The Singapore Dollar/Philippine Peso currency pair (also referred to as SGDPHP and SGD/PHP) is an exotic currency pair. In this article, we will examine how SGDPHP is performing.

SGDPHP Key Stats

- 2021 high: 38.041

- 2021 low: 35.690

- 2022 high: 41.984

- 2022 low: 37.476

- 2022 % change: 9.8%

SGDPHP Forecast

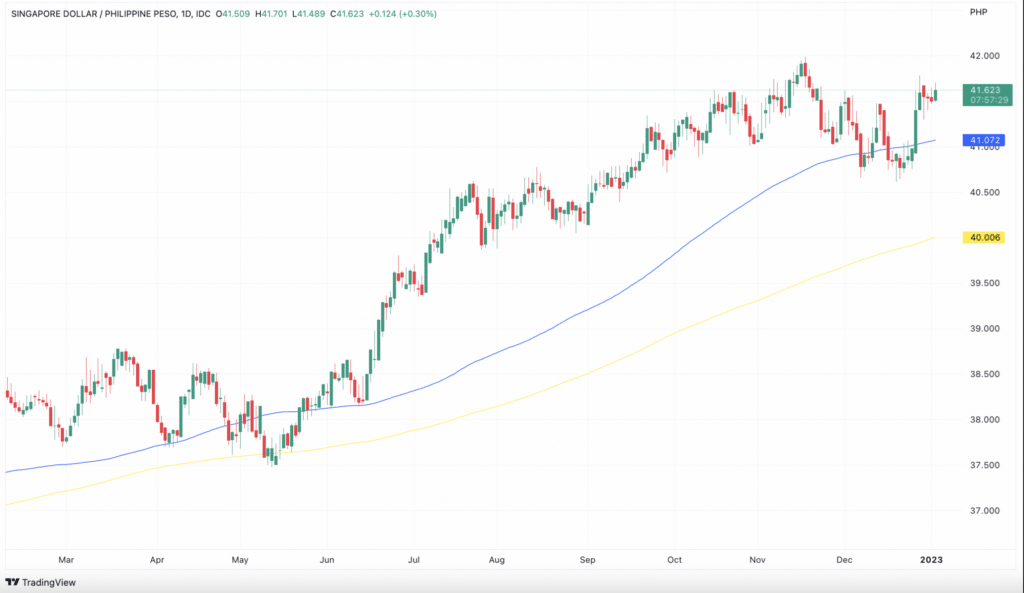

The Singaporean dollar is a currency considered a safe haven, similar to the Japanese yen (previously) and the US dollar. As a result, it has performed positively throughout 2022. Given the recent macroeconomic headwinds are expected to persist, and the current momentum is to the upside, we are bullish on the pair in the near term. It bounced nicely following a pullback in late November/December and is once again looking to test its recent highs. We expect a break and push above over the next month. However, if the price once again breaks and closes below the 100 MA, we will reconsider our current bullish stance on the pair and potentially look for a pullback toward the 200 MA.

SGDPHP Fundamental Analysis

Singapore has a growing financial centre and its house prices are resilient, making it a preferred choice during times of economic upheaval. The country’s strong growth rate is due to the fact it has an extremely business-friendly regulatory environment for entrepreneurs. Meanwhile, it is also a major trading hub, with its manufacturing and services sector remaining one of its key growth drivers. As a result, the Singapore dollar has performed well in times of increased economic and market risk, with investors using it as a safe haven against more risk-associated currencies.

Like most other currencies, the price of the PHP is impacted by the current economic situation in the Philippines and the actions of its central bank. However, it can be difficult to predict the direction of the currency pair. For example, the Covid-19 lockdown in the country meant many would have expected the currency to decline, but as its imports fell more than its exports, it actually rose against the safe haven of the US dollar. However, like most currencies, uncertainty will always result in a fall, and 2021 and 2022 brought about a slide in the Philippine peso, which we expect to continue this year.

Related Articles

- SGDMYR Forecast and Live Chart

- SGDJPY Forecast and Live Chart

- AUDSGD Forecast and Live Chart

- What Are Exotic Forex Pairs?

- Forex Charts

SGDPHP Technical Analysis

As mentioned previously, the 100 MA on the daily chart acted as a solid support level for the SGDPHP, which has since bounced from that area. It is currently trading around the critical 41.60 level, and a close above would represent a continuation of the current bullish move. Additionally, both the 100 and 200 MA have acted as solid support levels in the past, and any pullbacks to those areas, while the macroeconomic environment is uncertain, could result in a bounce.

Trade SGD/PHP with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

77% of CFD traders lose

Founded: 2007 77% of CFD traders lose

Founded: 200777 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.