FOCUS ON: US CPI Inflation Report, Fed Minutes, and Start of Earnings Season

- Easter holidays make the trading week shorter than usual, but key data is due to be released.

- US CPI inflation numbers and UK GDP figures are due out later in the week.

- Investors then see the US earnings season kick off on Friday when big banks update the markets.

The Easter holiday caused the release of the US Non-Farm Payroll jobs to come on a day when many exchanges were closed. Price moves were, as a result, relatively low-key, but important data releases in the coming week look set to create further trading opportunities.

Forex

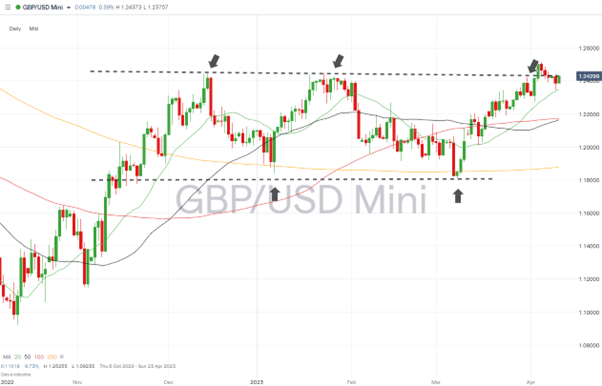

GBPUSD

The UK economy continues to teeter on the edge of a full-on recession. Thursday sees the release of the all-important GDP numbers for February, with the consensus analyst estimate being that the UK economy shrunk by -0.1%.

Any deviation from that number can trigger price swings in GBP-linked currency pairs as investors consider the impact growth data has on the Bank of England interest rate policy.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

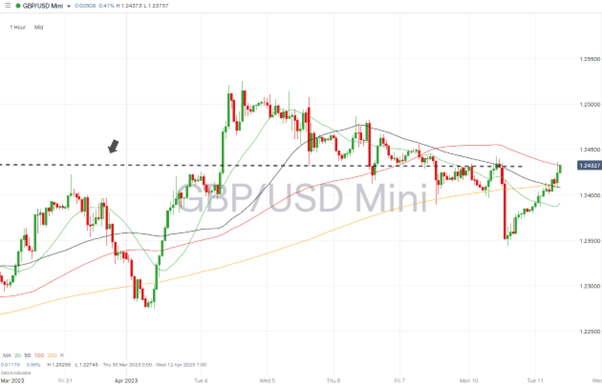

GBPUSD Chart – Hourly Price Chart

Source: IG

UK economic reports:

- Thursday 13th April – 7 am GMT – UK GDP (February). Analysts forecast growth to be -0.1% for February and in the three months to the end of February.

UK company reports:

- Tuesday 11th April – Deliveroo trading update.

- Thursday 13th April – Tesco full-year earnings, Imperial Brands trading update.

- Friday 14th April – Hays trading update.

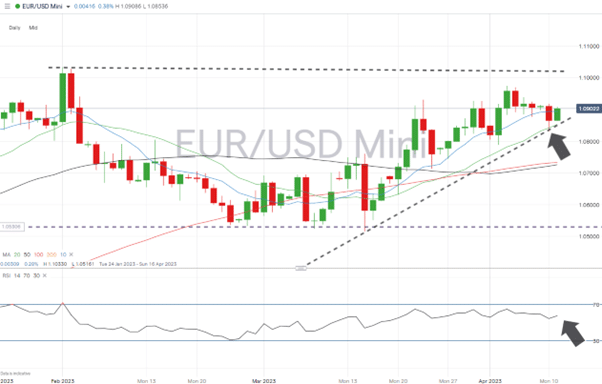

EURUSD

With little Eurozone-specific data due this week, Eurodollar traders will focus instead on the US CPI inflation report due on Wednesday. The release of the US Federal Reserve’s FOMC minutes on the same day can also be expected to impact the price of EURUSD.

EURUSD Chart – Daily Price Chart

Source: IG

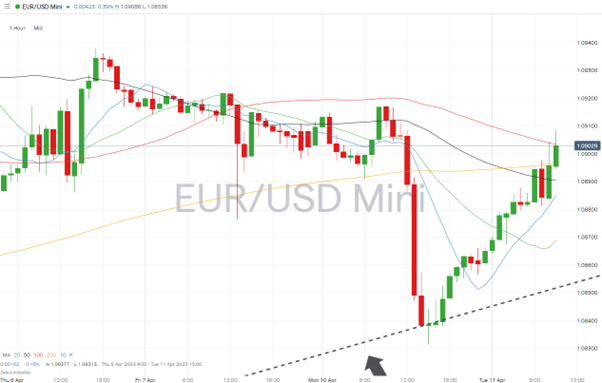

EURUSD Chart – Hourly Price Chart

Source: IG

Eurozone asset-influencing economic data:

- Wednesday 12th April – 1.30 pm GMT – US CPI (March). Analysts predict prices to rise 0.3% month-on-month and 5% year-on-year, from 0.4% at the previous reading.

- Wednesday 12th April – 7.00 pm GMT – FOMC minutes. Granular detailed report explaining the reasons behind the recent decision to raise rates by 25bps.

- Thursday 13th April – 1.30 pm GMT – US PPI (March). Analysts predict prices to rise 0.0% month-on-month.

- Friday 14th April – 1.30 pm GMT – US Retail Sales (March). Analysts predict sales to fall 0.4% month-on-month.

Indices

S&P 500

A busy week for US markets kicks off on Wednesday when the CPI inflation report and FOMC minutes are released. On Friday, the Q1 earnings season opens, with big banks being the first to share updates with investors.

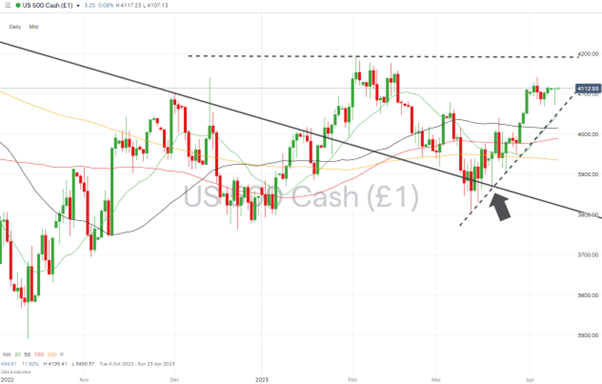

S&P 500 Chart – Daily Price Chart – Trendline Support

Source: IG

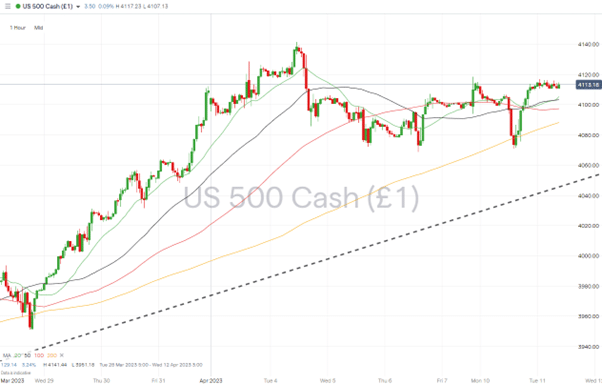

S&P 500 – Hourly Price Chart – Trendline Support

Source: IG

US economic data:

- Wednesday 12th April – 1.30 pm GMT – US CPI (March). Analysts predict prices to rise 0.3% month-on-month and 5% year-on-year, from 0.4% at the previous reading.

- Wednesday 12th April – 7.00 pm GMT – FOMC minutes. Granular detailed report explaining the reasons behind the recent decision to raise rates by 25bps.

- Thursday 13th April – 1.30 pm GMT – US PPI (March). Analysts predict prices to rise 0.0% month-on-month.

- Friday 14th April – 1.30 pm GMT – US Retail Sales (March). Analysts predict sales to fall 0.4% month-on-month.

US company reports:

- Friday 14th April – Q1 Earnings released by Wells Fargo, JP Morgan Chase, and Citigroup.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.04.10

- EURUSD and GBPUSD go into Crucial NFP Announcement Hovering at Key Price Levels

- The Best and Worst Performing Currency Pairs in March 2023

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk