Interested in 101Investing? We’ve found that FXTM consistently comes out on top in our exhaustive broker reviews.

Learn More Here

| Pros | Cons |

|---|---|

| Access to several education materials | Customer support only operational from 7am-5pm |

| Low minimum deposit |

Traders’ Viewpoint

In this review, we will take a look at 101investing, the brand name of FXBFI Broker Financial Invest Ltd, an investment firm headquartered in Cyprus.

Regulated by the Cyprus Securities and Exchange Commission (CySEC), this CFD broker offers retail and professional clients the choice of 250+ financial instruments across five asset classes: forex, commodities, stocks, indices and cryptocurrencies.

All of the trading instruments are accessible from the broker’s MetaTrader 4 (MT4) platform across PCs and mobile devices.

The 101investing broker offers a choice of four account types plus the swap-free Sharia account. You can select the account type depending on your experience, the initial deposit, and the kind of trader you are. Regardless of whether you are a fresher or a professional client, 101investing pledges negative balance protection to everyone.

The trading conditions, especially the spread and the swap charges, largely depend on your account type. While retail clients receive max leverage of 30:1 on some financial instruments, it can go up to 500:1 for professionals.

Likewise, the broker claims to offer spreads starting from 0.3 pips for the Platinum account to 0.7 pips for the Silver account holders. 101investing does not charge a commission, and clients signing up for the Gold and Platinum accounts receive a swap discount of 25% and 50% respectively.

Our extensive review of 101investing found that it provides a lot of educational material comprising video on demand, eBooks and MT4 tutorials. You can also access the live economic calendar and corporate earnings announcements, and you can register for webinars that the broker conducts regularly.

101investing is a tier-one regulated broker offering a handful of financial instruments across the world’s most appreciated CFD trading platform. If you are looking for a CFD broker that is legitimate, caters to your trading style, and provides the right trading conditions at reasonable costs, you should consider 101investing.

However, this broker offers services only to individuals residing in the EU, the UK and Switzerland. Before you decide to go with this CFD broker, you may want to check if 101investing provides services in your country of residence.

About 101investing

101investing is the trading name of FXBFI Broker Financial Invest Ltd. Established in 2016, the CFD broker operates out of Limassol, Cyprus. It has a registered office in 13 & 15 Grogori Afxentinou str. IDE Ioannou Court, 3rd floor, 301, 4003, Limassol. 101investing comes under the regulations of the Cyprus Securities and Exchange Commission (CySEC) with licence number 315/16.

Although claiming to be a Straight through Processing (STP) broker, FXBFI Broker Financial Invest Ltd, a New Zealand incorporated entity, is one of the execution venues for all its clients. The firm’s regulators include the Australian Securities and Investments Commission (ASIC) and the Financial Markets Authority (FMA) in New Zealand. Previously, Cyprus-based CFI Markets Limited was the execution venue for 101investing.

The broker covers five asset classes and 250+ CFD products across 10,000+ markets, all of which are accessible on the 101investing MT4 terminal. Besides a range of trading tools, variable spreads and leverage, zero commission, and plenty of educational materials, the 101investing broker provides resources for clients to carry out manual, automated and social trading. It does not matter if you are a beginner or an experienced trader, 101investing has you covered.

Who does 101investing appeal to?

Based on our comprehensive 101investing review, we believe that the CFD broker appeals to all categories of traders – beginners and professionals.

Beginners can benefit from the various educational resources, tutorials, webinars and social trading features offered by the broker. When it comes to registering with the broker, 101investing provides novice traders with the option to choose from multiple account types. There are low minimum deposits starting from €100, and several funding methods.

Likewise, professionals have the advantage of higher leverage, low spreads, live global economic/corporate earnings calendars, several trading tools, and the amenities to carry out automated trading.

Also, 101investing allows experienced traders to hedge positions, and it offers swap discounts, speedy order execution, negative balance protection, access to VIP education, and 24/5 multilingual customer support.

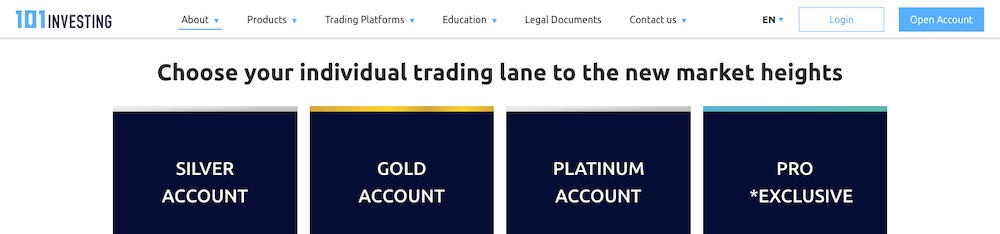

Account types

Individuals signing up with this CFD broker have the choice of four trading accounts along with the Sharia option. In this 101investing broker review, we analysed the account types, the features and their impact on the trading conditions.

The 101investing account types comprise the Silver, Gold, Platinum and the Pro Exclusive or the VIP account. The features that are common with all the trading accounts are the zero commission, fifth decimal and the option to hedge positions.

Some of the other characteristics of the individual account types include the following:

- Silver – This account is for beginners and experienced traders who wish to test the broker before bringing in additional cash. The zero commission account comprises multiple base currencies, a minimum deposit of $100, spreads from 0.07, and max leverage of 200:1.

- Gold – Here, the broker offers spreads from 0.05, leverage of up 400:1, an average trade execution speed of 0.08, and a swap discount of 25%. The trading framework is for clients using the No Dealing Desk (NDD) option.

- Platinum – The spreads for this account type start from 0.03, and the max leverage is at 400:1. You also get to access additional FX pairs and receive a 50% discount on the swap charges. There is a choice of multiple execution modes and account currencies, and an average execution speed of 0.05.

- Pro or VIP – Individuals registering for this account type benefit from 70% lower margins, 500:1 leverage, rapid order execution and better trading conditions. Also, all professional clients receive negative balance protection, access to the Financial Ombudsman Service (FOS), a dedicated account manager, and substantially lower margin closeout levels.

Markets and territories

As mentioned earlier, 101investing is a CIF firm authorised and regulated by CySEC. It offers 250+ products across five asset classes. Since the broker is operating out of Europe, the regulations permit 101investing to provide cross-border services to countries in the EU and beyond.

However, this CFD broker limits its services only to specific countries within the EU and Switzerland. Even within the EU, FXBFI Broker Financial Invest Ltd does not provide services to member states such as Belgium and France.

If you are residing outside of the EU other than in Switzerland, you should not consider signing up with 101investing. On the other hand, residents in the EU member states could reach out to the CFD broker to confirm if it operates in their country.

Instruments and spreads

The 101investing broker offers a range of 250+ financial instruments across five asset classes, comprising CFDs in spot and futures. These include forex, commodities, stocks, indices and cryptocurrencies. The range of products could differ slightly with additional products for Platinum and Pro account holders.

The following table highlights the product-wise tradable instruments at 101investing:

| Description | Number of tradable products |

| Forex | 48 |

| Metals | 04 |

| Stocks | 78 |

| Indices | 15 |

| Cryptocurrencies | 33 |

| Commodities futures | 17 |

While the product mix is right, the broker could have included some more share CFDs from the other major markets such as Europe, the UK, Australia and Japan.

The spreads start at 0.7 pips in FX, 0.003 in 101investing commodities, 0.21 in stocks, 0.32 in indices, 0.037 in spot silver, and a floating spread if you are trading 101investing cryptocurrencies.

However, these are again a factor of the account type. While VIP and Platinum account holders are eligible for the lowest spread, the bid-ask difference increases and the max is payable by individuals signing up for the Silver account.

In this 101investing broker review, we tested the Live platform and found the spread on the major FX pairs to be in the 1.7-2.2 pips range, which is high for a CFD broker focusing on clients from only one region.

Fees and commissions

If you are speculating on your trading costs, you will be pleasantly surprised to learn that the broker does not charge commissions on any of the financial instruments.

However, there are a few levies in the form of fees. These include:

- Swap fee – Charged on overnight positions and applicable across all the products.

- Inactivity fee – These come into effect if your account remains inactive for 60 days. The fee starts at €80 and can go up to €500 if the account is dormant for over 271 days.

- Withdrawal fee – These are chargeable if you place payout requests without carrying out sufficient trades or if your withdrawal amount is less than €100.

Platform review

Following in the footsteps of the majority of CFD brokers, 101investing does not have a proprietary platform of its own. It instead relies on MT4, which it offers to all its clients, irrespective of the trading account.

MT4 is a globally acclaimed platform to trade CFDs and supports forex, commodities, stocks, indices, cryptocurrencies, ETFs and futures. Currently offered by a large number of CFD brokers, MT4 is the most widely used terminal in the world.

In this comprehensive 101investing CFD review of the trading platforms, we analysed the three versions of the client trading terminals: web, desktop and mobile from a demo account.

The following is a detailed account of our study:

The MT4 platform offered by 101investing is the basic version of the MetaQuotes software. The CFD broker has not included additional features or analytical software such as Autochartist or Trading Central, which could have given traders the additional edge.

Also, if you are expecting the broker to deliver live news via the platform, you will be disappointed. The only additional feature offered by 101investing is the live global macro-economic data. Nevertheless, the platform is loaded with trading tools and analytical features in a user-friendly interface and 39 languages.

Here are some of the key features of the 101investing MT4 web and desktop applications:

- You can directly trade from your browser or download and install the application.

- Compatible with Windows, Linux and macOS.

- Real-time streaming quotes with access to the session’s high/low and the spread.

- Three types of order execution: instant, market and trailing stop orders.

- You can access three chart types and trading symbols in nine time frames.

- The MT4 platform has 30 in-built technical indicators and 24 graphic objects.

- Communicate with other traders via the free chat.

- The desktop platform also supports automated trading.

- It meets high security standards with an encrypted data exchange between the client terminal and the platform servers.

Mobile trading

The 101investing MT4 app is accessible on all iPhone and Android smartphones. The app features the watchlist, trading history, interactive charts and live news, and all of them are accessible as separate panels.

Android users can download the app from the Android Play Store, while iPhone, iPad or iPod Touch users can access all the features of the iOS MT4 by downloading the app from the Apple App Store.

The app is accessible on a wide range of smartphones and tablets, and the functionalities are similar to the PC version except for the algo trading feature. Besides the live news, users can access all the other attributes.

Here are the primary characteristics of the 101investing mobile app:

- User-friendly interface.

- Supports all order types that are available on the PC version, including one-click orders.

- The app includes three chart types in nine time frames – one minute-one month.

- It comes with 30 technical indicators and 24 graphic objects.

- Place trading alerts and push notifications.

- Option to communicate with traders from the MetaTrader community.

Social trading and copy trading

If social trading or copy trading interests you, you will be disappointed that 101investing is not associated with a social trading platform such as ZuluTrade. Also, it does not provide clients with the option to copy professional traders from within the brokers’ trading community. You can, however, use the copy trading feature offered by MT4. All you have to do is go to the MT4 website, click on ‘Signals’, and follow the instructions from there. However, before you hire a signal provider, we suggest that you keep the broker informed.

Crypto

If you are eyeing the world’s most volatile financial instruments, you could take a shot at the massive product offering from 101investing cryptocurrencies. The range includes 33 crypto CFDs against the USD, GBP and EUR. The product range comprises all the major digital currencies such as bitcoin, Ethereum, Dash, Litecoin, Ripple and several more. While the broker offers a floating spread, the leverage is at 2:1.

Charting and tools

The MT4 trading platform offered by the 101investing broker comprises live charts and comes with several in-built analytical and automated trading tools. In this section of the 101investing review, we have put down all the charting features and trading tools available on the MT4 so that readers and potential clients know what to expect.

When it comes to charting, all MT4 platforms support three chart types: Line, Bar and Candlesticks. You can access them in nine time frames, starting from one minute to one month.

The charting tools comprise 30 technical indicators and 24 graphic objects. Users can download dozens of technical analysis tools free of cost from the codebase. Combine them correctly and you can carry out a detailed analysis of price dynamics, define entries/exits, and predict market movements.

Besides charting, the MT4 desktop application also supports automated trading. Users can download trading robots or purchase, rent and order them from professional programmers. If you wish to develop the expert advisor (EA) yourself, the MT4 platform has an in-built MQL4 IDE development environment. You can use it to develop, test and optimise your trading robots.

Education

There are lots of educational and training resources available on the 101investing website. These cater to all classes of individuals – beginners and experienced traders. It doesn’t matter if you are a fresher or a professional: there’s always something for everyone to learn.

The various categories in the section include:

- Video on demand (VOD) – Short videos on trading basics, distributing risks, chart patterns and a few audio-visuals featuring the functionalities of the MetaTrader platform.

- eBooks – These are handy for beginners who are not familiar with the psychology of the markets and the risk involved. The eLearning topics include capital management, trading psychology, technical analysis, advanced strategies and a few more.

- Tutorials – If you are not familiar with the MetaTrader platform, the video tutorials guide you through setting up the client terminal and accessing all the MetaTrader functions.

- Courses – The short audio-video courses are for beginners and cover the basics of CFDs, stocks, trading strategies and tools, among others.

