The markets look set for a quieter week. After two weeks of dramatic news events, this week brings the US Thanksgiving holiday on Thursday. The willingness of traders in the world’s most important markets to take a three-day week traditionally results in markets drifting to some extent.

The European open on Monday has seen equity indices post small percentage increases in value which is characteristic of a methodical move into riskier asset groups. Currencies offer a little more price volatility and a chance for momentum to swing either way.

GBPUSD

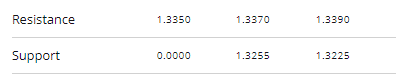

Last: 1.3322

Pivot: 1.3285

Review:

The four-hour candle chart on Friday had an RSI of 46. That opened the door to bullish price action but that same time-frame is now showing an RSI of 70. Touching the key metric and ‘turning red’ suggests that price may show weakness, or at least not rise as strongly during the opening hours of Monday’s European session.

Source: IG

The 4Hr RSI last broke the 70 (oversold) level on the 11th of November. The sell-off which followed didn’t occur until 24 hours later but did ultimately come.

Preference scenario – Bullish:

Long positions above 1.3285 with Target 1 at 1.3350 and Target 2 at 1.3370.

Alternative scenario – Bearish:

Short positions below 1.3285 with Target 1 at 1.3255 and Target 2 at 1.3225

EURGBP

Last: 0.8877

Pivot: 0.8891

Review:

EURUSD had a quiet day on Friday, posting a modest rise at the close. It continues to trade within the downward channel which was outlined by Forex Traders analysts last week and Monday’s early trading saw a relatively sharp sell-off.

Source: IG

Trade volumes continue to flatline and a break of the September low at 0.8866 would be bearish. Price is currently well below all the major daily SMA’s suggesting more price weakness. It would take a break of the supporting trend line to confirm any sell-off had significant momentum.

Preference scenario – Bearish:

Short positions below 0.8890 with Target 1 0.8866 and Target 2 0.88249

Alternative scenario – Bullish:

Long positions above 0.8878 looking to trade a rebound and with Target price of 0.8968

EURUSD

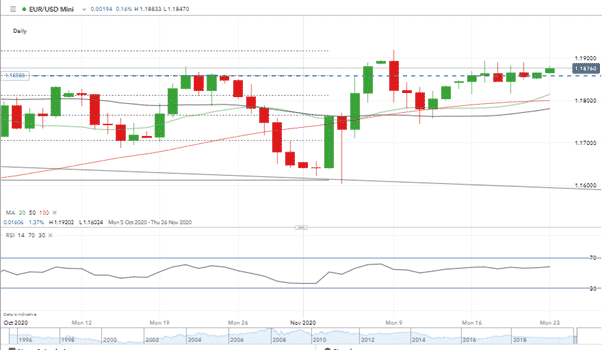

Last: 1.1879

Pivot: 1.1850

Price has spent the last six days consolidating at 1.186. Still holding above that level the cross by the Daily 20 SMA of the 100 SMA is a bullish signal. The RSI has for two months traded comfortably within the 34 and 62.

There are plenty of analysts suggesting price could break to the upside from here. They could well be right and there appears little reason to bet against them. With price lacking any real conviction, many will be waiting for a break of 1.192 before stepping in with long positions.

With price starting the week trading above the Pivot, it is a market worth monitoring. The potential downside being getting caught in a ‘boredom trade’ which is hard to get out of with the US holiday causing all markets effectively to have a three-day week.

Source: IG

Preference scenario – Bullish:

Long positions above 1.1850 with Target 1 at 1.1890 and Target 2 at 1.1905.

Alternative scenario – Bearish:

Below 1.1850, look for further downside with Target 1 at 1.1830 and Target 2 at 1.1815.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk