Understanding And Trading The US Presidential Vote Count

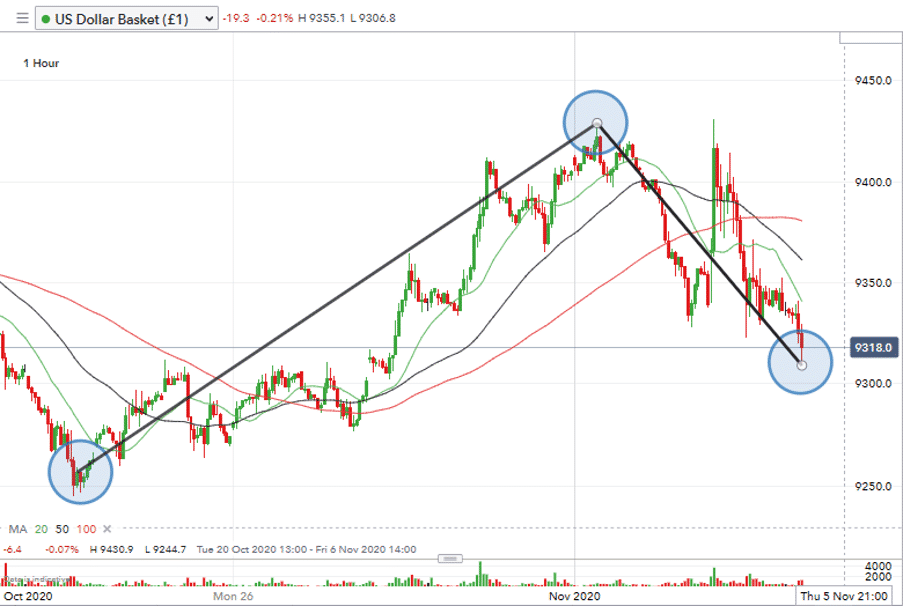

The two-week USD basket chart shows how the adage ‘buy the rumour, sell the fact’ has played out in typical fashion. It’s been an exciting two-weeks in the market with plenty of opportunities to enter and exit trades.

‘Buy the Rumour, Sell the Fact’

The upcoming, known, major news event acted as a catalyst for all sorts of market jitters, while the strength of the dollar came from its status as a reserve currency. Fuelled by a negative tone in the market it exacerbated all other news, be it COVID-19, Brexit or corporate earnings.

Source: IG

It hasn’t been a comfortable ride and staying in positions can be challenging in fast-moving markets. Those traders who caught the report Trading The Risk Off Move, or picked up on the later tip-off that risk appetite might be returning, might have made a return.

Those that didn’t should look to exchange their FOMO for the comfort of knowing they didn’t make a loss after being shaken out of positions during what was a bumpy ride.

Using Game Theory to Trade Forex

There is little certainty about the path to be taken from Thursday morning, pending a president being declared and accepted. The timing is even trickier to predict.

The nature of US presidential elections and the fact they are a two-horse race means neck-and-neck finishes are very much the default. There is historical precedent for even less divisive contests being dragged through the courts. How far this dispute will go is anyone’s guess.

- Worst-case scenario – A Biden victory is challenged in the courts for an extended period. Fiscal and monetary programs to boost the economy during a COVID resurgence are bogged down by political in-fighting

- A possible boost for markets – A Biden victory and a Republican Senate could herald years of ‘normality’. Non-confrontational policies would be the order of the day and tech and eco sectors, which the US is strong in, would flourish

- Wildcard – a lot appears to be hanging on whether Donald Trump wants to run for president in 2024. He would still be younger than Joe Biden is today.

- A fight to the death – on the other hand, if Trump thinks the gossiped about lawsuits which could see him convicted have some credence, remaining president for as long as possible could be an act of survival.

Reasons to Be Careful Trading the Markets

Insider trading is illegal and those convicted face severe punishment. The problem is that a massive grey area surrounds the subject. With so many possible scenarios in place, it could be that price moves happen before any announcements are made public. Any major investor with an ear to the ground in the Biden or Trump camp will be the first to respond to developments.

Key Resistance and Support Levels for USD Basket

Everybody has their favourite forex pair, but the dollar basket index is the market to watch. There could be a downside breakout move forming.

- R3 95.13

- R2 94.74

- R1 94.07

- S1 93.02

- S2 92.61

- S3 91.96

Our analysis is based on a comprehensive summary of market data. We use a range of metrics with weighting given to simple and exponential moving averages and key technical indicatorsAny information contained on this Website is provided as general market information for educational and entertainment purposes only, and does not constitute investment advice. The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions. Opinions, market data, recommendations or any other content is subject to change at any time without notice. ForexTraders will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Your capital is at risk

Your capital is at risk  73% of retail CFD accounts lose money

73% of retail CFD accounts lose money  Your capital is at risk

Your capital is at risk  Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  77% of CFD traders lose

77% of CFD traders lose