- GBPUSD strength follows the appointment of Rishi Sunak as Prime Minister

- The Rishi-bounce has brought key resistance levels into play

- Strong US fundamentals pose a bigger challenge for GBPUSD bulls

The UK has its third Prime Minister in as many months, but this time the appointment appears to be in tune with the financial markets. Soon after Rishi Sunak took up the post, sterling burst into life, and GBPUSD reported a 3.28% week-to-date gain.

Sunak’s career history includes stints at Goldman Sachs and hedge funds, but the rally in cable was about more than him being able to speak the same language as City traders. Financial prudence and balancing the books are firmly back in fashion in Westminster.

GBPUSD Hourly Price Chart – The Rishi Bounce

Source: IG

Also Read: GBP/USD Chart Forecast

Cable’s Party Could be Over Before it Begins

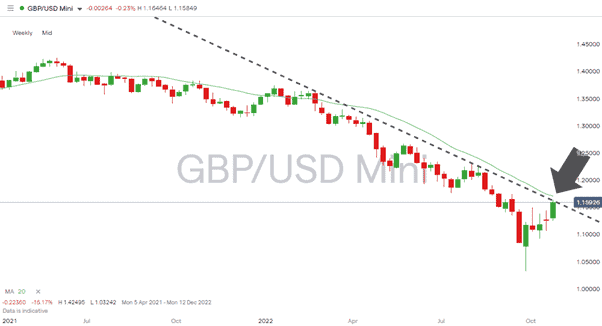

Those hoping that a change at the top might be enough to end the year-long downtrend in GBPUSD could do with applying some caution. The currency pair is approaching key technical resistance levels, and fundamental analysis reveals significant headwinds.

The upward move by GBPUSD has taken it to 1.1564, within touching distance of the downward trendline, which dates back to the start of the year, currently in the region of 1.16154. That trendline sits just below the 20 SMA on the Weekly Price Chart, now 1.17055 – and the last time cable traded above that metric was 21st February 2022.

GBPUSD Weekly Price Chart – 2021 – 2022

Source: IG

There’s every likelihood that price could test those key resistance levels, but the chances of a confirmed break are hampered by the economic situation in the US.

At the last three meetings of the FOMC, the Federal Reserve’s brightest minds hiked interest rates by 75 basis points and confirmed their approach would continue to be “hawkish”. With geopolitical and economic uncertainty on the rise, the greenback’s position as a safe-haven currency is now also supported by a US base rate of 3.25%, considerably higher than the UK’s 1.75%

The real problem for GBPUSD bulls is that looking through the interest rate rises to the next level of analysis shows that the US economy is in good health. Employment numbers are stable, and it’s more than two years before the next Presidential election. The only economic handicap is inflation, which is being targeted very aggressively and is paradoxically a sign of underlying strength.

Economic growth prospects in the UK appear far less appealing to investors. An investor weighing up whether to buy into the US or UK would have to consider the latter’s recent political mayhem, the ongoing work being undertaken to manage the shift away from EU membership, and increased chances of a snap early election being called.

People Also Read

- Forex Outlook – Technicals vs News Flow

- Japanese Yen – The Other Major Forex Trend Of 2022

- The Best and Worst Performing Currency Pairs in September 2022

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, don’t hesitate to get in touch with us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk