FOCUS ON: Jackson Hole Symposium and PMI Reports

- Jackson Hole Symposium starts Thursday

- Central bankers convene at a time when investors are showing signs of losing risk appetite

- Range of PMI reports likely to trigger price moves

The Jackson Hole Symposium can be expected to shed light on the ideas of the world’s central bankers. Investors will be keenly watching for any indication of how long higher interest rates are expected to be applied.

Forex

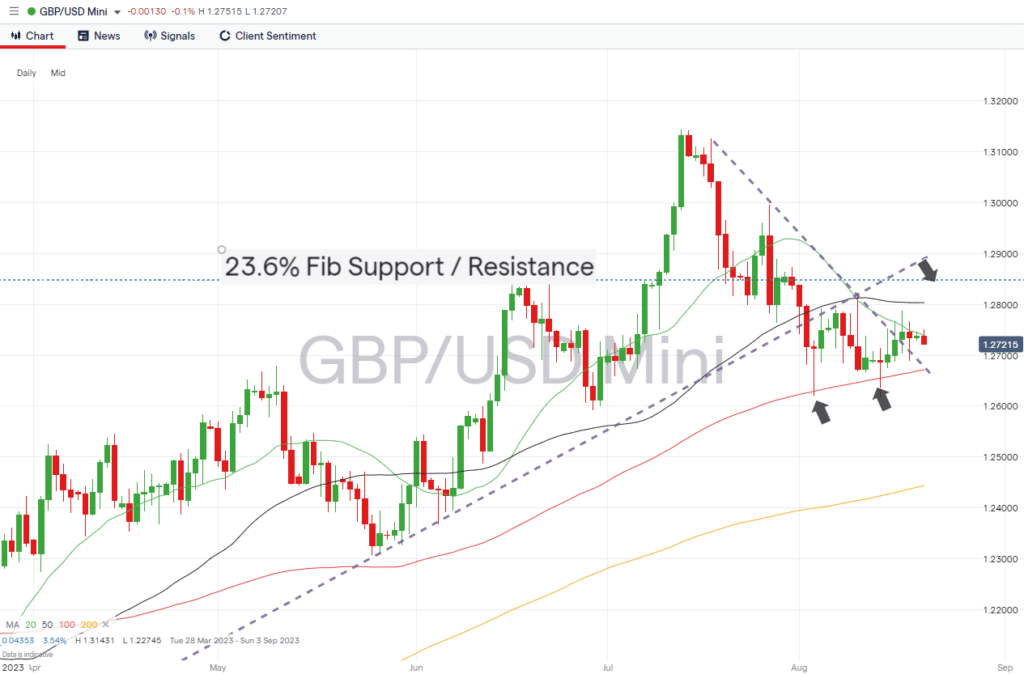

GBPUSD

Sterling continues to outperform the euro thanks to signs the Bank of England is prioritising lower inflation over economic growth. The Purchasing Managers Index data due on Tuesday will offer an insight into the health of the UK economy and indicate if the Bank might need to reconsider its approach.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

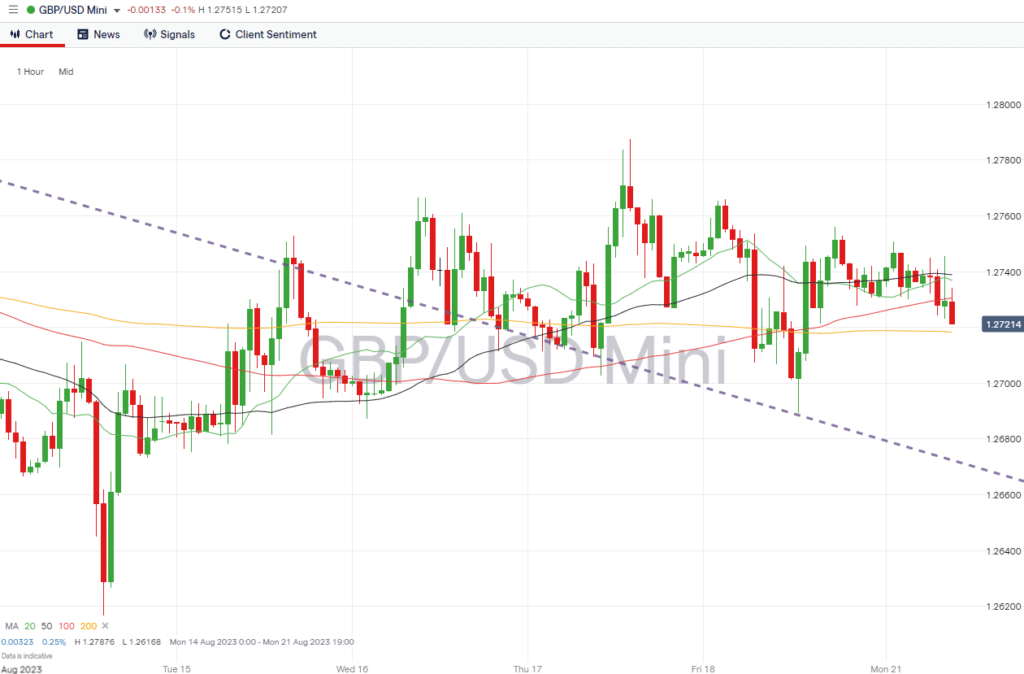

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs, all times BST:

- Wednesday 23rd August – 9:30am – UK PMI (July, flash). PMI manufacturing index forecast to rise to 46.2 and services index to fall to 51.2.

- Thursday 24th August – Jackson Hole Symposium begins. Central bankers from around the world will gather in Wyoming to discuss structural shifts in the global economy.

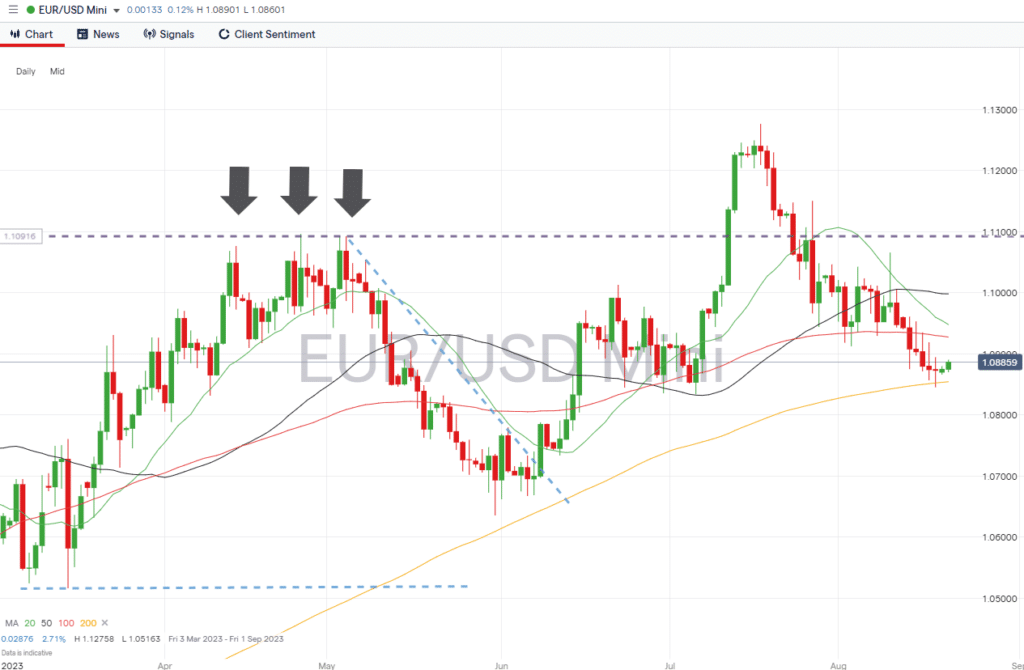

EURUSD

Eurozone and Germany PMI data due on Tuesday can be expected to trigger moves in the price of EURUSD. On Friday, the German IFO index will allow analysts to establish the mood among industry leaders.

EURUSD Chart – Daily Price Chart

Source: IG

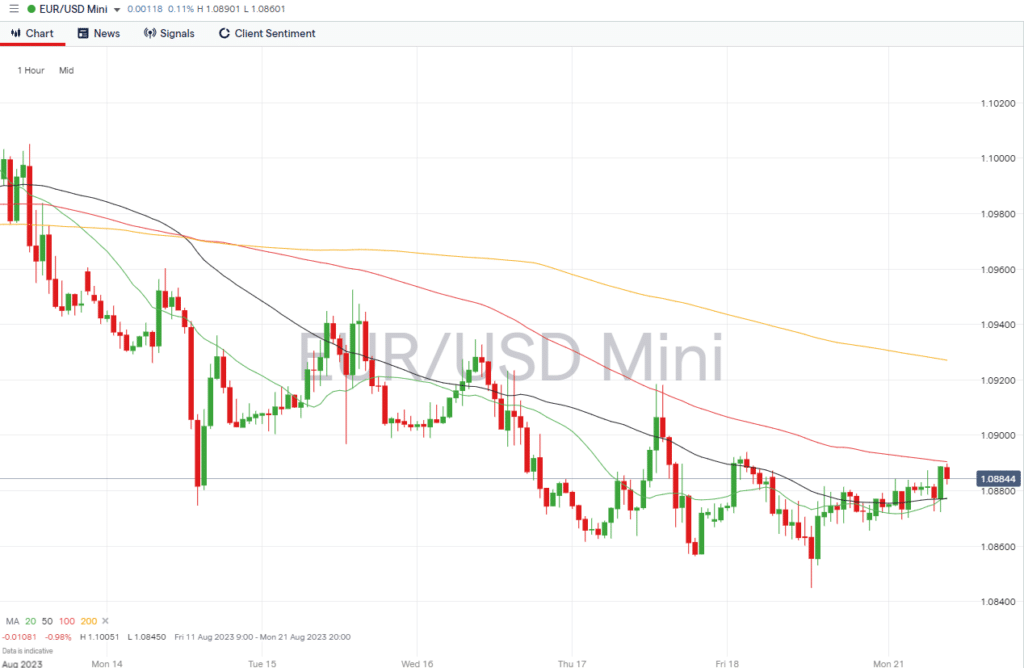

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

- Wednesday 23rd August – 8:30am – Germany PMI (July, flash). Manufacturing to rise to 41 from 38.8. Also, 9:00am – Eurozone PMI (July, flash).

- Thursday 24th August – Jackson Hole Symposium begins. Central bankers from around the world will gather in Wyoming to discuss structural shifts in the global economy.

- Friday 25th August – 9:00am – German IFO index (August). Analysts forecast the business climate index to fall to 86.9.

Indices

S&P 500

Earnings season is drawing to a close, but NVIDIA’s investor update due on Wednesday could trigger wider moves in the market. The company’s exposure to the AI sector has resulted in it being seen as something of a bellwether for equities as a whole.

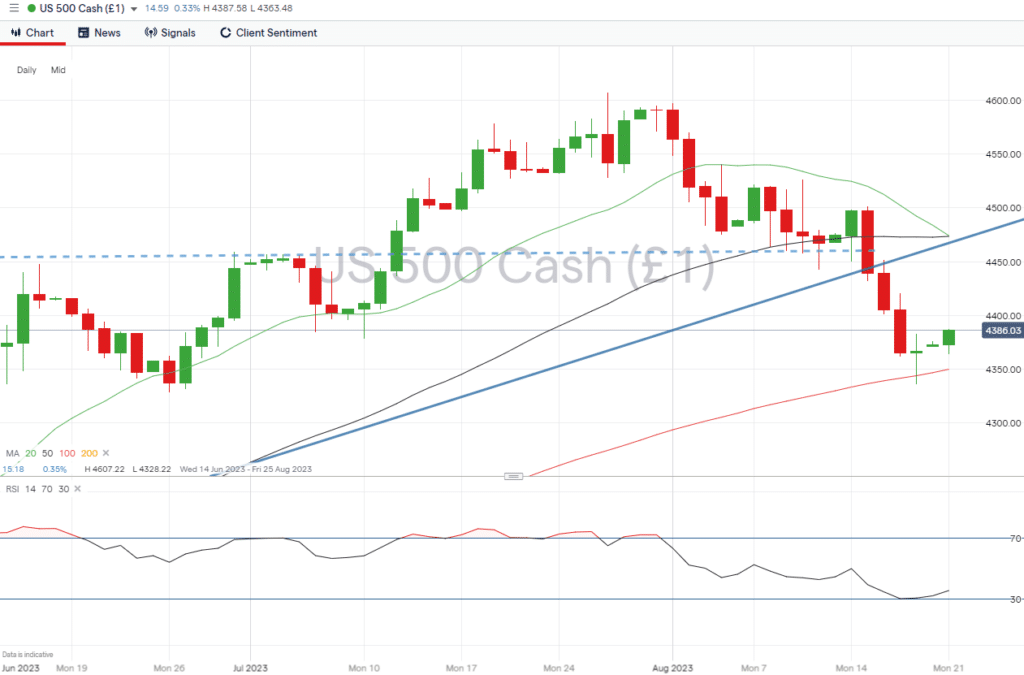

S&P 500 Chart – Daily Price Chart – 100 SMA

Source: IG

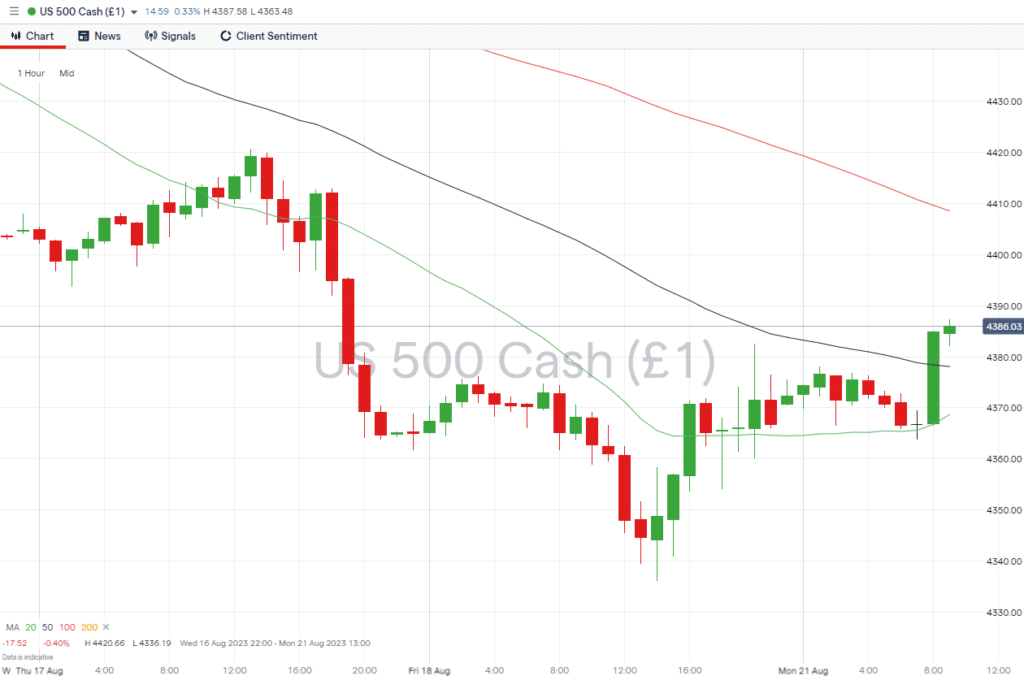

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

- Wednesday 23rd August – 2:45pm – US PMI (July, flash). Manufacturing PMI expected to rise to 49.5 and services to fall to 52.

- Thursday 24th August – Jackson Hole Symposium begins. Central bankers from around the world will gather in Wyoming to discuss structural shifts in the global economy.

Companies releasing earnings reports this week:

- Monday 21st August – Zoom

- Tuesday 22nd August – Macy’s, Urban Outfitters.

- Wednesday 23rd August – NVIDIA, Peloton

- Friday 25th August – Gap

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.08.21

- The Week Ahead – 14th August 2023

- The Week Ahead – 7th August 2023

- The Best and Worst Performing Currency Pairs in July 2023

- Forex Market Forecast for August 2023

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk