FOCUS ON: Non-Farm Payrolls US Unemployment Report

- The US Non-Farm Payrolls jobs number is due on Friday.

- Major milestone of the month’s reporting calendar will be closely monitored.

- US interest rate policy and asset prices are closely linked to the crucial employment data point.

The main event of the week, and possibly the whole month, is the US Non-Farm Payrolls jobs report, due to be released at 1.30 pm GMT on 10th March. All eyes will be on whether the actual number beats expectations (again) or suggests that hawkish monetary policy is effectively taking some of the heat out of the US economy.

Forex

GBPUSD

Friday 10th is the date of the all-important US Jobs numbers report, but traders of sterling currency pairs will also be watching the UK GDP report for January, which is released at 7 am (GMT) on the same day. Analysts currently predict the UK economy will post a 0.00% increase. A contraction, even a small one, opens the door to the UK being confirmed in a technical recession.

Some big names in the UK stock markets will be providing updates to investors. Investor sentiment has cooled since the FTSE 100 index broke the psychologically important 8,000 price level in February, and those earnings updates could trigger another rally in UK stocks.

Daily Price Chart – GBPUSD Chart – Daily Price Chart – Sideways Trading Pattern

Source: IG

GBPUSD Chart – Hourly Price Chart

Source: IG

UK earnings updates:

- Tuesday 7th March: Just Group, Greggs, Foxtons.

- Wednesday 8th March: Tullow Oil, Legal & General, Admiral.

- Thursday 9th March: Hammerson, Aviva.

EURUSD

With minimal euro-specific news due for release in the coming week, traders of the EURUSD currency pair could be left waiting for the NFP jobs report to trigger price volatility. Price currently sits at key pivot points, and with the RSI trading mid-range, there is room for a move in either direction.

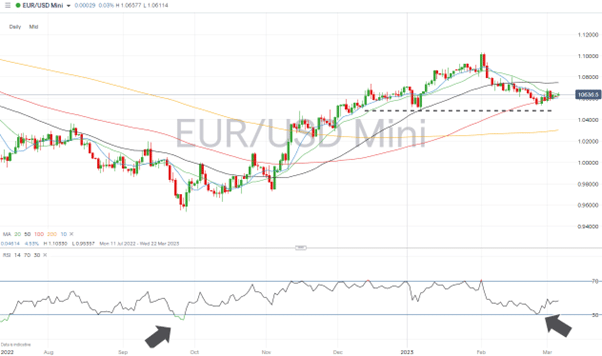

EURUSD Chart – Daily Price Chart –SMA Break

Source: IG

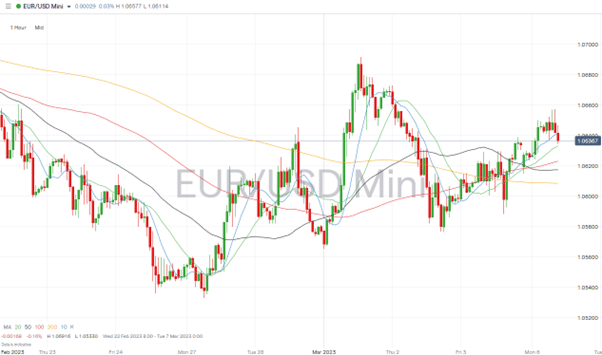

EURUSD Chart – Hourly Price Chart

Source: IG

Indices

S&P 500

Jerome Powell’s regular testimony to US lawmakers starts on Tuesday 7th March and continues into Wednesday. The comments of the Chair of the US Federal Reserve could offer clues on how hawkish or dovish his stance currently is. Still, like many, he can be expected to wait until Friday’s US employment data is released before acting with much conviction.

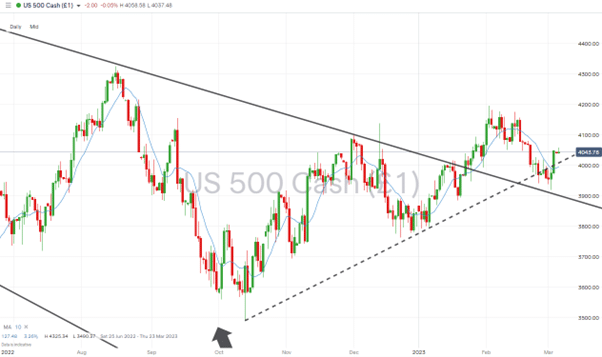

S&P 500 Chart – Daily Price Chart –SMA Support

Source: IG

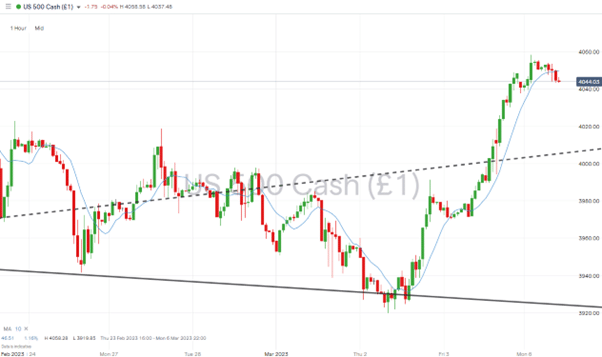

S&P 500 – Hourly Price Chart

Source: IG

- Tuesday 7th and Wednesday 8th – 3 pm GMT – Fed chair Powell testimony: the Fed’s chairman will appear before US lawmakers.

- Wednesday 8th March: 1.30 pm GMT – US trade balance (January): Analysts forecast the deficit to widen to $68.8 billion.

- Friday 10th March – 1.30 pm GMT – US non-farm payrolls (February): Analysts forecast payrolls to fall to 200K from 517K last month.

People Also read:

- Obscure But Reliable Technical Indicator Signals the Stock Bear Market Has Ended

- WEEKLY FOREX TRADING TIPS – 2023.03.06

- EURUSD Approaches Key Support Level as Fed Minutes Match Market Expectations

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk