The Aroon Indicator is a popular member of the Oscillator family of technical indicators. Tushar Chande developed the Aroon Indicator in the nineties to help traders determine the strength of a trend and whether pricing behaviour was favouring a trend or sideways action. Traders use the “Up and Down” indicator lines to judge the power of a trend, as absolute values signify strength, but simultaneous changes reflect a market that has yet to make up its mind.

In this article we will educate you on the usefulness of the Aroon Indicator, focusing on its usefulness in forex trading. You will learn how to interpret it and its advantages, how it’s calculated and a little about its history.

Tushar Chande was born in India in 1958 but spent most of his career in America. He is a professional trader, but he gained fame for his research in the Technical Analysis field and for his innovative indicator systems. He has written several books and scientific articles, but his most acclaimed work is Beyond Technical Analysis: How to Develop and Implement a Winning Trading System. He created the Aroon in 1995. A list of his other creations in the indicator arena includes VIDYA (Variable Index Dynamic Average), Adaptive Stochastic Oscillator, Stoch-RSI, and Dynamic Momentum Index. He has also created several successful asset management companies in his lifetime.

The Aroon Indicator is classified as an oscillator since the values fluctuate between calculated upper and lower boundaries. The indicator chart typically has two lines, an “Up” version and a “Down” version, which simultaneously measures the momentum in either direction. When polar opposites occur, overbought or oversold conditions are at play. The Aroon is also regarded as a leading indicator since it attempts to detect that a change in market pricing direction is imminent.

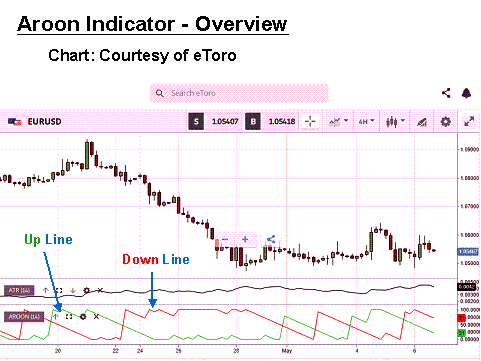

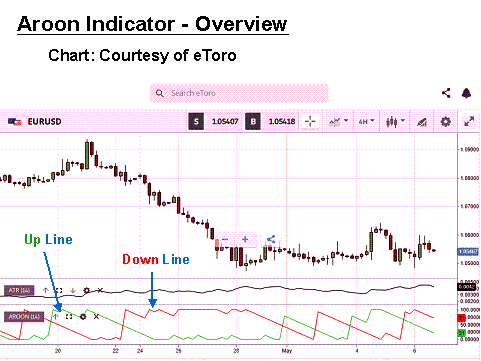

The Aroon Indicator is composed of two fluctuating curves. In the “EUR/USD” 4-Hour example above, the “Green” line is the Aroon “Up” Indicator, while the “Red” line represents the Aroon “Down” Indicator. The weakness in the Aroon is that timing is not necessarily a product of the oscillator. Still, the interpretation of the action of each opposing line can aid in the confirmation of buy and sell signals. Forex traders believe that the most significant value of the Aroon Indicator is in distinguishing if a long-term trend has indeed ended or whether it has stalled.

The critical reference points are high points, low points, and simultaneous positioning relationships. The two Aroon indicator lines behave like a rollercoaster, but the indicator tends to be sensitive to peaks and valleys of future pricing behaviour. It works best in trending waves but is inconclusive during ranging periods. The Aroon oscillator also attempts to convey pricing momentum direction changes. Typical oversold and overbought conditions occur at extremes and are generally confirmed when the opposite indicator line traverses the mid-region at a similar time.

The subtle dance between the two curves can be a challenge to interpret, but practice on a demo system is the recommended way to build confidence with this indicator and learn its nuances. When Chande developed this Technical Analysis tool, he was focused more on the stock world. He suggested a look-back setting of 25 periods, but with the fast-changing pace of the forex market, MetaTrader4 and other proprietary trading platforms have set the default at a standard “14” setting. You may wish to test the Aroon with a “25” setting, but a “14” tends to be more responsive to sudden changes in pricing behaviour.

