- The surge in the value of the US dollar is turning the screw on US shareholders

- Inaction by big corporations is resulting in forex exposure going unchecked

- A stronger dollar results in base currency earnings being lower in real terms, which is causing a disconnect in the market

Another 75-basis point interest rate hike by the Fed on Wednesday signals a continuation of headlines referencing “Dollar Strength”, “The King Dollar”, and “Dollar Supremacy”. It’s a pattern which has now been running for ten months. While a strong currency is traditionally seen as positive for an economy, it’s causing considerable pain for millions of shareholders of US stocks.

With so many US firms being multinationals, a large percentage of their earnings are in non-USD currencies, and that is creating a disconnect. When those international revenues are reported back to the firm’s US HQ and converted to the firm’s base currency, US dollars, the total profits are smaller because the dollar has appreciated in value.

The currency effect impacts sales made in the euro, yen, pound, or the currency of any other country where Netflix, Microsoft, or Johnson & Johnson sell their goods. Something’s got to give. Either big global US corporations need to start hedging their overseas revenue, and there’s no sign of that happening, or US stock valuations will continue to be squeezed.

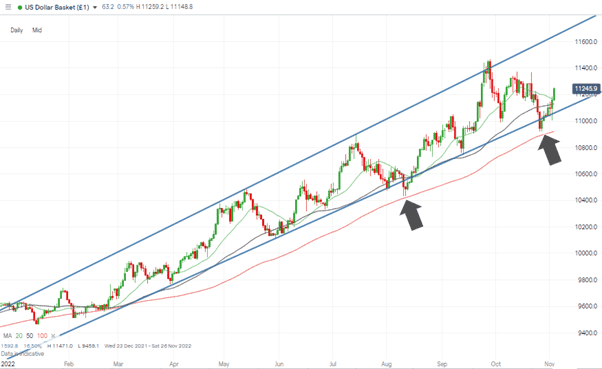

US Dollar Basket Index – Daily Price Chart 2022 – +17.5%

Source: IG

Also Read: What is the USD Index?

The US Dollar Basket index is now up 17.5% on a year-to-date basis. That’s a significant problem for US investors. Jonathan Golub, head of US equities strategy at Credit Suisse, says that every eight to 10% increase in the dollar index cuts roughly 1% off S&P 500 earnings.

As a result, the financial statements of US firms which reported Q3 earnings season misses are full of references to currency exposure but contain little mention of proactive plans to ameliorate the effects. Hedging foreign revenues in the currency market is a tried and tested way of balancing the impact of forex moves but is, so far, largely off the table.

Inaction could stem from career risk. Senior managers who decide to hedge inflation risk are personally accountable if they get it wrong but can blame ‘market forces’ if the dollar continues to appreciate. The Netflix Q3 earnings report confirms the firm is willing to continue to report earnings subject to the influence of forex markets:

“However, when currency movements are rapid, they may affect our near-term operating margin. We’ll tend to outperform our near-term operating margin targets on dollar weakness and underperform on dollar strength.”

The trillions of dollars being bought by overseas investors need to go somewhere. One natural home for them is US stocks, but the currency effect reduces their attractiveness. It could ultimately result in dollar weakness as investors decide to invest in local stocks instead and wait for the dollar surge to subside.

People Also Read

- Forex Outlook – Technicals vs News Flow

- GBPUSD – How Far Can The Rishi Bounce Go?

- The Best and Worst Performing Currency Pairs in September 2022

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, don’t hesitate to get in touch with us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk