets in dairy commodities.

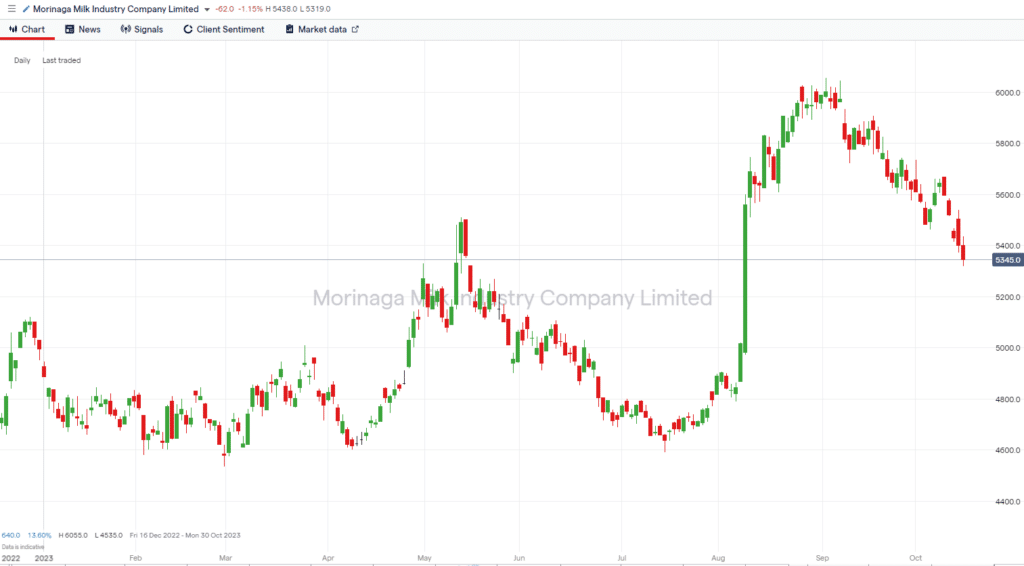

Those looking to gain exposure to the dairy sector can buy stocks in companies closely involved in the dairy industry. Listed equities in firms specialising in milk production include Morinaga Milk Industry Limited (MGAAF), which has a market capitalisation of JPY 258bn. This approach can extend to buying stocks in firms that specialise in grain, meat, or seed oil production, and stocks are often seen as a more convenient way to invest. They can also pay dividends, representing a form of passive income, with the current dividend yield of MGAAF being 1.667%.

Morinaga Milk Industry Limited (MGAAF) price chart – 2023

Source: IG

Meat

Meat commodities are broken down into two groups. The primary market supports trading in lean hogs, pork bellies, live cattle, and feeder cattle. There are also markets for meat products which have already been butchered, including hides, organs, bones, and hooves.

The actions of governments and regulators can heavily influence prices in meat markets. During the Covid pandemic, increased regulatory burdens resulted in EU pork, chicken, and beef production falling by 2%. With more regulatory controls expected and plant-based diets gaining popularity, a lack of investment in the sector has resulted in analysts predicting a further 2% fall in total production levels in 2023. Like other assets, agricultural commodity prices are driven by supply and demand, which can cause new price trends to form.

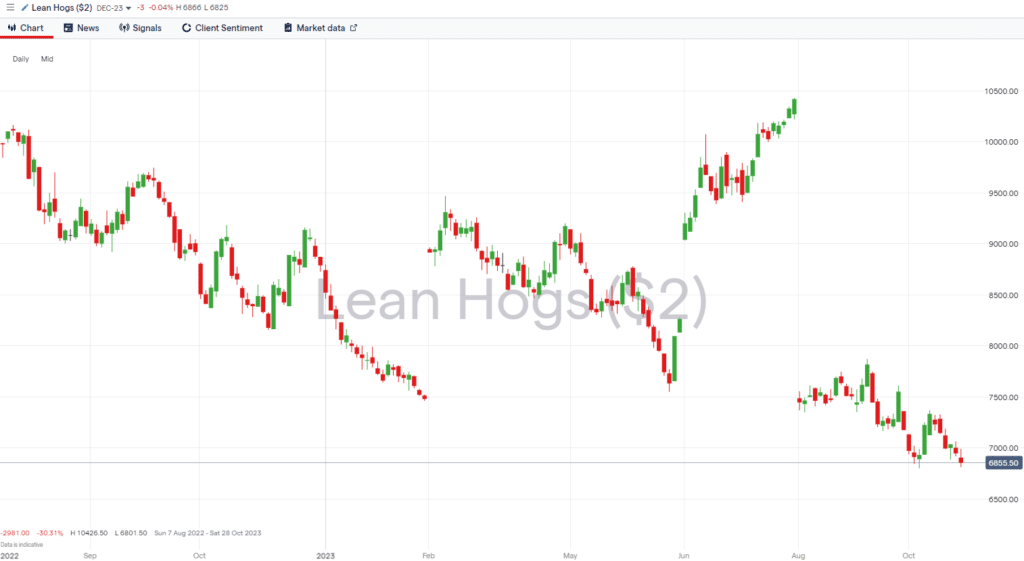

Lean Hogs price chart – 2023

Source: IG

Soft and Other Miscellaneous Commodities

The term’ soft commodities’ is sometimes used to describe the entire range of agricultural commodities but is more accurately used to describe the specific categories of cocoa, coffee, sugar, and frozen concentrated orange juice (FCO). Those commodities are traded on well-established and highly liquid markets and are widely available on retail trading platforms. Coffee is, in fact, the most commonly traded agricultural commodity by value, with trading activity in that market sometimes totalling $31bn per year.

