FOCUS ON: US Jobs Data Triggers Increased Appetite for Risk-on Assets

- US dollar slides following the release of Non-Farm Payroll numbers

- EUR and GBP test key resistance price levels

- All eyes now turn to the US CPI inflation data to be released on Thursday 12th January

The first week of 2023 started with a bang in terms of economic data releases. The Non-Farm Payroll US jobs report is always one of the most keenly anticipated data points of any month, and the figure released on Friday 6th January didn’t disappoint.

After whipsawing price action tested both support and resistance price levels, investor sentiment turned bullish, with risk-on assets gaining value. Euro, sterling and stock indices posted gains in the run into the close of the week and have continued to inch upwards during the Asian and European trading sessions beginning 9th January.

China has continued to relax its covid policies, but with an extended new year holiday taking place, traders will be looking elsewhere for information on the state of the market. The big data release of the week is the US CPI report due on Thursday 12th January, which will shed light on the all-important rate of US price increases.

Forex

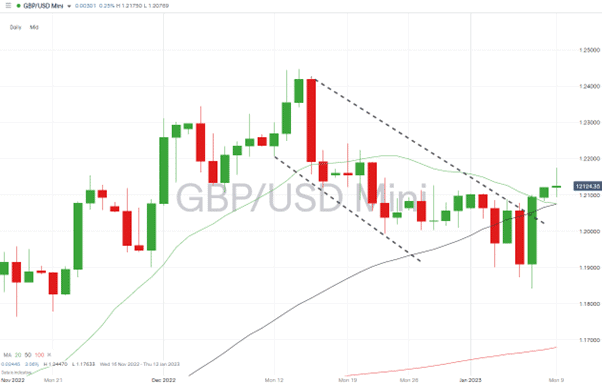

GBPUSD

Cable’s strong finish at the end of last week resulted in it breaking through some key technical resistance levels. Those metrics could continue to play a part in determining price moves in the first half of a week, with little UK-based data being released. The significant number of the week traders will be waiting for is the UK GDP report to be released at 7 am on Friday 13th January.

GBPUSD Chart – Daily Price Chart – Breakout Pattern

Source: IG

Also Read: GBPUSD Forecast and Live Chart

Analysts are pricing in that the November GDP data will show a contraction in the UK economy. That sets the UK up to be confirmed as in recession if the December report, as expected, also shows further contraction took place.

The price of sterling could also be influenced by Q4 earnings reports being released by UK firms. Barratt Developments, JD Sports, Topps Tiles, and Sainsbury’s all update investors on Wednesday 11th January. Tesco, Marks & Spencer, Halfords, Persimmon, and Whitbread release their latest earnings data on Thursday 12th January.

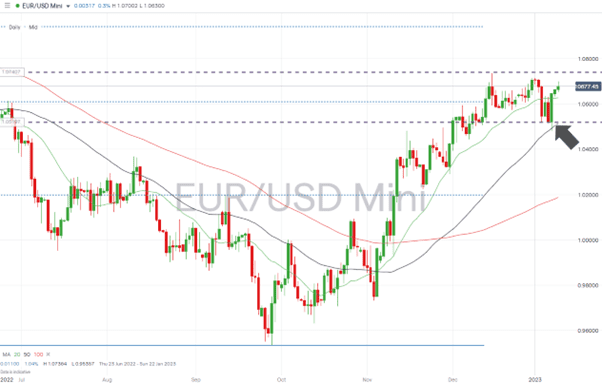

EURUSD

With little Eurozone data to be released, euro-dollar traders will focus on the US leg of the EURUSD currency pair.

Jerome Powell, Chair of the US Federal Reserve, addresses the markets on Tuesday. His recent guidance has been decidedly hawkish, so any deviation from that approach would trigger dollar weakness. Whether he chooses this update as the time to change tack is questionable due to the crucial US CPI inflation report being due out at 13.30 GMT on Thursday 12th January.

Consumer prices in the US have eased for five successive months. With that backdrop in place, analysts forecast that Thursday’s number will show that price rises in December were 6.5% on a year-on-year basis.

EURUSD Chart – Daily Price Chart – Bullish Price Action

Source: IG

Another number to watch out for is the US Michigan consumer confidence (January) release due at 15.00 GMT on Friday 13th January. It will offer insight and is considered a leading indicator.

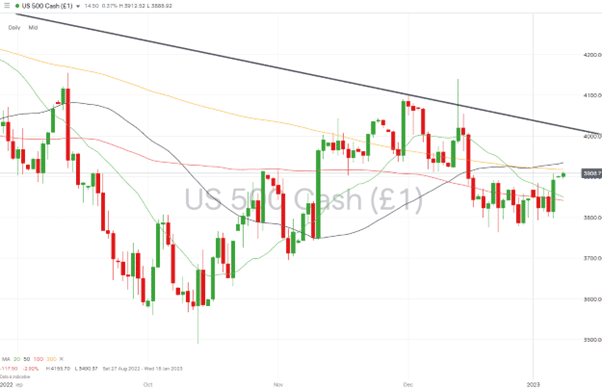

Indices

S&P 500

Earnings season kicks off this week with US corporations opening their books to investors and offering an insight into the economy’s health.

In line with tradition, big banks kick off the parade of reports. Bank of America, Wells Fargo, Citigroup, and JPMorgan are all expected to share their earnings reports on Friday 13th January. On the same day, Delta will also release its earnings report and offer an update on business and consumer air travel numbers.

S&P 500 – Daily Price Chart

Source: IG

People Also Read

- The Best and Worst Performing Currency Pairs in 2022

- The Best and Worst Performing Currency Pairs in December 2022

- Forex Markets Braced for US Jobs Number

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk