The Great British Pound/Australian Dollar currency pair, also known as GBPAUD and GBP/AUD, is another very popular pair among forex traders. These two currencies are among the most traded in the world. Lets take a look at how they are performing.

GBP/AUD Key Stats

- 2021 high: 1.9154

- 2021 low: 1.7415

- YTD high: 1.9221

- YTD low: 1.7173

- YTD % change: -5.85%

GBPAUD Forecast

The GBP/AUD has been bearish for most of the first half of 2022, giving up its 2021 gains. The BoE has been raising interest rates to combat inflation since December, while the RBA began later. However, with potential UK concerns creeping in that growth has started to slow, we may see a more cautious BoE in the near term and we expect the bearishness to continue with a move back to just above 1.74 and then a further decline to just above 1.72.

However, focusing on a longer-term view, we eventually see the GBPAUD turning around and heading up to the 1.8070 mark.

GBPAUD Fundamental Analysis

When analysing the Great British Pound/Australian Dollar pair, we have to take into consideration that each currency in the pair, or any forex pair in general, will have isolated factors impacting its performance.

For example, the Pound will be affected by the economic performance of the United Kingdom. Traders should keep an eye on inflation, monetary policy, GDP, retail sales, employment, and trade balance to understand how an economy is performing. Above, in our forecast, our near-term view was determined by expectations for monetary policy.

For the Australian Dollar, it is also important to focus on the data listed above. However, it is also vital to watch how Australia’s export industry is fairing as it is a large exporter of commodities such as coal, iron ore, and gold.

In addition, political factors will also play a role. For example, with Australia being a large exporter, its economic relationship with China will play a part, with a frostier relationship potentially impacting the number of goods China imports from Australia.

Similarly for the UK, its economic relationship with the European Union will also impact its currency. The most obvious point to focus on here is Brexit and the future trading relationship between the UK and EU.

Related Articles

- GBPNZD Forecast and Live Chart

- AUDUSD Forecast and Live Chart

- What are Commodity Forex Pairs?

- Forex Charts

GBPAUD Technical Analysis

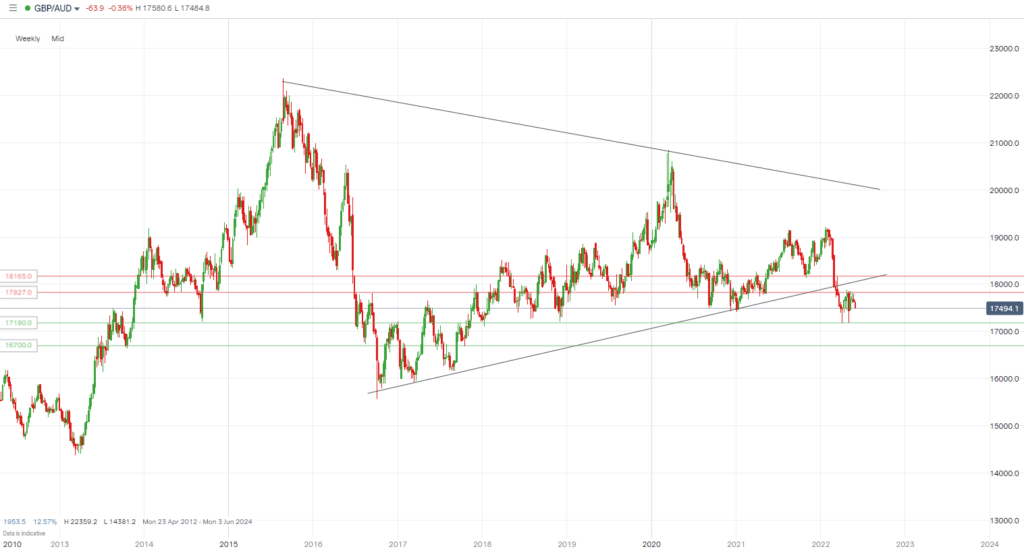

Key Support Levels:

- 1.7180

- 1.7100

- 1.7047

- 1.6700

Key Resistance Levels:

- 1.7827

- 1.8035

- 1.8165

- 1.8200

The GBP/AUD has run into stern resistance at around the 1.7827 mark lately, testing it on several occasions, even breaking higher, before closing the day below. Before that, the pair had bounced off support twice at around the 1.7180 level and, at the time of writing, it looks to be heading back there once again. Zooming out to a weekly chart, we can see why, in the near term, price is heading lower, after breaking below the triangle pattern, moving back to test and then continuing lower. Some other key levels to the downside to watch out for are 1.7100, 1.7047, and further below at 1.6700.

Levels to watch on the upside, above the key resistance already mentioned, include 1.8035, 1.8165, 1.8200 and 1.8350

Trade GBPAUD with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.