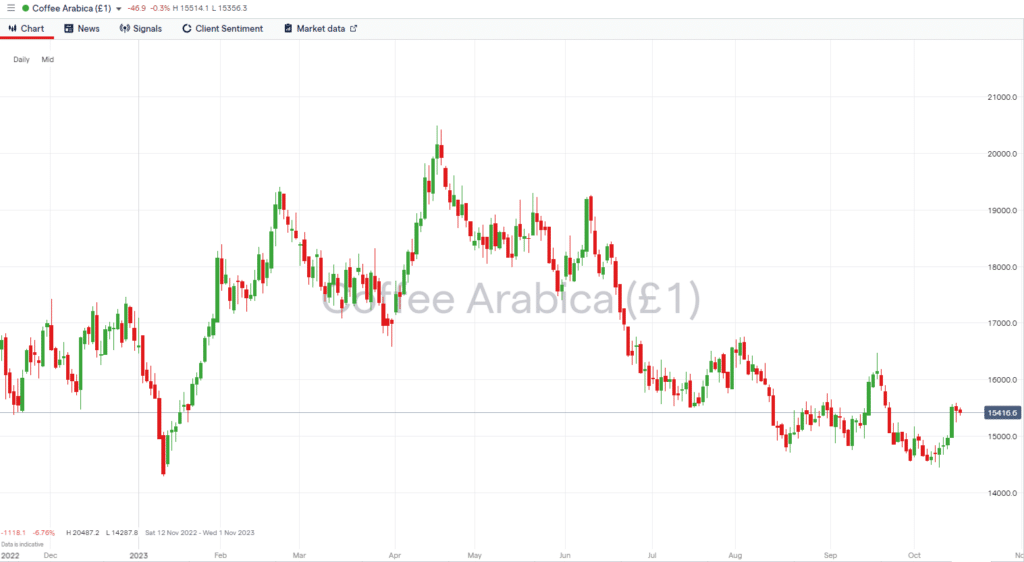

Coffee price chart – 2023

Source: IG

There are also commodities which, while actively traded, don’t fall into one of the main categories. They include lumber, rubber, and wool. The most actively traded of these three ‘miscellaneous’ commodities is lumber, with demand for that product being closely correlated to activity levels in the construction industry and increasing demand from energy producers.

How to Trade Agricultural Commodities

Sensible trading requires carrying out thorough research. Given the popularity of the agricultural commodity sector, an extensive range of freely available materials are available to investors. These explain the nuances of the markets and the price drivers influencing prices. It is also essential to keep track of news events because unfavourable weather can impact production yields, and geopolitical risk and food security concerns can result in governments and regulators stepping into the market and implementing controls.

The sometimes hard-to-predict nature of many of the variables in play can result in relatively high price volatility in agricultural commodities. How that is approached depends on each investor’s personal risk profile and investment aims. Those looking to mitigate against the risk of dramatic price moves can trade in small size and use stop losses. Others running short-term strategies might be drawn to the market because of the chance of a sudden price change.

There are a variety of different financial instruments to choose from when trading agricultural commodities, each having their pros and cons. Stocks have already been identified as a way of gaining indirect exposure to the dairy sector and remain an entry-level way to move into investing in agricultural commodities.

It is also possible to use CFDs that track the price of a commodity on global exchanges. They represent an agreement between an investor and a broker, a structure that allows them to have additional functionality features, such as the ability to use leverage or sell short. However, CFDs incur daily financing fees.

Agricultural commodity Exchange Traded Funds (ETFs) are cost-effective, passive investment vehicles comprising a basket of different assets with similar characteristics. For example, the Invesco DB Agriculture Fund ETF (DBA) is formed by holdings in the most liquid and widely traded agricultural commodity futures. It tracks the performance of the broader agricultural commodity sectors, offering exposure to the sector in a single trade.

The Pros and Cons of Trading Agricultural Commodities

Sensitivity to ‘food security’ means that agricultural commodity markets are constantly exposed to the risk of governments intervening in the market. That isn’t necessarily bad news if your position benefits from the situation. However, it does highlight how commodity trading requires factoring in a wide range of variables, appreciating that price volatility might spike, and keeping up to date with market conditions.

If risk management is incorporated into your strategy, it is still possible to benefit from price moves in agricultural commodities without being forced out of positions when markets are distressed. Effective selection and management of positions allows you to incorporate into your portfolio an asset type which experiences price moves potentially having a low correlation to other positions.

The Best Commodities Brokers

Once you’ve established which agricultural commodity you want to trade, the next step is to choose a broker which is trustworthy and offers the tools that best support your style of trading.

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Final Thoughts

There are plenty of good reasons to invest in agricultural commodities, and it’s easy to get started. The market offers a way to gain exposure to price moves in a unique area of the global economy. It can help you diversify your portfolio to mitigate against risk and smooth out returns. Price moves can be volatile due to the nature of the variables in play, and the markets can be considered to have greater risk-return than other asset types. However, allocating a percentage of your available capital to agricultural commodities can help you adopt a more considered approach and achieve your investment aims.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.