Candlestick charts offer valuable information to a trader that is visually easier to interpret than a bar chart or line chart, for example. Technical analysts closely watch candlesticks for well-known patterns that tend to repeat in all markets and timeframes.

As a novice trader, it is important to educate yourself as much as possible if you wish to become consistently profitable in trading. Understanding candlestick patterns and what they tend to forecast is an important part on your personal trading journey.

In this article, we will explore one such important candlestick pattern: the evening star forex pattern. We’ll discuss what it means when you see it on your chart and how to trade it.

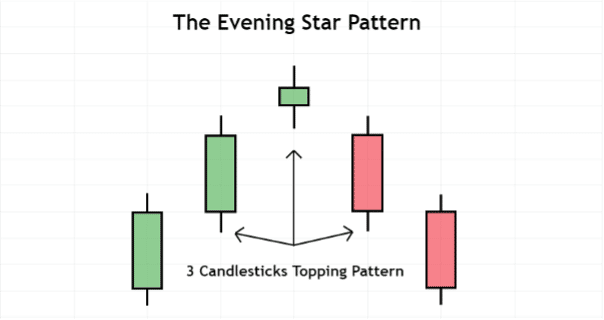

What is the evening star forex pattern?

Image for illustration purposes only

The evening star pattern consists of three candlesticks, unlike a singular candlestick pattern like the doji or hammer, for example. The three candlesticks are typically found at important market highs, and the pattern forms when you see a green candlestick moving higher, followed by a second candlestick with a much smaller body (which could be green or red).

After the second candlestick with the smaller body closes, the third candlestick of an evening star forex pattern immediately reverses lower to form a red candlestick.

What does the evening star forex pattern mean?

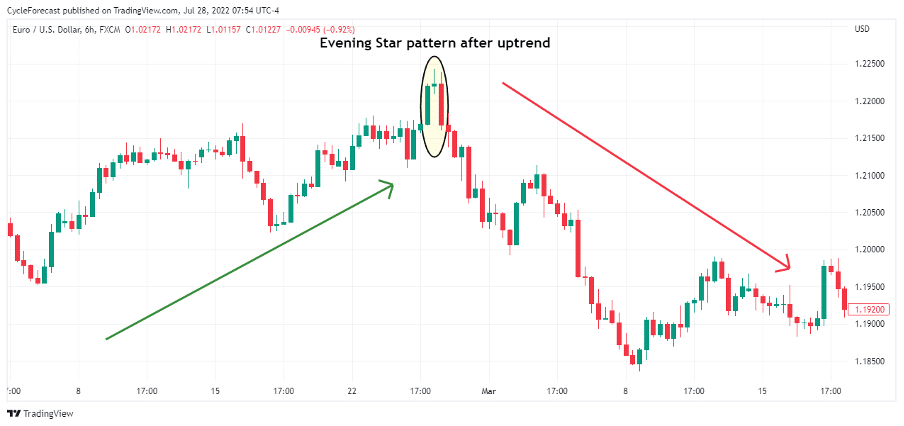

Image for illustration purposes only

An evening star forex pattern is considered a rare pattern, but when it does occur, there is a strong possibility that a bullish trend might be nearing an end with a strong reversal lower to potentially follow. The chart example above shows how an uptrend ended abruptly directly after the formation of a forex evening star pattern.

This pattern is therefore considered to be a bearish reversal pattern.

During the three-candlestick pattern, buyers are in control during the first green candle on the left. On the second candle, however, indecision steps in and neither the buyers nor the sellers gained the upper hand by the time that candlestick closes. Then, on the third candlestick, sellers almost immediately take control, driving the market lower – often with a wide-ranging red body that is accompanied by an increase in volume.

How to trade the evening star forex pattern

The three-candlestick formation of an evening star pattern is relatively easy to identify, but there are a few additional things to look out for to determine which forex evening star patterns offer the best trading opportunities.

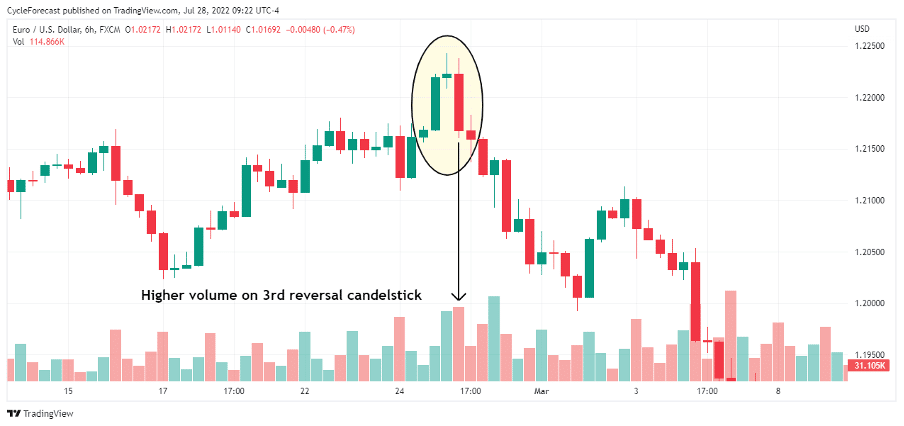

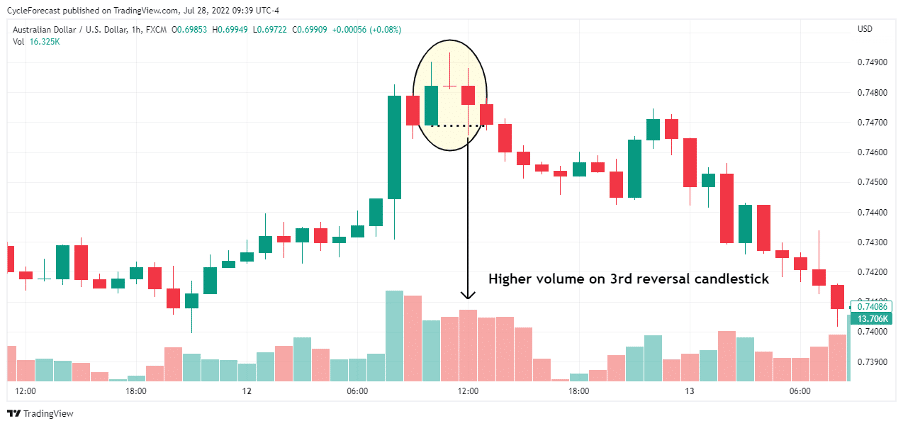

Image for illustration purposes only

We previously mentioned that the third reversal candlestick of the evening star pattern often shows an increase in volume. Using the same chart example as before, we added the volume indicator to illustrate this behaviour.

An increase in volume during the third candlestick is considered a tell-tale sign that you are dealing with a high-probability evening star reversal. If the volume also peaks above the prior two candlesticks of the same pattern, then that is an even better sign that generally confirms the sellers are taking control.

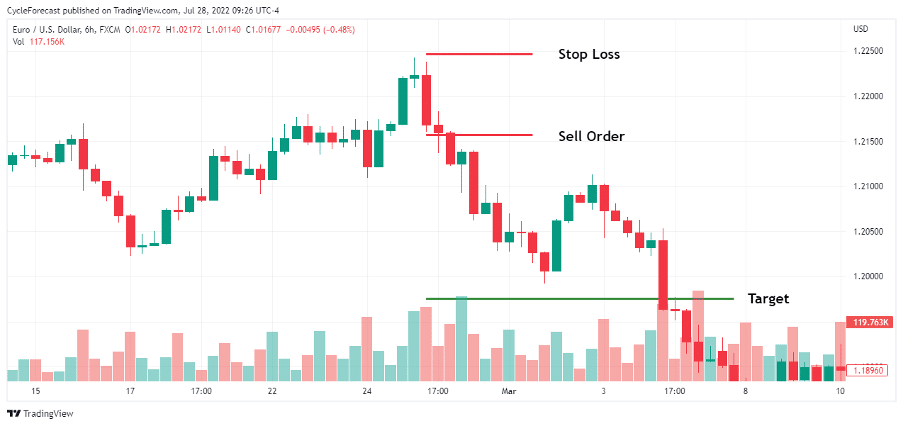

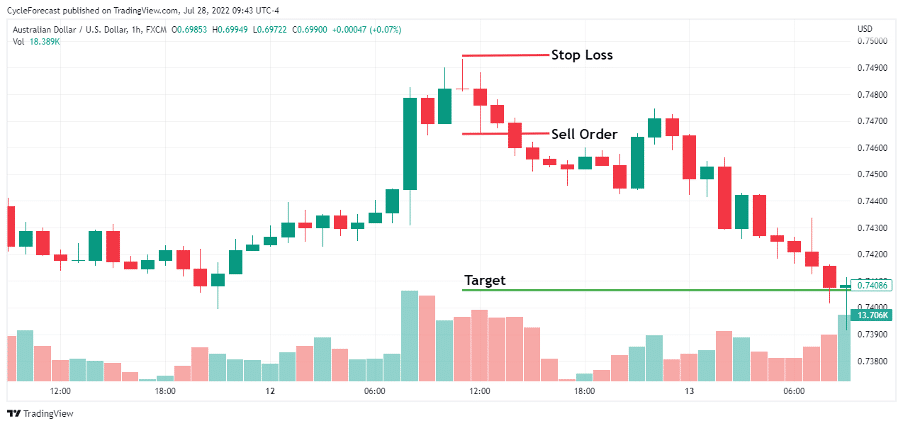

Image for illustration purposes only

Once an evening star forex pattern has formed and volume supports the idea that selling pressure is increasing, then a sell order can be placed a few pips below the third red candlestick of the pattern, with a stop loss a few pips above the candlestick with the small body.

With this easy strategy, a target can be placed at a level that would allow you to profit twice as much than what you are willing to initially risk on any particular trade.

Image for illustration purposes only

Our second entry example shows another evening star forex pattern that also appeared at the end of a bullish trend. With this example, however, the third red candlestick did not have a large red body like our previous example. That being said, when it comes to trading the financial markets, not all the patterns you will learn about will always have the “picture-perfect” look.

With this example, the volume did increase on the third candlestick, and the amount of volume was larger than the previous two candlesticks of the same pattern. These occurrences were enough to classify this evening star pattern as valid although the entire pattern does not look exactly like a picture-perfect example.

Trader’s tip: It is important sometimes to be a bit flexible with your interpretation of what an evening star pattern “should” look like. Reading what the price action is telling you and the story that volume is revealing to you is often more important than trying to find perfect patterns.

There is one final thing that can help you spot the highest probability reversals whenever an evening star forex pattern shows up on your chart. Note how the third red reversal candlestick’s range broke below the low of the first green candle of the same pattern (black dotted horizontal line on the chart above).

The same thing happened with our first trade example, and apart from the increase in volume condition we have been talking about before, this was another good indication that a reversal was imminent.

Image for illustration purposes only

With all the right conditions in place, a sell order could have been placed a few pips below the third red reversal candlestick, and a stop-loss could have been placed a few pips above the second candlestick with the small red body.

In this final example, a target was again placed at a level that offered double the reward versus the initial risk.

Conclusion

Although the evening star forex pattern is considered a rare candlestick pattern, the appearance of this formation almost always leads to some sort of a reversal, whether it’s a change in trend or just a counter-trend correction.

However, understanding that not all candlestick patterns provide the best setups all the time is also important, which is why the volume indicator can be used to help you spot the best evening star forex setups.

Hopefully, this article helped shed some light on this fascinating pattern and will motivate you further to study candlestick patterns in more detail.

Trade candlestick patterns with top forex brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.