FOCUS ON: US Federal Debt-Ceiling and FOMC Minutes

- US debt ceiling talks in Washington continue to cast a shadow over the markets

- US Federal Reserve releases minutes of its last FOMC meeting on Wednesday 24th May

- UK CPI inflation data due to be released on Wednesday expected to influence prices of GBP currency pairs

The stand-off between political parties in Washington appeared to make progress last week. That resulted in a bounce in the value of the US dollar and risk-on assets such as stocks. Further good news could trigger a similar move, but there still appears to be some way to go until any deal is signed off.

Also expected to influence asset prices is the release of the minutes of the Fed’s last meeting. Analysts are currently predicting a 40% chance of a 25-basis point interest rate rise when the Fed next meets on 13th June.

Forex

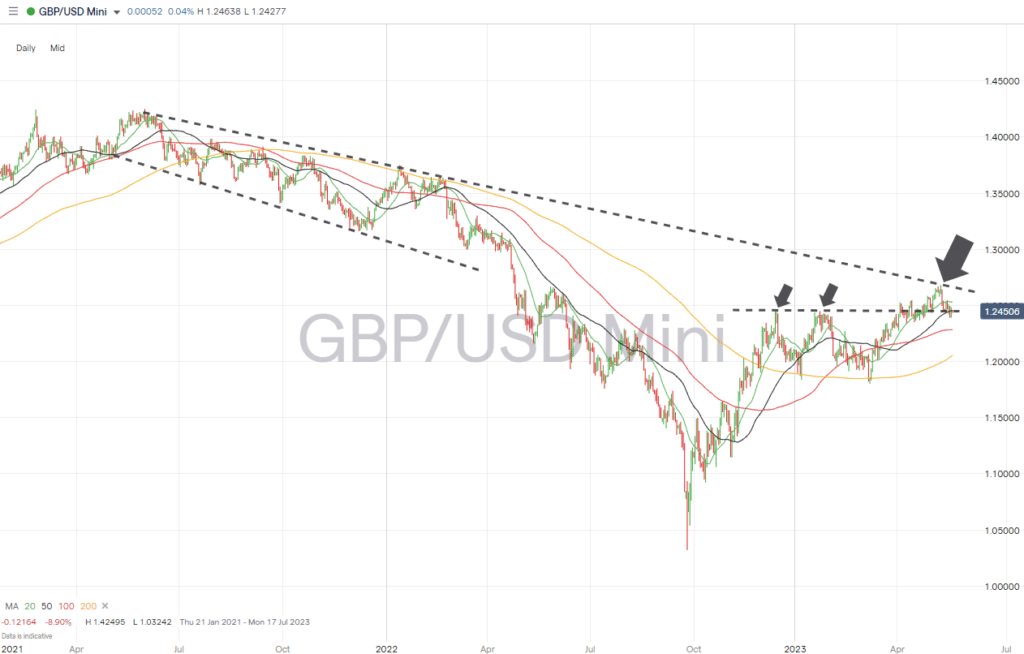

GBPUSD

The key data point of the week for traders in GBP currency pairs will be the UK CPI inflation report, due to be released on Wednesday. The year-on-year inflation rate is expected to fall, but the question analysts ask is by how much.

Signs that the UK economy is continuing to overheat would reduce the likelihood of the Bank of England lowering interest rates at its forthcoming meetings.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

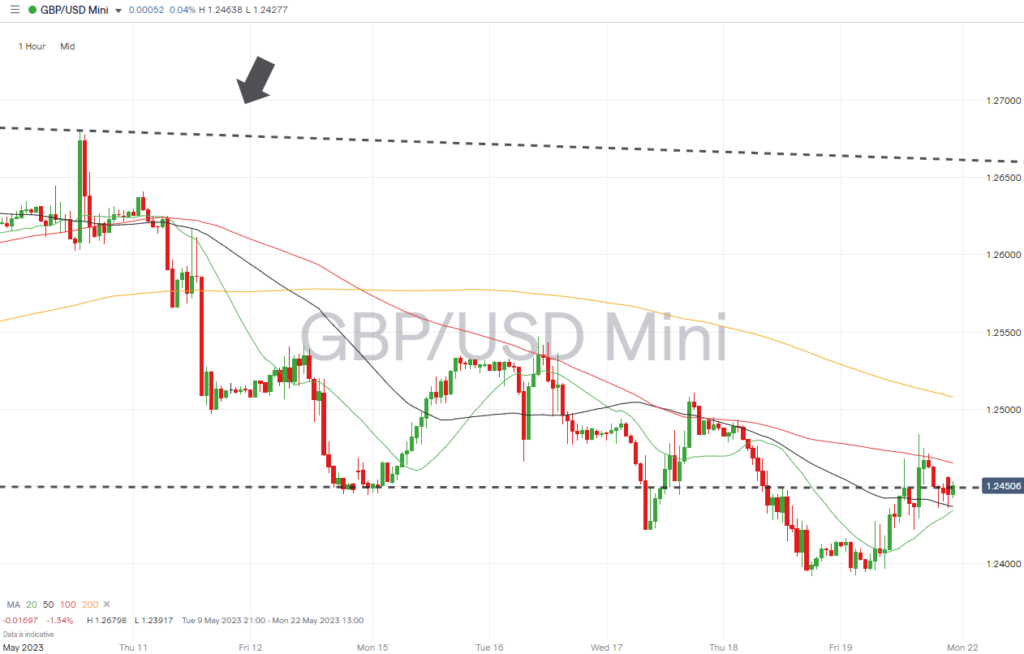

GBPUSD Chart – Hourly Price Chart

Source: IG

UK economic data:

- Tuesday 23rd May – 9.30 am BST – UK PMI (May, flash): Analysts expect services to rise to 56 and manufacturing to rise to 48.8.

- Wednesday 24th May – 7 am BST – UK CPI (April): Forecasts are that consumer prices to rise by 8.5% year-on-year, down from 10.1% in March, and 1% month-on-month, up from 0.8% in March.

- Friday 26th May – 7 am BST – UK retail sales (April): Sales expected to rise 0.3% on a month-on-month basis.

UK earnings reports:

- Monday 22nd May – Ryanair, Big Yellow, Wincanton.

- Tuesday 23rd May – Topps Tiles, Kier

- Wednesday 24th May – Severn Trent, Marks & Spencer, Kingfisher, Aviva.

- Thursday 25th May – Tate & Lyle, United Utilities.

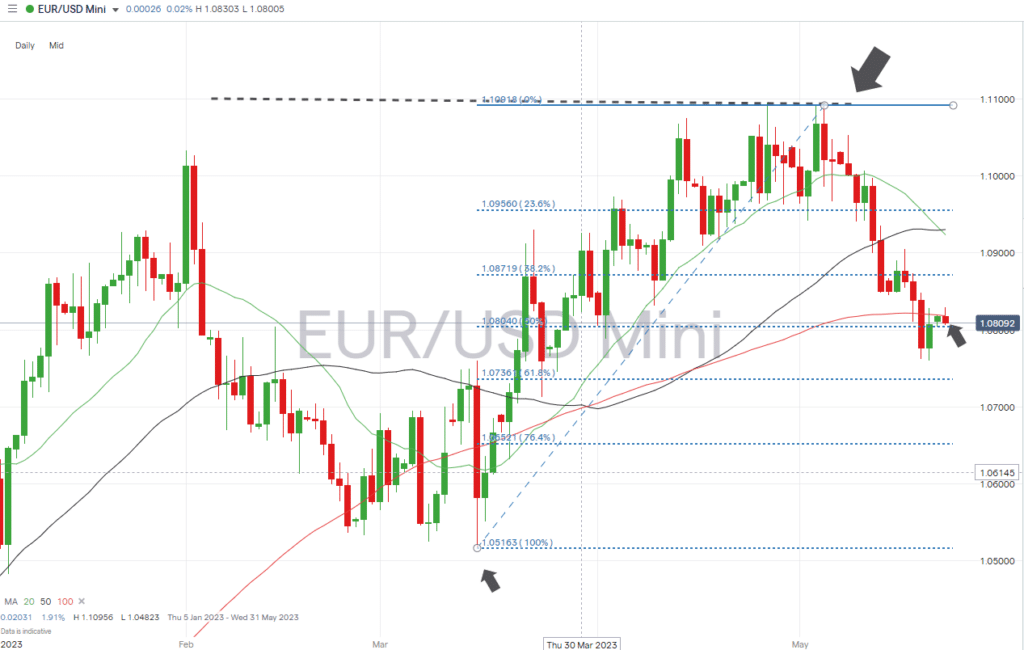

EURUSD

An array of Eurozone economic data reports due this week will likely influence the price of EUR currency pairs. Inflation, consumer confidence, and industrial sentiment reports will give EURUSD traders several opportunities to find trade entry and exit points.

EURUSD Chart – Daily Price Chart

Source: IG

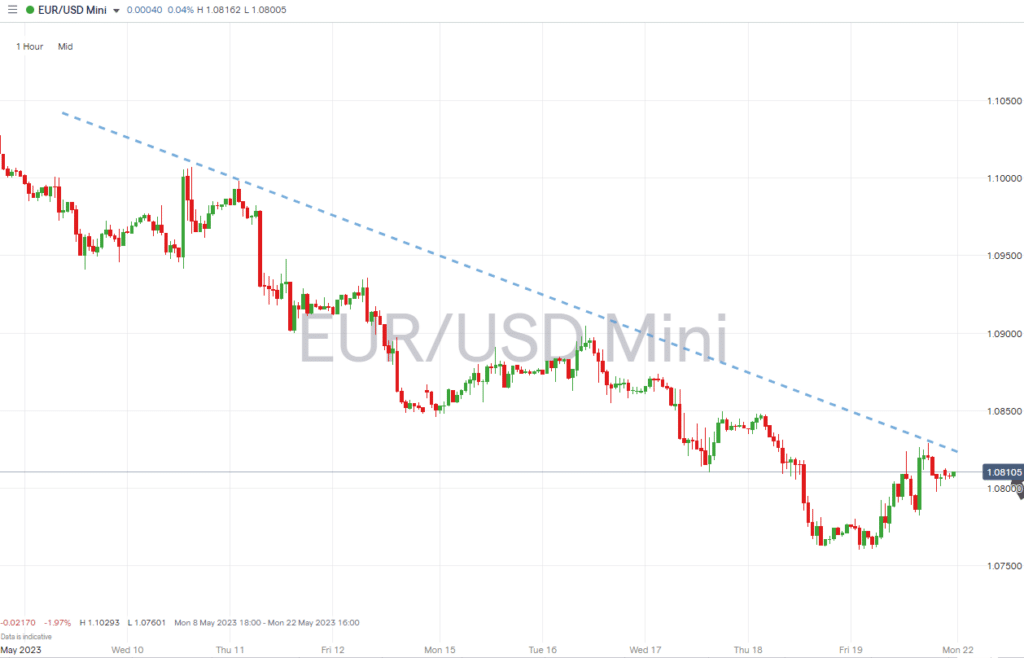

EURUSD Chart – Hourly Price Chart

Source: IG

Eurozone asset-influencing economic data:

- Monday 22nd May – 3 pm BST – Eurozone consumer confidence (May): Index forecast to rise to -16.

- Tuesday 23rd May – 8.30 am BST – German PMI (May, flash): Analysts expect manufacturing PMI to fall to 43.6 and services to rise to 56.6.

- Thursday 25th May – 7.00 am BST – German GfK consumer confidence (June): Index forecast to rise to -24.

Indices

S&P 500

Uncertainty about the US debt ceiling can continue to influence stock prices. Last week’s hints that common ground was being found triggered a rally which saw the S&P 500 gain 1.14% in value, but there is room for those gains to be given up if there is no signed deal.

Analysts predict a 40% chance that a 25-basis point hike in interest rates will follow the next meeting of the US Fed, while at the same time, other data points suggest the US economy could be heading into a recession. With stagflation potentially coming into play, some are questioning the medium and long-term valuation of stocks.

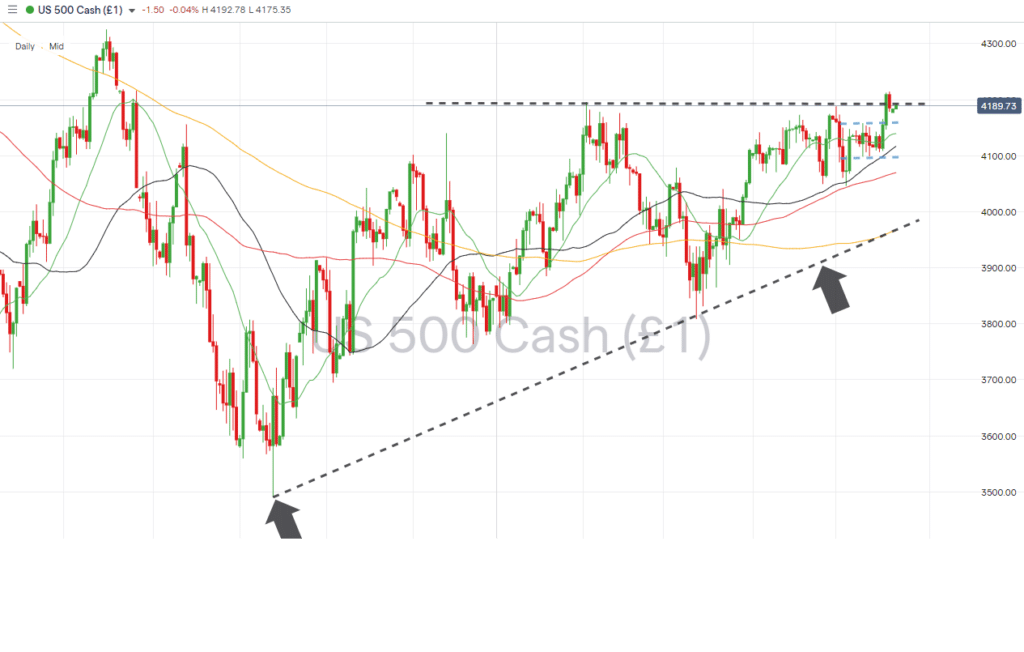

S&P 500 Chart – Daily Price Chart – Ascending Wedge Pattern

Source: IG

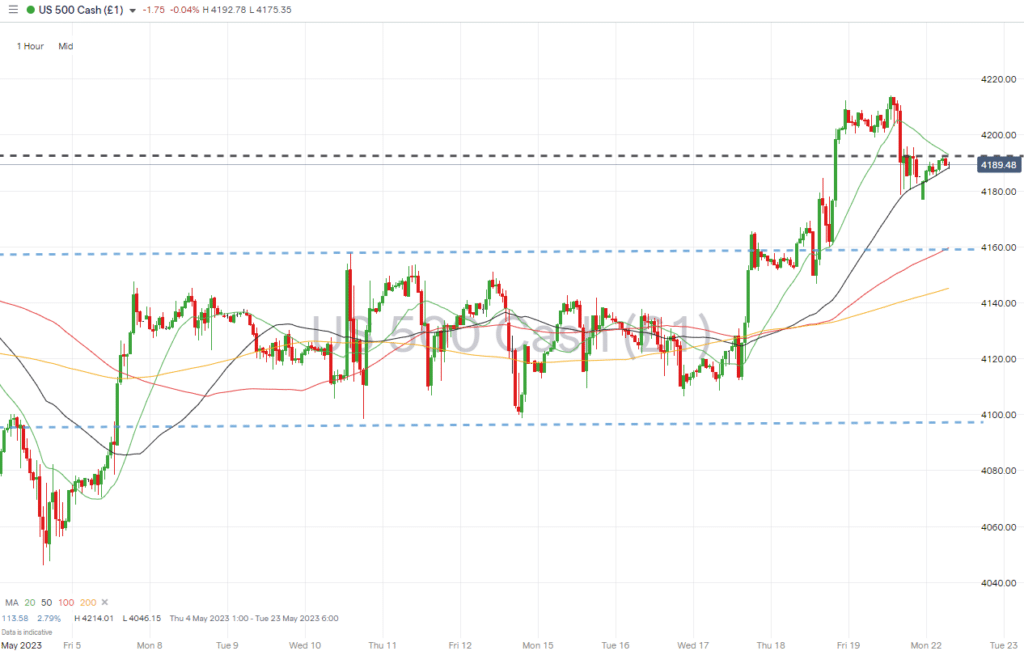

S&P 500 – Hourly Price Chart

Source: IG

US economic data:

- Tuesday 23rd May – 2.45 pm BST – US PMI (May, flash): Services PMI forecast to fall to 53 and manufacturing PMI to rise to 50.2.

- Wednesday 24th May – 7.00 pm BST – FOMC minutes of last meeting: these will shed light on the factors considered when the Fed decided to raise rates at its latest meeting and will offer guidance on future policy moves.

US earnings reports:

- Monday 22nd May – Zoom.

- Wednesday 24th May – Nvidia

- Thursday 25th May – Gap, Costco, Best Buy.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.05.22

- Is Now the Time to Buy into the Debt-Ceiling Bounce?

- How Much Higher Can Sterling Go?

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk