The Euro/Swedish Krona currency pair (also referred to as EURSEK and EUR/SEK) is considered an exotic pair. In this article, we will examine how EURSEK is performing.

EURSEK Key Stats

- 2021 high: 10.3687

- 2021 low: 9.8636

- YTD high: 11.0645

- YTD low: 10.2112

- YTD % change: +6.8%

EURSEK Forecast

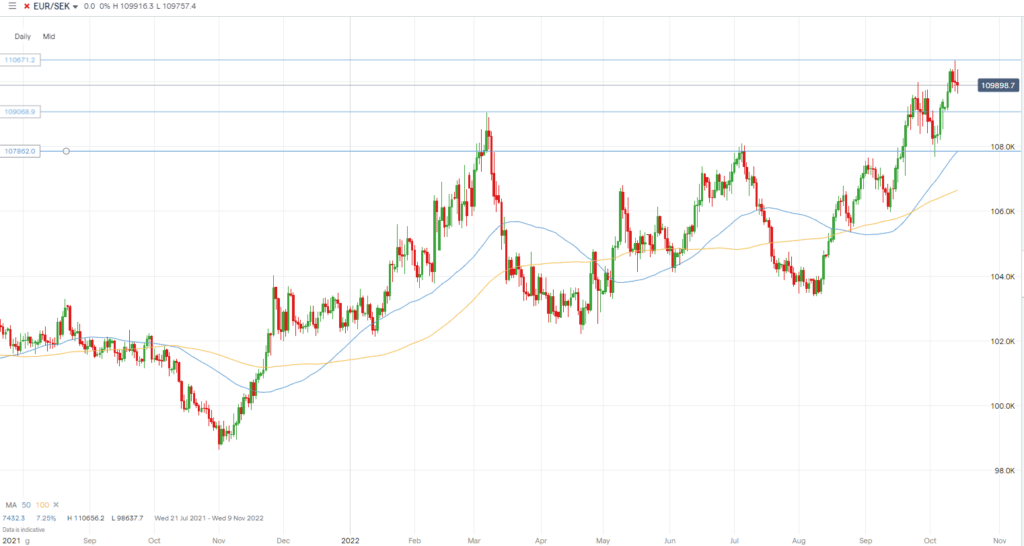

The EURSEK has been steadily rising since the end of 2021, with a couple of significant pullbacks in between. However, the move since August has been pretty much one-way traffic to the upside, with the price now trading around its early-pandemic levels. Both countries’ economies are facing headwinds, but as the euro is seen as more of a safer bet, the upside has prevailed. However, with significant uncertainty ahead (think energy) for both the Eurozone and the Swedish economies, we are currently neutral on this pair.

EURSEK Fundamental Analysis

Fundamental analysis can be a great tool in helping traders ascertain a directional bias for a currency pair by assessing the current condition of the two economies.

Before the pound’s collapse, all eyes were on the euro as it fell below parity against the dollar. Despite its rise against the SEK, it is still below parity vs. the USD. Russia’s halt to gas supplies has heightened fears about a deepening energy crisis, especially over the fast-approaching winter. The euro has had a significant inverse correlation with natural gas prices in recent months. With energy prices rising, the euro has been sinking as Europe continues its attempt for a clean break from Russian supplies. Investors expect further rate hikes by the ECB, with inflation in Eurozone nations continuing to rise.

The Swedish Krona moves heavily on its monetary policy. Its central bank is one of the oldest banks to date. The SEK is also impacted by the currencies of other Nordic countries, such as the Danish Krone or the Norwegian Krone. While the move against the euro may not appear so, with Sweden being a small economy, the SEK is considered a safe haven due to its tech-savvy workforce and numerous multinational corporations. Therefore, any global uncertainties, such as inflation worries or recessions, can cause a rise in the SEK. However, recent years have seen overall weakness for the Krona, despite the country’s central bank raising rates.

Related Articles

EURSEK Technical Analysis

Technical analysis is great for short-term traders, but it is also helpful for long-term traders as well, helping to define entry and exit points in a trade.

The EURSEK is currently trading around levels last seen early in the pandemic after a substantial rise starting in early August. It has since run into some slight resistance trying to breach those highs and is pulling back slightly on the daily chart, looking o form a flag pattern. A key level it may bounce from on the downside is the swing high from March 2022, although the 50 MA also looks as though it will provide some support on a more significant pullback. If traders are looking for a further upside move, areas to potentially target are the most recent swing high and the 11.1003 level.

Trade EURSEK with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.