![]()

The Australian Dollar (AUD) has shown mixed performance against several major currencies throughout January 2024. Despite a general optimism for the AUD’s value increase by the end of the year from major Australian banks, the currency faced challenges influenced by both domestic and international factors.

Key Events and Fundamental Factors

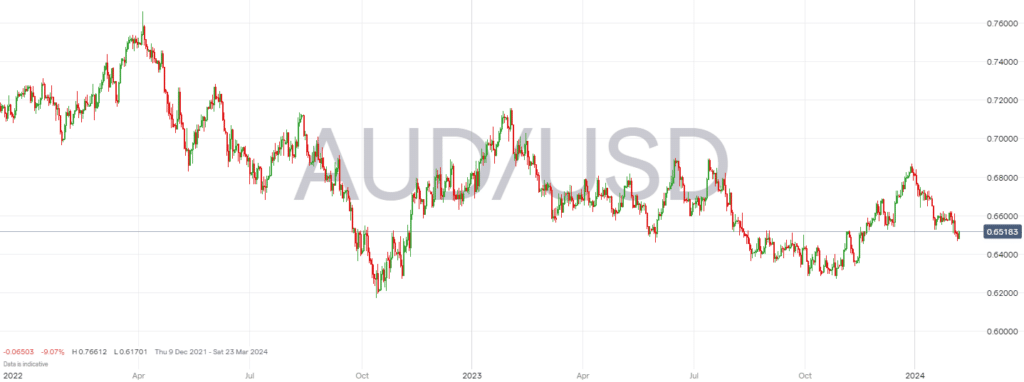

- Economic Predictions and Chinese Influence: The AUD experienced a downward trajectory for most of 2023. It reached yearly lows in October before a minor recovery. The forecast for 2024 was optimistic, with banks like NAB, ING, Westpac, and Commonwealth Bank predicting varying degrees of recovery or decline based on factors including Chinese economic performance and global interest rates.

- Retail Sales and Equities Impact: Despite a significant drop in local retail sales, the Australian dollar found support from a surge in equities. This saw both Australian and US share markets reach record highs. This indicates the currency’s resilience to domestic setbacks when bolstered by international market optimism.

- Employment Figures: The Australian economy faced a surprising setback with the loss of 65,100 jobs in December, against expectations of job growth. This unexpected decline in employment negatively impacted the AUD, highlighting the importance of labor market health to currency strength.

AUD Technical Analysis

The AUD’s performance in January 2024 showed declines against major currencies. AUDUSD is down by 3.1%, AUDCAD by 2.6%, and AUDCHF by 1.7%. These movements were reflective of broader economic trends, including job market shifts and global market dynamics.

The AUD/USD pair has shown bearish price signals, trading below the 50-day and 200-day Exponential Moving Averages (EMAs), hinting at a bearish near-term outlook. The direction of AUD/USD in the short term will likely be influenced by the outcomes of the RBA rate statement and press conference.

The Australian Dollar’s journey through January 2024 underlines the complexity of factors influencing currency markets. From domestic economic challenges to global market sentiments, the AUD’s fluctuations against major currencies provide insight into the interconnected nature of global finance. With the mixed outlook from financial institutions, the future of the AUD remains cautiously optimistic, contingent on both domestic economic health and global economic trends.

AUD Forecast for February 2024

The Australian Dollar (AUD) has seen varied performance as of early February 2024. This has been influenced by both domestic economic factors and international market dynamics. A notable development is the anticipation surrounding the Reserve Bank of Australia‘s (RBA) interest rate decision.

The AUD’s performance in February will closely depend on the RBA’s interest rate decision and the subsequent press conference. Market reactions to the US economic calendar and Fed speakers’ comments will also be significant. With inflation easing but still above target, the RBA’s stance on monetary policy will be crucial for the AUD’s direction. The global economic environment, particularly US financial conditions and Chinese market support measures, will continue to play a role in shaping the AUD’s value against major currencies.

Key Developments Influencing AUD

- Interest Rate Decision: The RBA’s decision on interest rates is highly anticipated. Expectations are leaning towards maintaining the current cash rate of 4.35%. Market participants are keenly watching for any forward guidance on economic outlook, inflation, and future interest rate moves.

- Economic Indicators: Australian inflation data for Q4 2023 showed a year-on-year increase of 4.1%. This was a decrease from 5.4% in the previous quarter, indicating a slowdown in inflationary pressures. This data plays a crucial role in shaping RBA’s monetary policy decisions.

- Market Sentiment: The AUD’s performance has also been influenced by global currency market dynamics. These include the US dollar’s movements and risk sentiment among investors. Recent US economic indicators have impacted Fed rate cut expectations, affecting the AUD/USD exchange rate.

This period could present a choppy trading and investment climate across Asia, especially for the AUD. Investors and traders should stay attuned to the RBA’s announcements and global economic indicators to gauge the potential impact on the AUD’s movement.

Related Articles

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk