The value of gold influences the modern world’s economies and, as a result, the forex markets. In ancient times gold coins were the currency of choice for much of the world. That situation gradually evolved into one where the value of paper currencies, such as the US dollar and the British pound, was supported by the supplies of gold held by the governments.

That formal linkage was known as the Gold Standard. In the 1930s, Britain and the United States stopped using the system, and in 1971 the Gold Standard was finally abandoned for the major currencies. That meant fiat currencies were no longer supported by a country’s gold reserves. But the fact that central banks and investors still hold significant amounts of the metal gives a clue to the influence gold prices have on the forex market.

It’s possible to trade gold outright, but for others, the relationship between gold and currencies opens the door to trading forex pairs. Trading currencies can be cheaper and easier to do; it’s just a case of knowing how the precious metal influences currency values.

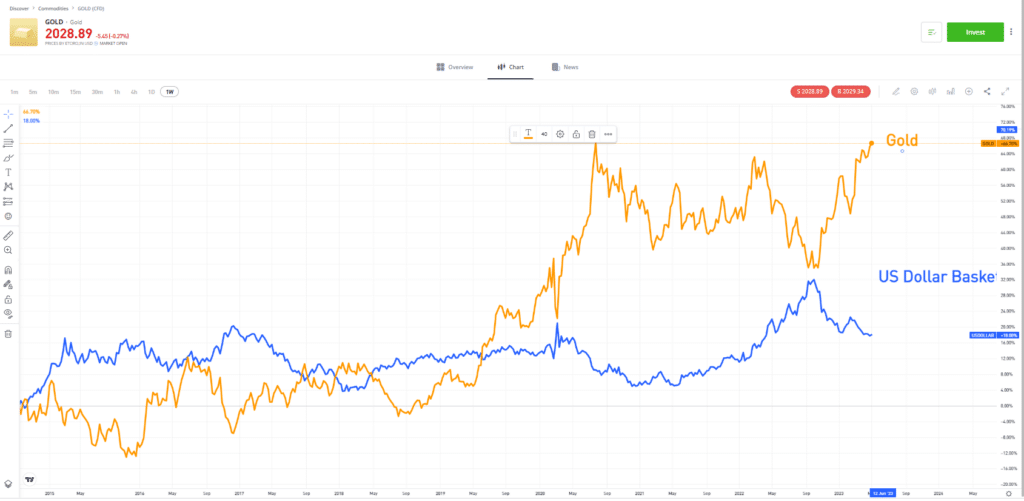

Gold and US Dollar Basket Index – Combined Price Chart – 2014 – 2023

Source: eToro

How are Gold and Forex Related?

Gold might no longer be used to facilitate day-to-day transactions, but it could be. Its role as a safe-haven asset is based on the belief of many that if the financial system imploded, gold could replace fiat currencies.

That’s a plausible argument considering the relatively limited supply of gold and the fact that it has performed that function during previous times. It is possible to store gold in a relatively small space, it is durable, and as a result, many people keep gold to ensure they would still have a means of exchange in tumultuous times.

Gold is also held as a hedge against inflation. The thinking goes that if the US Federal Reserve doubled the supply of US dollars in circulation overnight in what would be an inflationary move, then the price of gold would also double. Gold is traded mainly in dollars, and the fact that there was more paper currency wouldn’t be enough to convince holders of gold, or gold miners, to sell their assets when all other goods and services would at the same time double in price.

Between September 2014 and April 2023, the price of gold increased by 66%. That move reflected that central banks were running loose monetary policies, which dated back to the quantitative easing packages after the financial crisis of 2008. As long as the supply of fiat currencies was increasing, so was the price of gold.

Related articles

- What is a Gold Contract?

- From the Gold Standard to Floating Exchange Rates

- What Are Precious Metals?

How Gold Affects Different Currencies

The relationship between gold and forex prices varies according to the intrinsic value of each currency. For example, the euro and the dollar are attractive for different reasons. The euro tends to be in greater demand during periods of economic growth, while the dollar has dual use as a safe-haven asset, so it is in increased demand when the outlook is less favourable.

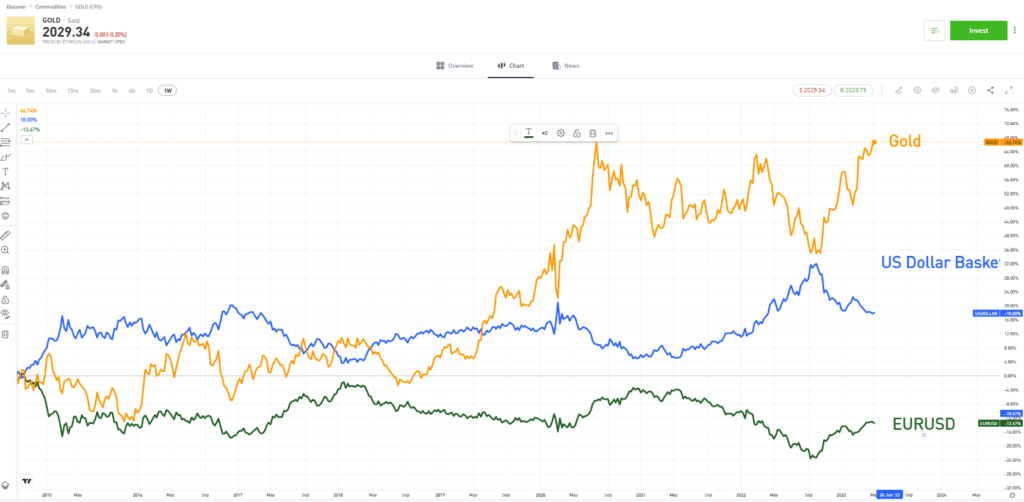

Between 2014 and 2023, and specifically after the Covid pandemic of 2020, the price of gold outperformed the US Dollar Basket index and EURUSD. Gold was seen as the optimal hedge against financial and social uncertainty, and the greenback was regarded as a better option to hold than the euro during a period of financial stress.

Gold, US Dollar Basket Index and EURUSD – Combined Price Chart – 2014 – 2023

Source: eToro

Why doesn’t the US dollar track the price of gold anymore?

Until June 2019, gold’s price was closely aligned with that of the US dollar. After that point, investors became increasingly concerned about the inflationary implications of increasing US government borrowing to print more paper money. That policy was initiated under the guise of stimulating the country’s failing credit-driven economy, and for many investors, gold appeared to be a better way of storing wealth.

Gold and the Aussie Dollar

The Australian dollar has a more complex relationship to the price of gold. The country is seen as a growth economy that will perform well when investors take a risk-on approach and not so well when the market mood becomes cautious. At the same time, the country has the most extensive known reserves of gold in the world (17%) and is a net exporter of the metal. When gold prices increase, that often translates as a rise in the price of AUDUSD as someone wanting to purchase the metal from Australia will need to buy the country’s currency to carry out the purchase.

Gold and the Swiss Franc

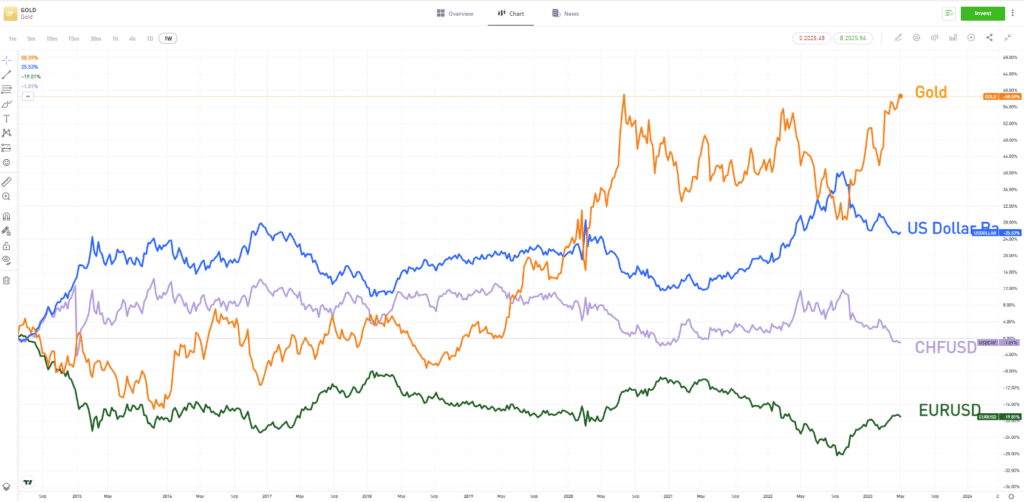

The Swiss franc only gave up on the Gold Standard in 2000. It was the last currency to ditch being tied to gold, with the franc being seen as a safe option that would hold its value during market distress.

The Swiss franc can no longer be exchanged for gold, and the county’s more relaxed approach to monetary policy has also diminished its reputation among international investors. As a result, the correlation between CHFUSD and gold prices has weakened over recent years.

Gold, US Dollar Basket Index, EURUSD and CHFUSD – Combined Price Chart – 2014 – 2023

Source: eToro

Inflation and the Price of Gold

The relationship between the price of gold and inflation varies over time. That causes a heated debate among analysts, with some stating that the link between the two will ultimately hold and others pointing to a paradigm shift.

The Traditional View of the Relationship Between Gold and Inflation

Renowned investor Marc Faber takes a largely pessimistic view of how markets operate. His Gloom, Boom & Doom report has accurately predicted when disconnects in the financial system result in asset prices crashing.

Faber’s comments about how central banks are inflating the money supply led him to conclude that it is time to stock up on gold. The metal has intrinsic value as a store of wealth and acts to avoid speculative inflationary activities of central banks and governments.