Besides the above training material, you could sign up for the webinars that the broker conducts frequently. The broker states the webinar topic/s in advance, so if you find something interesting, go ahead and register. The 101investing broker also provides live access to the global macro-economic releases and corporate earnings announcements – an absolute necessity if you are a trader.

Trader protection by territory

FXBFI Broker Financial Invest Ltd is a registered Cyprus investment firm, authorised and regulated by CySEC. The regulator follows all the guidelines of the European Securities and Markets Authority (ESMA) when it comes to max leverage, trading conditions, negative balance protection and investor compensation.

The stringent monitoring framework requires members to maintain adequate capital requirements and ensures that all client deposits are in segregated accounts in tier-one banks, distinct from the broker’s operational expenses. Also, all CFD brokers have to mandatorily carry out audits at the prescribed time, separate retail from professional clients, and ensure adequate client data security.

In keeping with the regulatory framework of CySEC, 101investing has not only ensured negative balance protection to retail customers but has also extended the safeguard to include professional clients.

When it comes to trader protection, investors can be assured that their deposits are safe with the CFD broker. The monitoring authority also addresses disputes and claims if the CFD broker fails to resolve them to the satisfaction of its clients.

How to open an account

The account opening process at 101investing is a pleasant experience. Unlike the traditional account opening forms, the broker has introduced slide-based registration.

The registration steps are simple and can be completed in a minute. You don’t have to include your ID and proof of residence to open an account. However, to activate the demo MT4 desktop or the mobile app, you have to get in touch with the support team or contact your account manager.

Once you complete the account opening process, you can log into your client area, test the demo web application, edit your profile, fund your account, upload KYC documents, and chat with the live support team.

Customer support

If you would like to get in touch with the customer helpdesk, 101investing has four alternatives: live chat, phone, email and the ‘contact us’ form.

If you are not satisfied with the support offered or wish to leave feedback, you can also write directly to the management. The support channels are open only from 07:00am to 05:00pm, Monday to Friday, though the broker claims that there is 24/5 support for retail and professional clients.

As part of this 101investing broker review, we contacted the live chat support several times and were not happy with the response time or the quality of support offered.

While the initial response time was under five minutes, the subsequent replies were staggered. Our guess is that the brokerage may not be operating to its full potential due to the current COVID-19 situation. Since customer support is paramount, especially for existing clients, this is one space in which 101investing could do better.

Tabled below are the contact details of 101investing phone and email support

| Phone | +357 80092740 |

| [email protected] |

The bottom line

As we conclude our 101investing CFD review, we will outline what we think about the broker. When it comes to the positives, 101investing is a tier-one regulated broker, covering all the major asset classes from the world’s number one trading platform.

It doesn’t matter if you are a beginner, copy trader or professional algo trader, this cutting-edge platform covers all of your trading activity. The broker offers the choice of multiple account types, a quick and straightforward registration process, excellent trading conditions, speedy order execution, zero commission, and plenty of educational resources.

On the flip side, the broker’s product range is small; it does not provide additional trading or analytical tools besides those included in the platform; and the customer support is not that great.

However, the pros outnumber the cons by a wide margin. Although 101investing has limited its client base to individuals residing in the EU, if you are one of them, then this broker is worth a look.

FAQs

Does 101investing offer services to clients across the globe?

At the moment, the 101investing broker is only providing services to residents in the UK, Switzerland, and the EU, excluding Belgium and France. If you are residing in a non-EU country, you cannot sign up with 101investing.

To what extent does the Investor Compensation Fund provide cover?

If you have registered as a retail client with 101investing, the Investor Compensation Fund (ICF) covers you and co-beneficiaries up to €20,000. The compensation is for claims arising from the failure of a member to fulfil its obligations due to negligence, fraud or bankruptcy.

In the case of joint accounts, the compensation received is equally divided or based on the agreement between the co-beneficiaries.

Who are the payment service providers of 101investing?

The payment service providers of FXBFI Broker Financial Invest Ltd include Inpay, eMerchant Pay, Trustly, KoalaPays, UPayCard and SafeCharge.

Who are the affected parties in the event of a conflict of interest?

A conflict of interest could arise between a registered client and the broker, two or more clients, the broker and its employees, the client and employee/s of the broker, or among the various departments of the brokerage firm.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Your capital is at risk

Your capital is at risk

Your capital is at risk

Your capital is at risk  73% of retail CFD accounts lose money

73% of retail CFD accounts lose money  Your capital is at risk

Your capital is at risk  Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  77% of CFD traders lose

77% of CFD traders lose