FOCUS ON: ECB and US Inflation Announcements Could Trigger Price Moves

- CPI Inflation news due out of the US on Wednesday will offer an insight into the health of the US economy

- Thursday’s ECB interest rate announcement will impact market mood

- There is a potential for markets to form new trends

Traders are split on whether the ECB will increase interest rates this week. The lack of certainty surrounding this issue means that prices may head in either direction once the announcement is made. US inflation data is due for release this week; a ‘hot’ number would suggest that the US Federal Reserve will be continuing with its hawkish interest rate policy.

Forex

GBPUSD

A busy week for traders of GBP currency pairs kicks off on Tuesday when the latest UK employment numbers are released. On Wednesday, the GDP data for July will be announced to traders and investors.

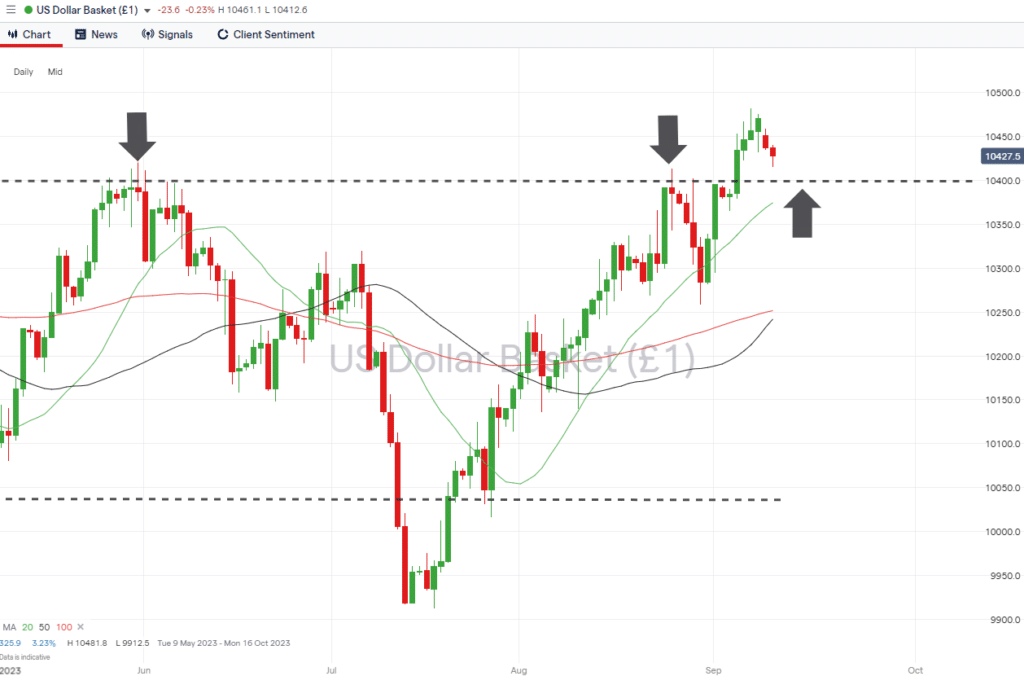

US Dollar Basket Chart – Daily Price Chart

Source: IG

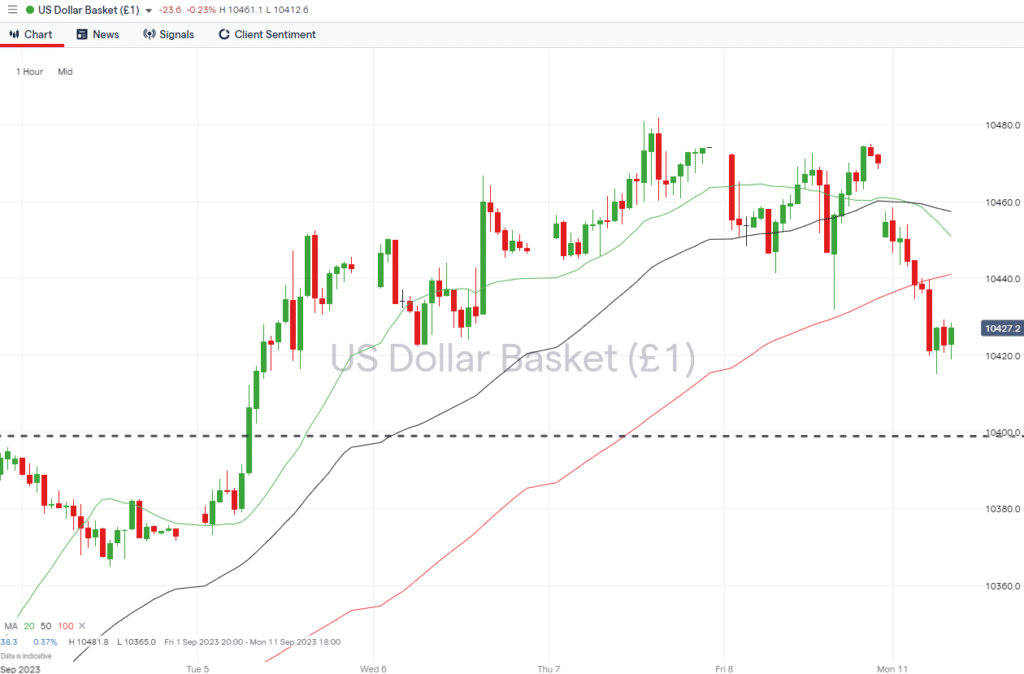

US Dollar Basket Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs:

Times are written in BST.

Tuesday 12th September

- 7:00 am: UK employment data. July unemployment rate expected to be unchanged at 4.2% and for wages to rise 8%.

- 3:00 pm: July US Factory Orders. Analysts forecast orders to rise 0.1% month-on-month.

Wednesday 13th September

- 7:00 am: July report for UK gross domestic product (GDP). Growth is expected to be -0.3% month-on-month (MoM), and 0.2% for the three months to July.

- 1:30 pm: August US CPI. CPI forecast to rise 0.3% month-on-month, up from 0.2%, and to increase 3.4% year-on-year, up from 3.2%. Core CPI is expected to rise 0.2%, in line with last month, and 4.5% year-on-year, down from 4.7%.

Thursday 14th September

- 1:15 pm: ECB interest rate decision. Rates are expected to be held at 4.25%, but there is a chance that they are raised by 25 basis points.

- 1:30 pm: August US Producer Price Index (PPI). PPI is forecasted to rise to from 0.3% to 0.4% month-on-month, and for retail sales to rise 0.2% from 0.7%.

Friday 15th September

- 3:00 pm: September US Michigan consumer sentiment. Analysts anticipate updated index reading to be 69.5, in line with last month.

EURUSD

The next announcement on Eurozone interest rates is due on Thursday, and the market is split on whether the ECB will increase rates again. This outcome would risk tipping the Eurozone into a recession, but taming inflation remains to be the bank’s main priority.

