The Australian Dollar/Indian Rupee currency pair (also referred to as AUDINR and AUD/INR) is an exotic currency pair. In this article, we will examine how AUDINR is performing.

AUDINR Key Stats

- 2021 high: 58.6090

- 2021 low: 52.6240

- YTD high: 57.6248

- YTD low: 52.3110

- YTD % change: +0.70%

AUDINR Forecast Summary

Given the current geopolitical and macroeconomic situation, we prefer the AUD/INR to the upside, although we have to admit it is not a very strong view, and we could be easily swayed if we see any macro changes. Our near-term target to the upside is 55.05, with a long-term view towards the 57.40 level.

However, there are risks to our view with the Reserve Bank of India intervening in order to maintain stability in the rupee.

AUDINR Fundamental Analysis

The direction in which a pair trades on any given day, week, month, or year, is significantly influenced by macroeconomic factors. At the moment, the Ukraine-Russia conflict, inflation, soaring energy prices, and more are impacting how markets, including FX pairs, move. Therefore, keeping up to date with economic/geopolitical data and activity is essential.

The Australian Dollar is one of the most traded currencies worldwide. Australia has a wealth of natural resources such as iron ore, coal, and gold which make up a significant percentage of its exports. India and China are large importers of Australia’s commodities, and Australia imports heavy machinery and goods produced in those countries. When countries that are big importers of Australian goods experience an economic downturn, it impacts Australian exporters, hurting the supply chain and resulting in a weakening Australian dollar.

Those rising commodity prices have impacted the Indian rupee in 2022. The Reserve Bank of India has increased interventions in an effort to slow its currency’s decline and maintain stability, protecting importers and exporters from potential shocks. In addition, during times of economic instability, investors will typically exit positions in what they perceive as riskier currencies such as the rupee and invest in so-called safe-haven currencies such as the Japanese yen and US dollar. The recent market downturn, inflation, and economic worries have seen the INR fall so far this year.

Related Articles

- GBPINR Forecast And Live Chart

- EURAUD Forecast And Live Chart

- What Are Exotic Forex Pairs?

- Forex Charts

AUDINR Technical Analysis

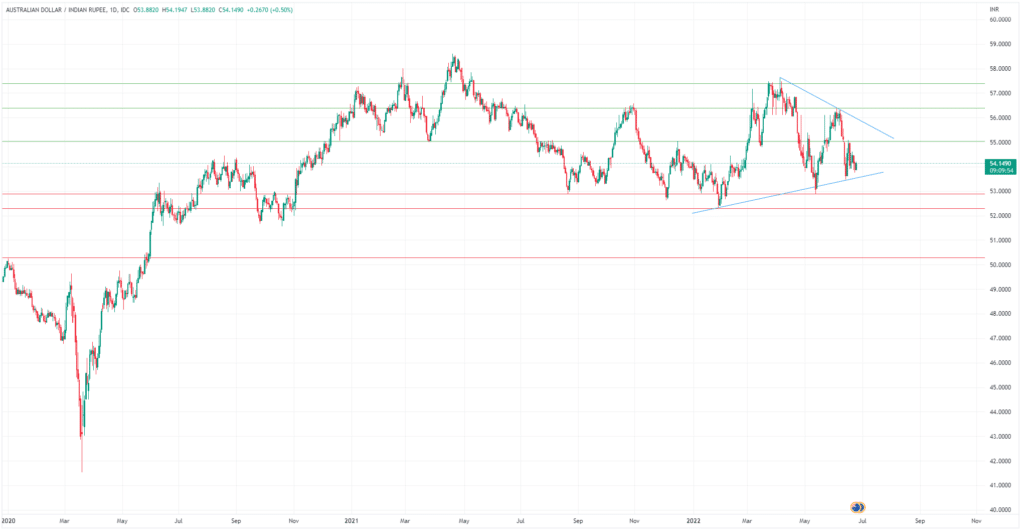

Support Levels:

- 52.90

- 52.30

- 50.30

Resistance Levels:

- 55.05

- 56.40

- 57.40

After a strong rally in 2020, the AUDINR has failed to find a clear direction over the last couple of years. On a few occasions, it has tested a key support level at 52.90, and below that, 52.30. If it were to break eventually, watch out for a key level at 50.30.

Looking to the first level we want to target is around 55.05, before a further move higher will push our focus to the 56.40 mark. The highest level we have our eye on at the moment is 57.40.

Trade AUDINR with our top brokers:

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.