The New Zealand Dollar/Canadian Dollar currency pair (also referred to as NZDCAD and NZD/CAD) is a major currency pair. In this article, we will examine how NZDCAD is performing.

NZDCAD Key Stats

- 2021 high: 0.9329

- 2021 low: 0.8548

- YTD high: 0.8808

- YTD low: 0.7624

- YTD % change: -3.13%

NZDCAD Forecast

The NZDCAD has declined for the majority of 2022 due to the Canadian economy benefitting from its energy exports. However, rate hikes and a robust economy have seen the pair turnaround in the last few months. Judging where the NZD/CAD may head from here is essentially a take on risk and oil prices. We expect a slight pullback in the near term, but in the longer term, we see the pair continuing to run higher as macroeconomic headwinds ease. This view, however, cannot be concrete and is subject to inflation data, interest rate hikes, and changes in geopolitical uncertainty.

NZDCAD Fundamental Analysis

The global economic climate is changing daily, and fundamental analysis can be a crucial component of a trading strategy to help determine the direction in which a currency pair will trade. Many factors influence price, including GDP, inflation, monetary and fiscal policies, and more.

While interest rate differentials and the fact that the NZD is considered a carry-trade currency will play a part in its movement against other currencies, other factors to consider are tourism numbers and dairy prices. New Zealand is a significant exporter of whole milk powder, so if the price of milk increases, the economy will benefit, strengthening the NZD. In addition, tourism is also important to its economy. As the number of visitors increases, the New Zealand economy benefits, resulting in a strengthened NZD. However, New Zealand’s tourism took a heavy hit from the pandemic, falling well below its usual numbers. This impacted the currency. Although in 2022, tourists travelling to New Zealand has shown signs of increasing, it is still well below the levels seen before the pandemic. Even so, there are encouraging signs going forward as the travel industry continues its recovery. As for inflation, New Zealand has not been immune to the significant rise in prices. Therefore, the Reserve Bank of New Zealand has had to raise rates considerably, which has benefitted the currency.

Canada has one of the world’s largest economies. Its trading is primarily dominated by its oil and gas industry, with most of its earnings coming from the sale of crude oil. Therefore, the Canadian Dollar benefited substantially from the rise in oil prices this year, with it being one of the largest exporters of the commodity. However, the economy has still faced difficulty, with soaring inflation also weighing on the Canadian economy. As a result, the Bank of Canada has hiked interest rates. These hikes have managed to slow the inflation pace, with prices falling from highs earlier this year.

Related Articles

- NZDUSD Forecast and Live Chart

- EURCAD Forecast and Live Chart

- What Are Minor Forex Pairs?

- Forex Charts

NZDCAD Technical Analysis

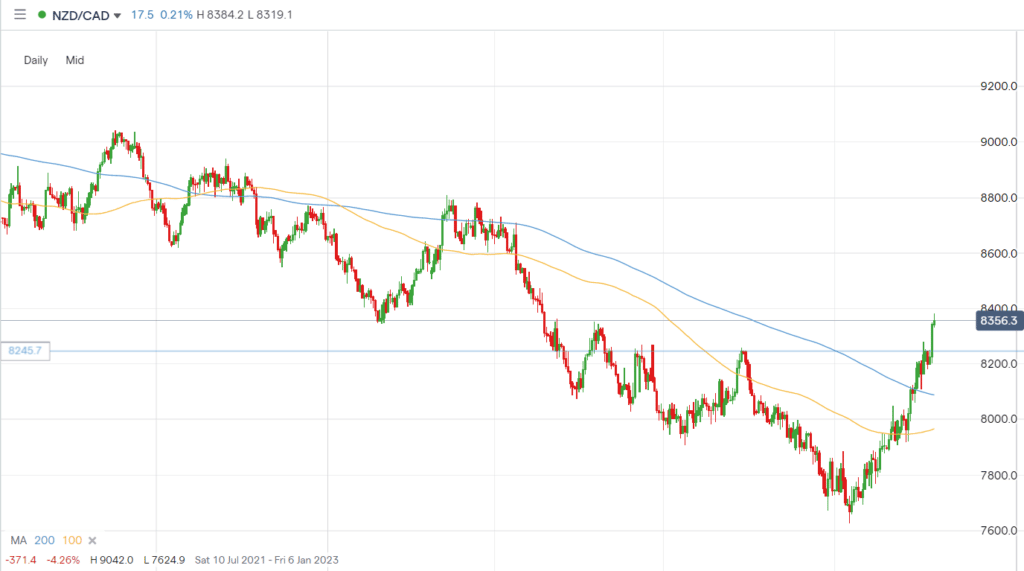

2021 marked the beginning of a sustained move lower in the NZDCAD as macroeconomic and geopolitical factors began to push the New Zealand dollar lower. However, that downtrend seems to have now ended, at least in the short term, with the pair now climbing — trading back around levels last seen in April this year.

The current bullish move has seen the pair cross above its 100 and 200 MA on the daily chart, and it has respected the current bullish trend line so far. For a near-term pullback, a level to look out for, for a near-term pullback, is 0.8245.

Trade NZDCAD with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.