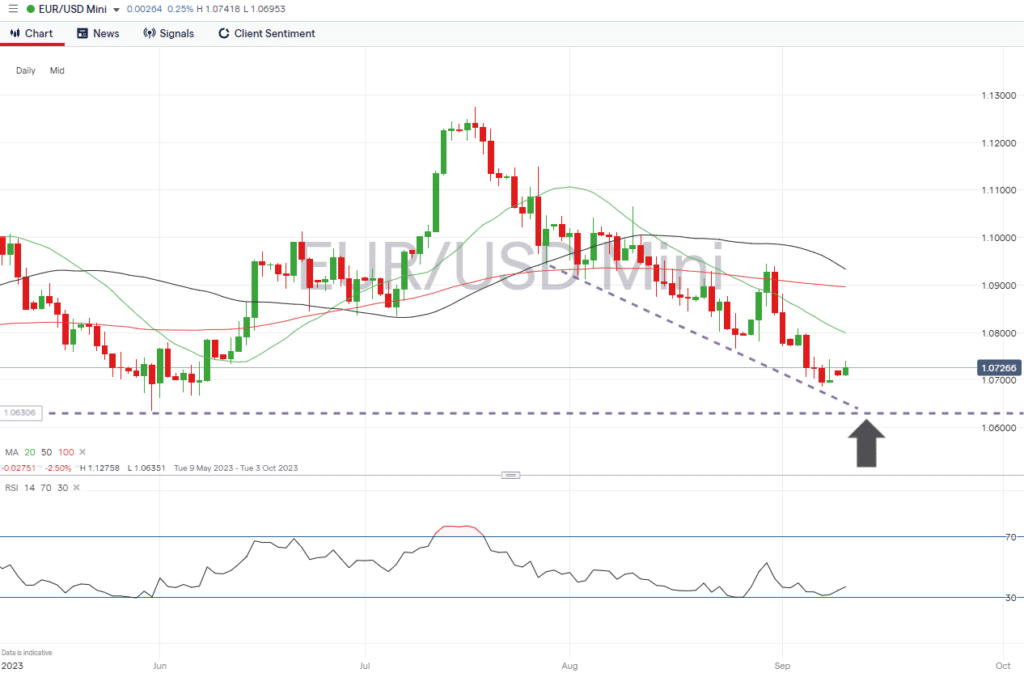

EURUSD Chart – Daily Price Chart

Source: IG

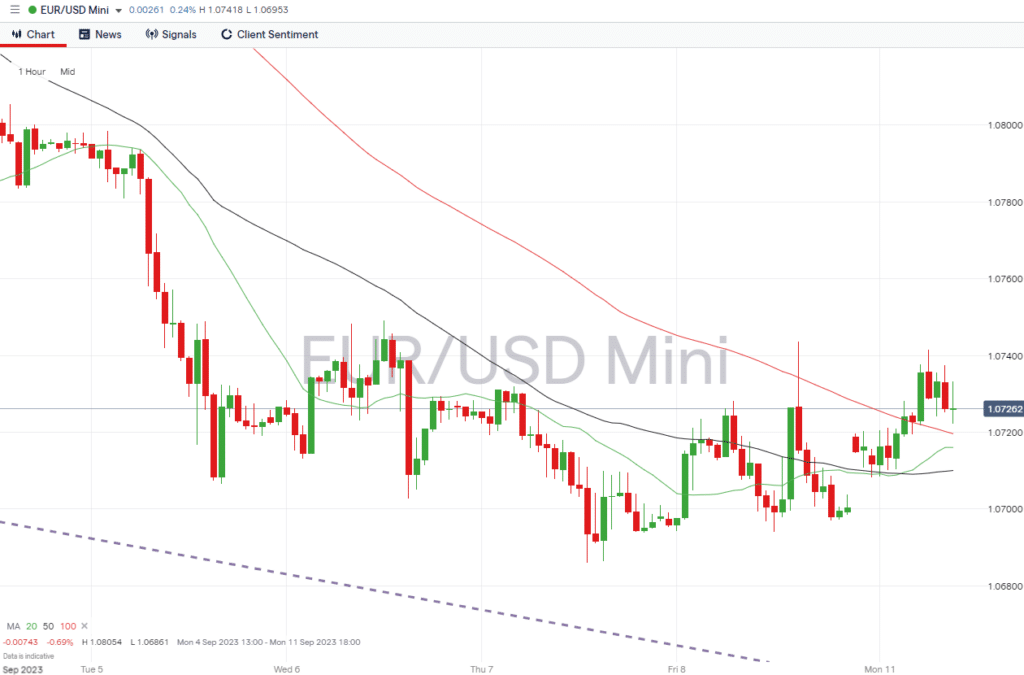

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

Times are written in BST.

Tuesday 12th September

- 10:00 am: September German ZEW index. Analysts expect the index to rise to -12.

- 3:00 pm: July US Factory Orders. Analysts forecast orders to rise 0.1% month-on-month.

Wednesday 13th September

- 1:30 pm: August US CPI. CPI forecast to rise 0.3% month-on-month, up from 0.2%, and to increase 3.4% year-on-year, up from 3.2%. Core CPI is expected to rise 0.2%, in line with last month, and 4.5% year-on-year, down from 4.7%.

Thursday 14th September

- 1:15 pm: ECB interest rate decision. Rates are expected to be held at 4.25%, but there is a chance that they are raised by 25 basis points.

- 1:30 pm: August US Producer Price Index (PPI). PPI is forecasted to rise to from 0.3% to 0.4% month-on-month, and for retail sales to rise 0.2% from 0.7%.

Friday 15th September

- 3pm: September US Michigan consumer sentiment. Analysts expect the updated index reading to be 69.5, which is in line with last month.

Indices

S&P 500

The US CPI inflation report that is due for release on Wednesday will allow investors to predict which way the Fed’s next interest rate decision will go. A ‘hot’ inflation number will increase the likelihood of further interest rate spikes, which would be bad news for ‘risk-on’ assets.

