The Euro/Hungarian Forint currency pair (also referred to as EURHUF and EUR/HUF) is considered an exotic currency pair. In this article, we will examine how EURHUF is performing.

EURHUF Key Stats

- 2021 high: 371.980

- 2021 low: 345.130

- YTD high: 416.856

- YTD low: 345.947

- YTD % change: 9.31%

EURHUF Forecast

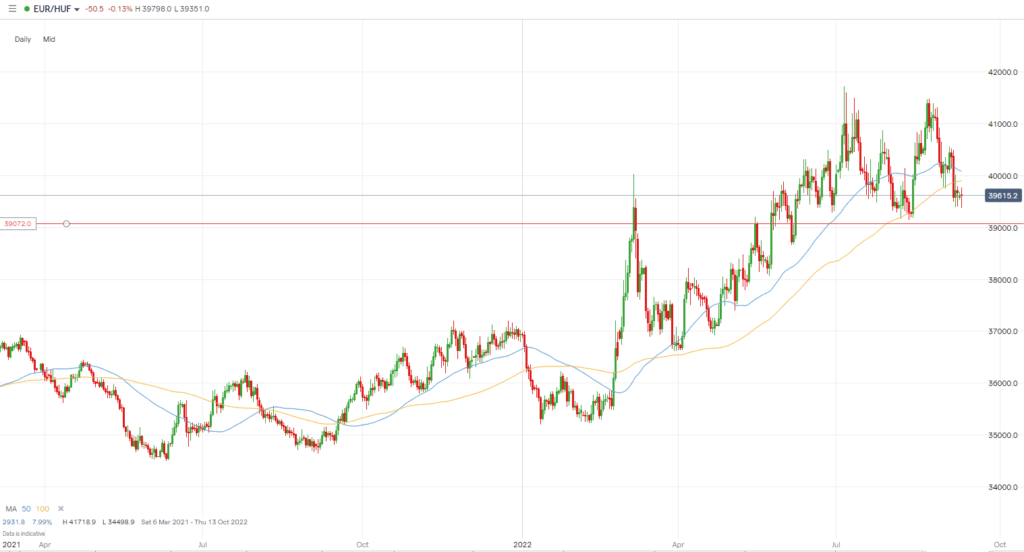

The EURHUF has risen for most of 2022, although it has run into a stumbling block of late, dipping from its July high. However, given what looks to be easing headwinds in Europe, a further move to the downside looks like a real possibility. Price is currently sitting just below the 100MA, and we believe a move back to 390.72 is an area to target.

EURHUF Fundamental Analysis

Fundamental analysis helps traders develop an understanding of what moves a currency and enables them to build a directional bias for a pair. That macroeconomic-related directional bias is usually dictated by recent economic activity, with factors such as unemployment, consumer spending, GDP, inflation, and several more being the reasons why trillions of dollars are traded each and every day. Therefore, coming to terms with the current economic conditioner in the countries associated with each country will help you develop a clear trading idea.

Related Articles

Over recent months, the euro has been a heavy talking point, with the ECB’s decisions causing much debate. The euro has hit major lows, and Russia’s halt to gas supplies has heightened fears about a deepening energy crisis. The euro has had a significant inverse correlation with natural gas prices in recent months. With energy prices rising, the euro has been sinking as Europe attempts to break away from Russian supplies. Furthermore, investors are expecting further rate hikes after a recent 75bps increase.

The Hungarian forint has taken some heavy blows in 2022 and was significantly impacted by Russia’s invasion of Ukraine. Many Hungarian businesses have since opted to accept the euro instead of its local currency, although Hungary is still well away from adopting the single currency. In addition, the National Bank of Hungary has been raising rates to cool prices; it recently raised its benchmark base rate by 100 basis points to 11.75%, with its borrowing costs ascending to their highest levels since May 2004.

EURHUF Technical Analysis

Fundamental analysis may be the driver of long-term prices, but technical analysis also plays a significant role in defining entries, exits, price targets, and stop losses for traders. Support levels help identify areas where price may bounce off after a significant downtrend. Levels such as 396.93 and 391.630 are potential levels for bullish investors to enter. Price has shown recent reactions to each level, which can be psychological for traders.

On the other hand, resistance levels are ideal for a potential entry point for bearish traders. These are areas traders can identify where price may react after a significant trend higher. Examples include 414.624 and 416.85. These are two previous highs of the EURHUF and a considerable level for investors looking at a sell position.

Furthermore, a moving average is another technical indicator used by traders. The 50-day moving is currently above the 100MA following this year’s bullish move. However, there is a hint it could turn over after a pullback in price, hinting at a potential near-term downtrend.

Trade EURHUF with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.