People Also Read

Historical Data and the Correlation Between Gold and Inflation

The only way to dig into the strength of the traditional theory is to consider historical prices. By checking the cross-correlation between oil, gold, and inflation over 30 years, beginning in 1980 until today, forex traders’ analysts were able to draw some surprising conclusions.

Our team of analysts studied the relationship between year-end gold prices in the period 1980-2009 and annual CPI (Consumer Price Inflation) inflation figures in the US by introducing a lag of seven years at a confidence interval of 95%.

As you can see in the above graph, there is barely a perceptible relationship between year-on-year CPI and gold prices. Correlation never rises above 0.2, which is well below the red lines indicating the lack of a statistically significant relationship between the two instruments.

How to Trade Gold

The correlation between gold and inflation might have temporarily (or permanently) broken down, but many investors still hold some of their wealth in the metal. The good news is that there are several ways to buy and hold gold, with the best-fit approach often coming down to an individual’s personal circumstances.

Gold CFDs

A more convenient and possibly cost-effective way to gain exposure to the price of gold is to buy the metal using an online broker offering CFD markets. Setting up an account and trading gold within a few minutes is possible. Contracts For Differences allow clients to make profits or losses on changes to the price of gold without holding the metal in physical form.

Most CFD brokers don’t charge commissions on trades, and investors can sell short if they think the price of gold has overshot to the upside. Leverage is another feature offered by CFDs which allows investors to scale up on risk-return by effectively borrowing from the broker to have a larger position. Using leverage comes with added risks as losses and profits are magnified.

Gold CFD – Combined Price Chart – 2013 – 2023

Source: eToro

Gold Stocks

A tried and tested way of following the gold price without buying the metal itself is to buy shares in gold mining firms. Their fortunes are closely tied to the price of gold, and equities often pay dividends, representing a regular income stream.

Stocks are easy and cheap to trade, you can pick the right broker, and there are few ongoing management fees. There are plenty of potential firms to choose from. Stocks of companies which specialise in the ‘bonanza’ world of gold exploration tend to have higher price volatility due to the hit-and-miss nature of their operations. In contrast, some of the bigger miners have market capitalisations of billions of dollars and are established blue-chip businesses with years of experience extracting and shipping gold. All their shareholders are waiting for is a spike in the price of the metal.

Gold ETFs

ETFs (Exchange Traded Funds) allow investors to buy a range of gold-related assets with the click of a button. Each ETF has different constituent parts; some are weighted heavily to holding the metal itself, while others are diversified to a greater extent and include stocks of firms operating in the gold sector.

ETFs typically have lower running costs than CFDs, so they are popular with longer-term investors. There is less likelihood of any profits being eaten away by administrative costs.

Buying Physical Gold

Some investors buy gold in its physical form as bullion or jewellery. This allows them to have hands-on access to their holding, which ties in nicely with its worth being associated with the risk of a meltdown in the financial markets. An investor holding a position in a fund-style product or listed equity is likely to consider their investment secure, but a niggling doubt that there might be a ‘run on the bank’ or a problem with their broker means some prefer to hold gold itself.

The obvious downside of holding gold in physical form is that making that process secure can be costly and leaves the holder vulnerable to loss through theft.

Whichever route you take to buying gold, it is possible to find a range of strategies to help your trading get off to the best start. Whether you are looking to scalp short-term moves or invest in swing trades with a long-term view, there are countless ways to identify trading opportunities in the gold market.

The Best Brokers for Trading Gold

Online brokers have revolutionised how people trade gold. Intense competition between the firms ensures costs are kept low and service levels high. It’s essential to choose a broker regulated by a Tier-1 financial authority, such as the FCA (Financial Conduct Authority), as that offers greater security from an operational risk perspective.

eToro

Well-regarded broker eToro has grown to have more than 2.7m active clients. The user-friendly platform is ideal for beginners as they can trade using their own strategies or use copy trading to follow the ideas of other, more experienced traders.

Pepperstone

Pepperstone was formed in 2010 by a group of experienced traders. The Pepperstone platform still has the feel of being built by traders, for traders and focuses on ensuring clients enjoy a high-grade user experience. The T&Cs and pricing are competitive, and the customer support team can be contacted via email or phone on a 24/7 basis.

AvaTrade

Dublin-based AvaTrade is one of the best-regulated brokers in the world. It operates under licences from the financial authorities of Japan, Australia, South Africa, Ireland, UAE, and the British Virgin Islands. It specialises in stock, forex, and commodity CFD markets and has a reputation for developing new trading tools and services to give its clients a trading edge.

Final Thoughts

Gold never seems to lose its allure to investors. That counts for something, especially when other riskier assets face a headwind. It is also often included in the portfolios of beginner and advanced traders. Buying and selling gold has been made increasingly accessible thanks to brokers offering new ways of tapping into the metal’s investment prospects. With others using the metal’s price as an indicator for trades in other related assets, such as currencies, gold still has influence.

Choose one of our Top Brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.