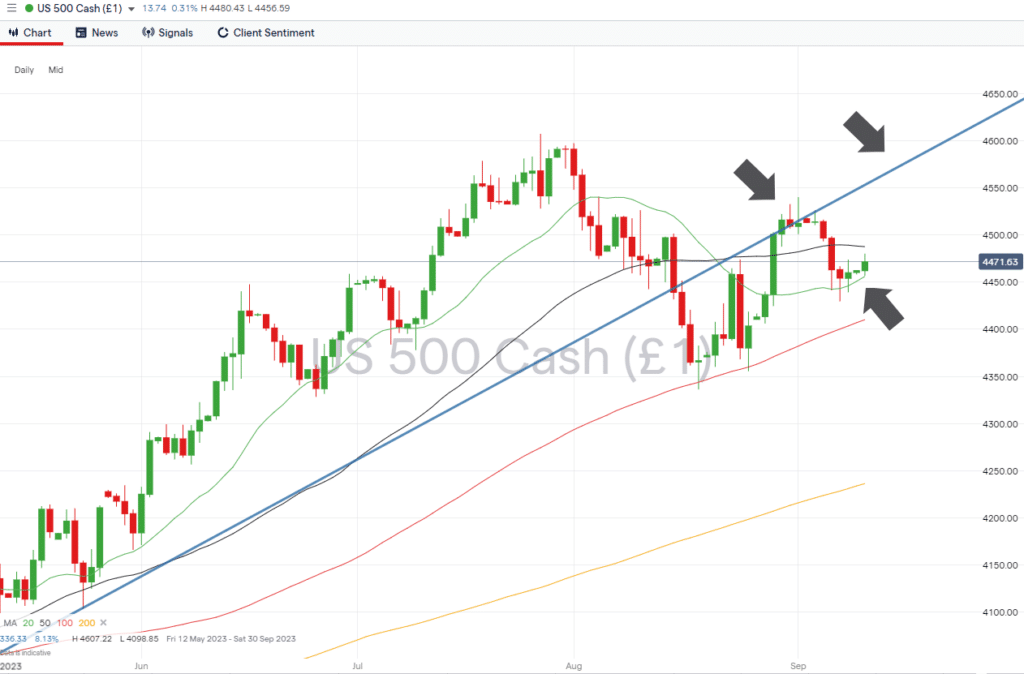

S&P 500 Chart – Daily Price Chart

Source: IG

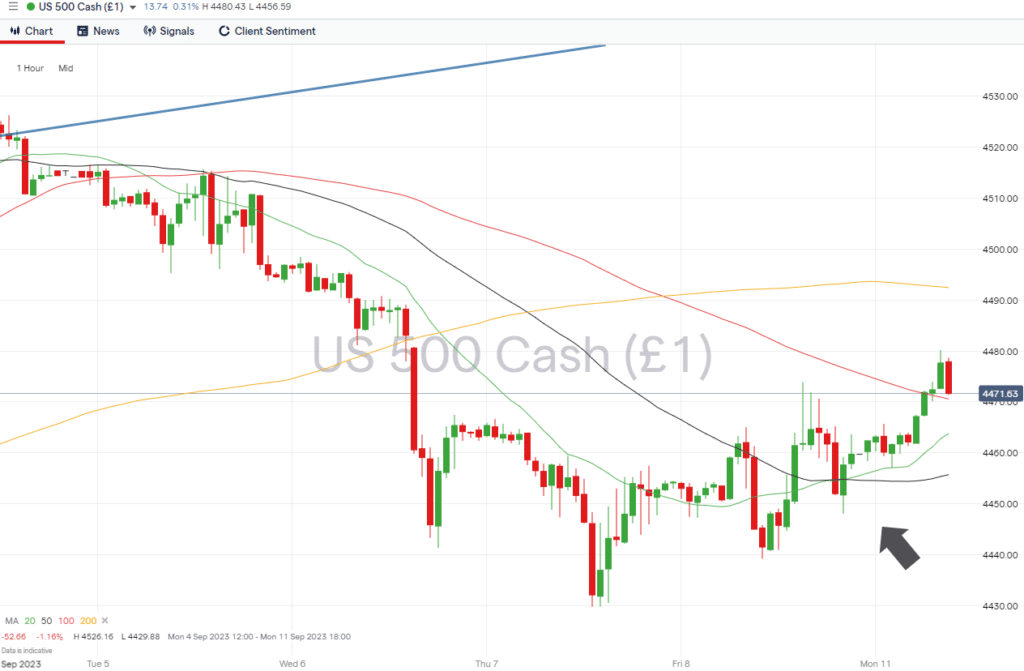

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

Times are written in BST.

Tuesday 12th September

- 3:00 pm: July US Factory Orders. Analysts forecast orders to rise 0.1% month-on-month.

Wednesday 13th September

- 1:30 pm: August US CPI. CPI forecast to rise 0.3% month-on-month, up from 0.2%, and to increase 3.4% year-on-year, up from 3.2%. Core CPI is expected to rise 0.2%, in line with last month, and 4.5% year-on-year, down from 4.7%.

Thursday 14th September

- 1:15 pm: ECB interest rate decision. Rates are expected to be held at 4.25%, but there is a chance that they are raised by 25 basis points.

- 1:30 pm: August US Producer Price Index (PPI). PPI is forecasted to rise to from 0.3% to 0.4% month-on-month, and for retail sales to rise 0.2% from 0.7%.

Friday 15th September

- 3pm: September US Michigan consumer sentiment. Analysts expect the updated index reading to be 69.5, which is in line with last month.

People Also Read

- WEEKLY FOREX TRADING TIPS – 2023.09.11

- The Best and Worst Performing Currency Pairs in August 2023

- The Week Ahead – 4th September 2023

- WEEKLY FOREX TRADING TIPS – 2023.09.04

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk