Despite many market participants expecting a Santa rally, it didn’t quite occur in December 2022, with sentiment remaining risk-off during the month. However, the potential for a policy shift by the Bank of Japan resulted in the yen rising while the Russian ruble weakened, moving back towards levels last seen before Russia’s invasion of Ukraine.

EURRUB +17.87%

- The euro gained significantly against the ruble in December, making a move back toward its pre-Ukraine invasion level.

- After the ruble weakened substantially in the immediate aftermath of the Russian invasion, it then went in the opposite direction and strengthened.

- However, the EURRUB is now back up, approaching its previous levels, however, given the slight dip in early January, it still has some way to go.

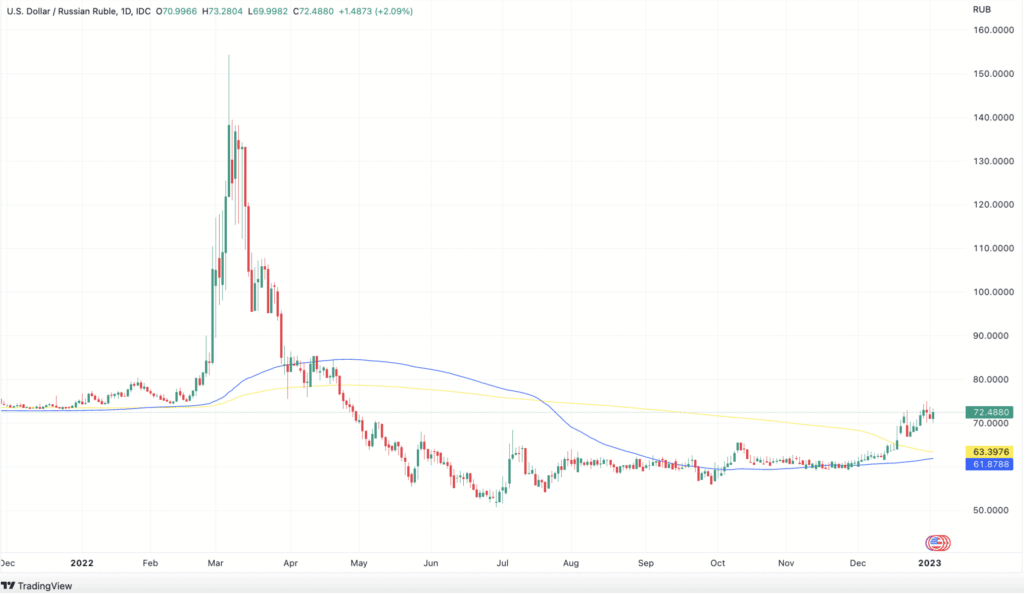

USDRUB +14.53%

- The USDRUB did hit its pre-Ukraine invasion level in December.

- The longer the war goes on, the more of an impact it is having on the Russian economy, which should, in theory, weaken the currency.

- The pair is currently trading at levels last seen in April 2022.

