The Euro/Australian Dollar currency pair (also referred to as EURAUD and EUR/AUD) is one of the most actively minor currency pairs traded in the world. In this article, we will examine how EURAUD is performing.

EURAUD Key Stats

- 2021 high: 158.21

- 2021 low: 139.68

- YTD high: 168.43

- YTD low: 150.97

- YTD % change: +6.53%

EURAUD Forecast

With metals such as copper falling in recent times, we have seen the euro gain against the Australian dollar. However, we expect that to be short-lived and expect another leg lower in the pair. Australia has just raised rates by the most in 22 years as it aims to curb surging inflation. Meanwhile, the ECB intends to raise rates for the first time in 11 years in July. So, we do expect the euro to make some gains on that news, but ultimately the pair will continue to slide in the mid to long term. Our target is nearer the 1.4559 level.

EURAUD Fundamental Analysis

Fundamental analysis enables traders to develop a clear directional bias between currency pairs. Major changes in monetary action and economic activity can cause price swings. As important as technical analysis can be in a strategy, fundamental news such as economic policy, must be watched carefully.

The Euro has been a heavy talking point as we approach the summer months. Its interest rates have been unchanged throughout Covid, but the anticipation has grown for the ECB to raise interest rates by 25 basis points in July. It will be the first increase in interest rates in more than a decade as they attempt to control inflation. In addition, borrowing rates may be expected to rise again in September.

The Australian Dollar is one of the most frequently traded currencies in the world. The popularity of the AUD comes from the wealth of natural resources and its trading with Asian countries. India and China are large importers of Australia’s commodities, and Australia imports heavy machinery and goods produced in those countries. Furthermore, when the Chinese economy is hit, it impacts Australian exporters, hurting the supply chain and resulting in a weakening Australian dollar.

Related Aricles

- EURGBP Forecast and Live Chart

- AUDUSD Forecast and Live Chart

- What are Forex Cross Pairs

- Forex Charts

EURAUD Technical Analysis

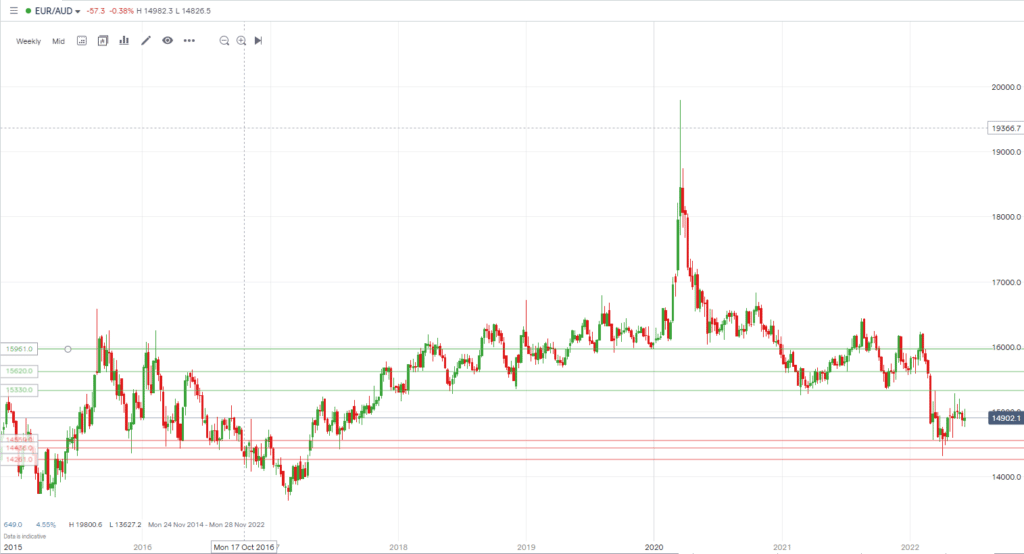

Support Levels:

- 1.4559

- 1.4436

- 1.4261

Resistance Levels:

- 1.5330

- 1.5620

- 1.5961

The first support level outlined is 1.4559, which recently held strong and was unable to be broken. Despite some Euro weakness, it has been unable to be broken so far. Level 1.4436 looks convincing on a weekly chart with multiple bounces after approaching the level. Furthermore, level 1.4261 has been a psychological area for traders, acting as a significant resistance level as far back as 2011 until 2017 and the potential to approach it soon.

As for some key resistance levels, 1.5330 stands out. It acted as a strong support level from 2018 until finally being broken this year. Therefore, traders may keep watch on any return back to the level. Meanwhile, slightly above this is 1.5620, which will be another test for the currency pair if it can break 1.5330. In addition, 1.5961 has been broken a few times over recent years but has also shown itself to be a key level.

Trade EURAUD with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.