As with any indicator regimen, the alerts and signals can never be correct at all times. Interpretation skills come with experience, and it is always wise to combine your effort with confirmation from another indicator to gain supporting insights for your overall decision-making process. We have added the Average True Range (ATR) indicator for this purpose in our overview and examples to follow since it helps telegraph a change in investor sentiment. This information, coupled with directional input from the Aroon, can be an effective strategy.

How is the Aroon Indicator calculated?

The Aroon Indicator is based upon the concept that bullish trends will result in higher highs and vice versa for bearish downtrends, using a calculation method more about counting how many new high or low occurrences happen within a specified look-back period. The Aroon is not standard on all MetaTrader trading software releases, but many major proprietary trading platforms include this indicator as standard. This calculation formula sequence involves these straightforward steps:

- Choose a look-back period “N” for the “Aroon Indicator” (Standard is “14”).

- Aroon-Up = 100 * ((N – Number of periods since highest high)/N).

- Aroon-Down = 100 * ((N – Number of periods since lowest low)/N).

Thankfully, software programs do the heavy lifting when it comes to counting specific highs and lows and assembling the data to produce an Aroon Indicator, as displayed in the bottom portion of the above overview chart. The look-back period setting for this depiction of the Aroon is “14”, more appropriate for forex trading than Chande’s proposed “25” setting.

This computational work shows that strong trends occur when the respective curve hovers near the “100” mark while the opposing curve falls to near zero. When the curves intersect, it is interpreted as a “Buy” or “Sell” signal, depending on which curve takes the lead. If the “Up” or Greenline is rising, then a shift to an uptrend is in progress. When the “Down” or Redline rises toward the 100 level, it is time to consider shorting your chosen asset. The latter situation is illustrated in the overview chart, i.e., a strong downward trend formed in the first half of the chart.

Using the Aroon Indicator in forex trading

The Aroon indicator explained is something different in that the trader must observe the dance between two distinctly separate curves and then interpret if the opportunity suggested is worthwhile. For the experienced trader, there is a wealth of information revealed by the Aroon, the reason the indicator remains in favour. Here are just a few of the high points that will help you:

- determine when new trends, whether up or down, are forming.

- gauge the strength of the trends as they develop.

- determine if the market is consolidating or preparing to break out.

- anticipate potential market pricing reversals.

For the Aroon, the excitement begins when the two curves decide to exchange positions. The shift is quick, indicating that a new trend is in formation. The longer each curve hovers in the extremities of the indicator space, the longer you are advised to hold onto your position. When the two curves keep flipping back and forth, the market cannot make up its mind. Ranging behaviour is at hand, but a breakout will happen. When will the market reverse back to a trend? The trader need only wait for a dramatic shift in the positioning of the Aroon curves.

Let’s revisit the overview chart. There is an early up-tick trend, followed by a strong downdraft. The curve crossover in the middle of the chart signifies the ending of the previously strong movement. The ensuing choppiness is symbolic of a return to ranging behaviour. At this stage in the story, traders are patient and waiting for the Aroon to predict a significant breakout. In the example above, no shift was forthcoming, but, at some point, the market will shift.

Related Articles

A simple Aroon Indicator trading strategy

As complicated as the Aroon appears, it can be used in a straightforward Aroon indicator strategy to reap sizable gains in the forex market. Opening a position in the forex market is easy. Many indicators can tell you the optimal timing; however, few indicators are as proficient at telling you how long to hold onto your position as the Aroon.

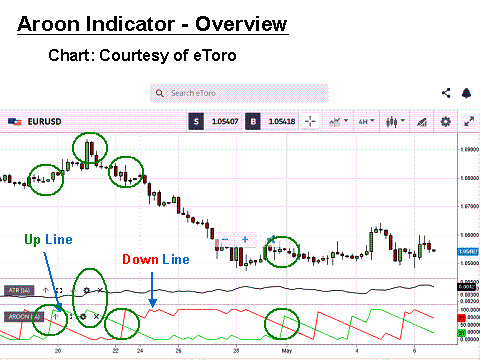

For purposes of this strategy discussion, let’s look at the previous overview chart with a few annotations:

Observe the addition of Green circles and one oval. These areas denote signals from the use of the Aroon with ATR support in some cases. Two trading opportunities are highlighted. If you are an aggressive trader, you might move on to both opportunities. For a conservative trader, there is more than enough gain in the second trade to satisfy your primary trading objective.

The keys here are to focus on crossovers, the time adhering to an extreme, and the moment when the curve descends from its peak. The ATR signals when investor sentiment rises, a sign that a major move is imminent, either up or down. The following system is for educational purposes only. Markets do not always comply with what seems certain, but your goal is consistency. Here is the 2-step strategy portrayed in the above graphic:

Trade #1:

- Pick your entry point after the “Green” Up line crosses above the “Red” Down line.

- Execute a “Buy” order for no more than 2% to 3% of your account.

- Place a stop-loss order at 30 “pips” above your entry point, based on the ATR reading.

- Determine your exit point after the Green Up line peaks and heads down and the ATR signifies increased investor sentiment.

Trade #2:

- Pick your entry point after the “Red” Down line crosses above the “Green” Up line.

- Execute a “Sell” order for no more than 2% to 3% of your account.

- Place a stop-loss order at 30 “pips” above your entry point, based on the ATR reading.

- Determine your exit point after the Red Down line crosses the Green Up line. You could have exited after the Redline peaked, but since it was a long trend, patience was warranted.

Steps “2” and “3” for each trade represent prudent risk and money management principles. This simple trading system would have yielded two profitable trades totalling roughly 600 pips. This trading system was profitable for these two situations but remember that not every plan goes according to expectations. Please be aware that trading is risky and can result in significant losses. Risk management techniques will ensure that you return another day if and when trading gains do not materialise as planned.

Example Aroon Indicator strategy trade

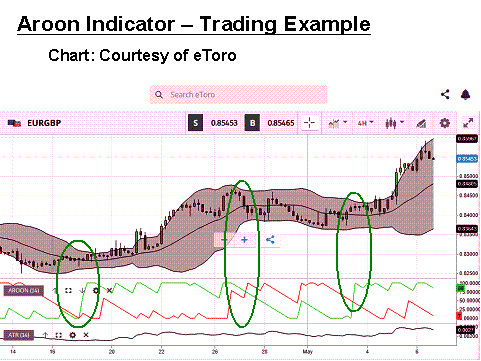

For a current forex trading example, we have chosen the “EUR/GBP” currency pair, displayed on a 4-Hour timeframe, courtesy of eToro. Take a moment to review the following chart and the annotations contained within:

We have chosen the popular “EUR/GBP” pair for our current real-time trading example, which displays two legs of a strong upward trend, something the Aroon indicator is designed to attack. Even though the UK and Europe are nearby, economic and central bank differences are enough to yield several trading opportunities. The Green ovals depict optimal entry and exit points along this path. We have added the Bollinger Bands for ATR clarity.

In the first oval, the Green Up line signals a “Buy” order is appropriate. The ATR is slow to signal turnover intensifying. A conservative trader might wait, but an aggressive trader might move at the crossover since the Greenline hit the extremes so quickly. The exit follows the Green decline from its peak, along with a Red intersection. After a ranging period, another crossover signal occurs. There is no exit given yet. Patience is key. Profit from Trade #1 was about 150 pips. Please be aware that trading is risky and can result in significant losses.

The Best Forex Demo Accounts

To master the SMA trading strategy you need to practice it. Reading the signals the charts and timing your entry and exit points correctly are skills that need to be mastered in order to maximise your profits. Please be aware that trading is risky and can result in significant losses. This is where a forex demo account comes in: It allows you to practice your new strategy without risking any of your hard-won capital. Below we have picked out some of our favourite forex demo accounts

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Conclusion

The Aroon indicator system is a unique member of the oscillating family of technical tools. Its presentation is based on the locations of two separate lines when most indicators generate alerts from a single indicator curve. As with other oscillators, it embodies overbought and oversold territories, but it also includes a measure of the strength of the prevailing trend.

Using the Aroon indicator in combination with other tools of the trade could make for a formidable forex trading strategy. However, before deploying this strategy in real-time, it is highly recommended that you invest in several practice sessions on your virtual demo system before putting any of your money at risk. There are no shortcuts to gaining experience, but to succeed in the forex market, interpretation skills are primary to finding good trading setups. Veterans swear by their demo sessions, and as you practice with the Aroon indicator strategy, you will learn quickly.

Continue Learning

- More Forex Indicators Explained

- Relative Vigor Index Explained

- Heikin Ashi Settings

- Momentum Indicator Explained

- Stochastics Indicator Explained

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.