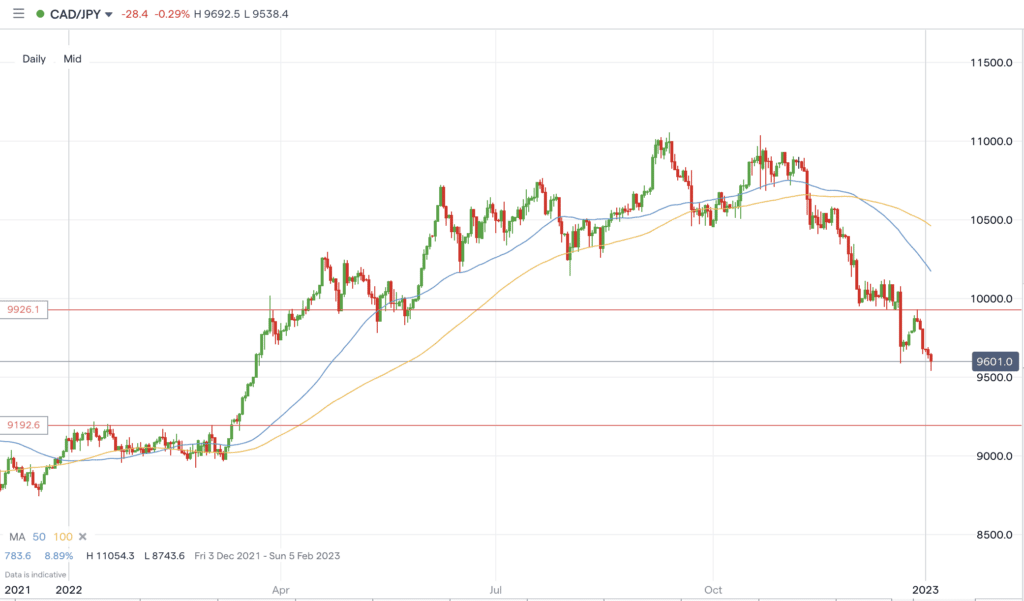

CADJPY -6.31%

- The Japanese yen made strong gains in the final month of 2022.

- Those gains are due to the Bank of Japan opening up the possibility for interest rate rises, potentially moving away from its current policy.

- The BoJ decided to increase its bond-yield cap last month, pushing investors to bet on a potential interest rate rise and strength in the yen.

- As a result, the CADJPY is trading around levels last seen in March 2022.

Also read: CADJPY Forecast and Live Chart

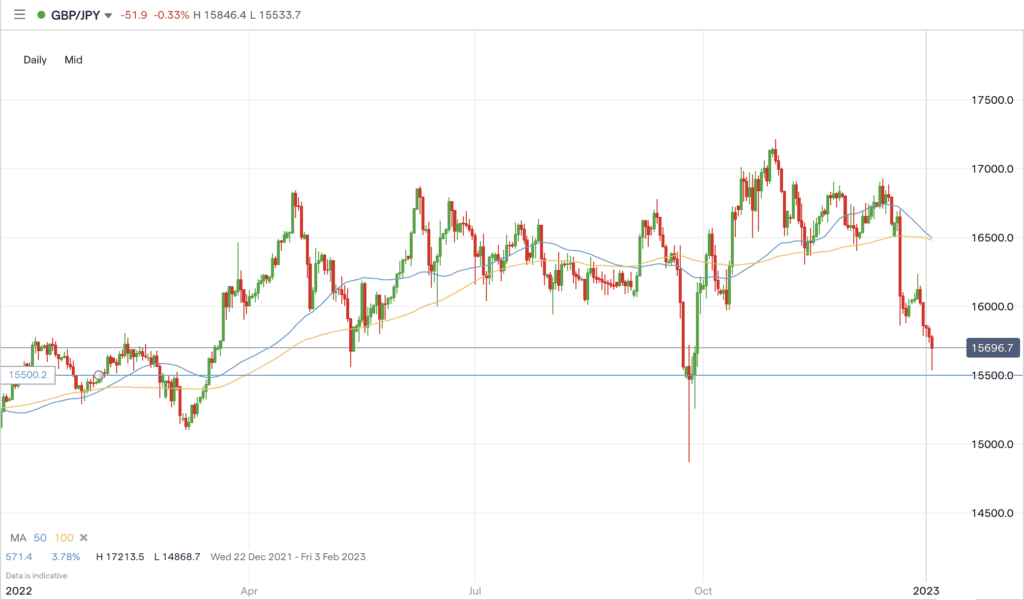

GBPJPY +6.86%

- The yen also made strong gains against the GBP in December, sending the pair lower, towards levels last seen in September, when the GBP plunged across the board

- The December move for the pair saw it break below both its 100 and 200 MA on the daily chart.

- It is now fast approaching a key level at the 155.00 mark.

Also read: GBPJPY Forecast and Live Chart

Your capital is at risk

Your capital is at risk  73% of retail CFD accounts lose money

73% of retail CFD accounts lose money  Your capital is at risk

Your capital is at risk  Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  77% of CFD traders lose

77% of CFD traders lose