The Singapore Dollar/Thai Baht currency pair (also referred to as SGDTHB and SGD/THB) is an exotic currency pair. In this article, we will examine how SGDTHB is performing.

SGDTHB Key Stats

- 2021 high: 25.042

- 2021 low: 22.462

- 2022 high: 26.974

- 2022 low: 26.868

- 2022 % change: 13.69%

SGDTHB Forecast

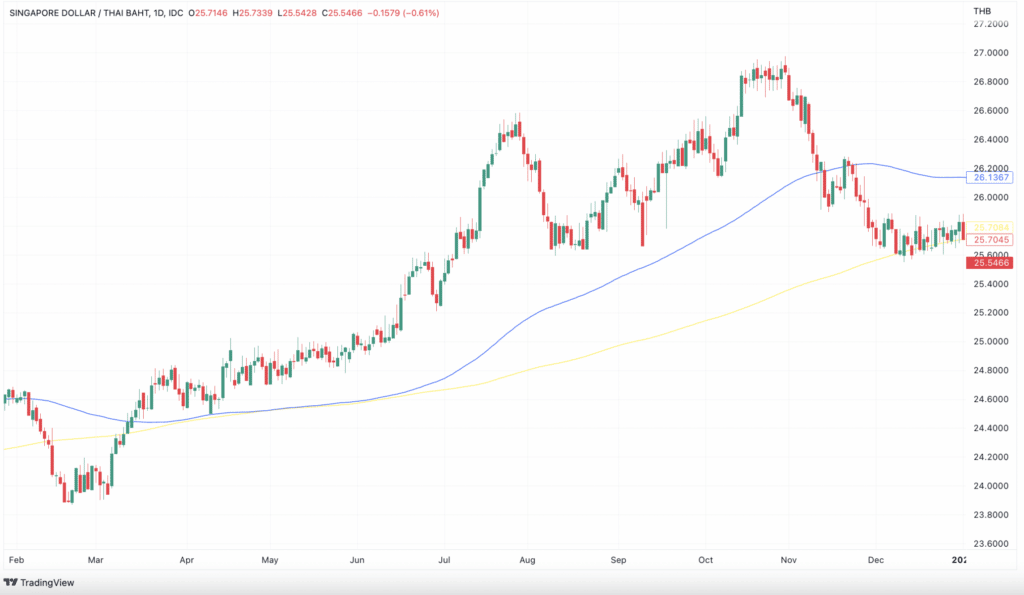

The safe haven of the Singaporean dollar showed itself once again against the Thai Baht in 2022, although there was a more recent pullback. Despite the macroeconomic uncertainty over the last month, the pullback and downside move in favour of the THB has remained robust, giving us reason to stay on the fence regarding our directional bias. You see, based on the fundamental analysis, we see an upside move and bullishness for the SGD. But, looking at the charts, we can see a move lower emerging. As a result, we remain neutral on the pair as the current price action means we cannot be sure of an upside move.

SGDTHB Fundamental Analysis

Singapore’s growing financial centre and resilient housing market make it a preferred choice of investors during macroeconomic uncertainty. In addition, its strong growth rate, as a result of Singapore’s extremely business-friendly regulatory environment for entrepreneurs, means it is an attractive investment regardless of the general economic climate. The country is also a major trading hub, with its manufacturing and services sector remaining one of its key growth drivers. As a result, the Singapore dollar has performed well in times of increased economic and market risk (most of 2022), with investors using it as a safe haven against more risk-associated currencies.

The rise of the Thai economy has resulted in currency traders flocking to the THB. According to the TradingHours website, it is the 19th most popular currency in the world, while other publications have labelled it “the best currency in Asia.”

As with other currencies, the value of the THB is impacted by the country’s current geopolitical and economic situation, with government and central bank actions resulting in potential price volatility. In addition, while the Thai government has a plan for economic growth, the country is impacted by significant external debt.

Related Articles

- SGDPHP Forecast and Live Chart

- SGDJPY Forecast and Live Chart

- SGDMYR Forecast and Live Chart

- What Are Exotic Forex Pairs?

- Forex Charts

SGDTHB Technical Analysis

Throughout 2021 and 2022, the SGDTHB has been in a strong uptrend, only breaking below its 200 MA on the daily chart on one occasion in March 2022. However, after a recent pullback from its rise, the price is hovering just above that 200 MA level again. Given that it keeps retreating to the area following small rallies, we see an eventual break to the downside, despite the current macroeconomic environment favouring the SGD. Whether a downside move can be sustained is another question, but we see 25.043 acting as the next potential support area.

Trade SGD/THB with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.