When retail forex trading became a reality in the nineties, a number of traders emerged as champions of the art form and have gone down in history as major influencers. Bill M. Williams (1932 – 2019) was one of these individuals, who was not only known for his trading prowess in stocks, commodities, and foreign exchange, but also for the many books he authored relating to technical analysis, trading psychology, and chaos theory.

He is better known, however, for the many technical indicators that he developed over time to put basic functionality to his proffered theories. One of his favourites was the Alligator Indicator, introduced in 1995, which conjured up the notion of open jaws and feeding time as a way to optimize market entry positions. Gaining an edge in the market is often said to be the proven way to be successful in the forex market, and technical indicators are the tools of the trade.

The Alligator forex indicator is a respected tool in the forex trader’s toolbox. It is a standard offering in most every trading platform, including MetaTrader 4 (MT4) and others proprietary systems, as well. The Alligator is as much a metaphor as it is an indicator. It consists of three lines, overlaid on a pricing chart, that represent the jaw, the teeth and the lips of the beast, and was created to help the trader confirm the presence of a trend and its direction.

- The Alligator’s Traits

- How the Alligator Indicator Works

- Calculating The Alligator Indicator

- How to use the Alligator Indicator in forex trading

- Combining the Alligator With Other Indicators

- Related Articles

- Using the Alligator In forex trading

- A Simple Alligator Indicator Strategy

- The Best Forex Demo Accounts

- Example of an Alligator Indicator strategy trade

- Concluding Remarks

- Don’t Trade Before you see this!

- Continue Learning

- The Alligator’s Traits

- How the Alligator Indicator Works

- Calculating The Alligator Indicator

- How to use the Alligator Indicator in forex trading

- Combining the Alligator With Other Indicators

- Related Articles

- Using the Alligator In forex trading

- A Simple Alligator Indicator Strategy

- The Best Forex Demo Accounts

- Example of an Alligator Indicator strategy trade

- Concluding Remarks

- Don’t Trade Before you see this!

- Continue Learning

The Alligator’s Traits

The traits or behaviour characteristics of the Alligator are numerous. They typically fall into four distinct phases:

- If the three lines are flat and entwined, then the Alligator’s mouth is closed and he is said to be sleeping.

- As he sleeps, he gets hungrier by the minute, waiting for a breakout from his slumber when he will eat.

- When the trend takes shape, the Alligator wakes and starts eating.

- Once satiated, the Alligator closes his mouth once again and goes to sleep.

The Alligator indicator can also help traders designate impulse and corrective wave formations, but the tool works best when combined with a momentum indicator. In the example to follow, the Commodity Channel Index (CCI) is used for this purpose. The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are also two popular momentum indicators, designed to measure the strength or weakness of current pricing behaviour.

No indicator is foolproof. False positive signals are a reality, and since the Alligator is a lagging signal creator based on simple moving averages, it is always best to confirm entry points by using other methods, either another indicator, pattern recognition, or perceived levels of strength and resistance. In summary, the Alligator indicator does help the trader stay in the position for a longer period. Williams also developed a “Gator” histogram indicator to help visually with its interpretation and provide another means of validation.

How the Alligator Indicator Works

The Alligator indicator is common on Metatrader4 trading software, and the calculation formula sequence involves these straightforward steps:

- The Alligator’s Jaw, the “Blue” line in the diagram below, is a 13-period Smoothed Moving Average, moved into the future by 8 bars.

- The Alligator’s Teeth, the “Red” line, is an 8-period Smoothed Moving Average, moved by 5 bars into the future.

- The Alligator’s Lips, the “Green” line, is a 5-period Smoothed Moving Average, moved by 3 bars into the future.

In other words, the Alligator is sensitive to the various crossings of differently timed moving averages. Williams concluded that his indicator helped the trader to “keep his powder dry” until the opportune moment to go into attack mode, in much the same fashion as an alligator that takes its time to size up an opportunity before it swiftly strikes at its prey.

Calculating The Alligator Indicator

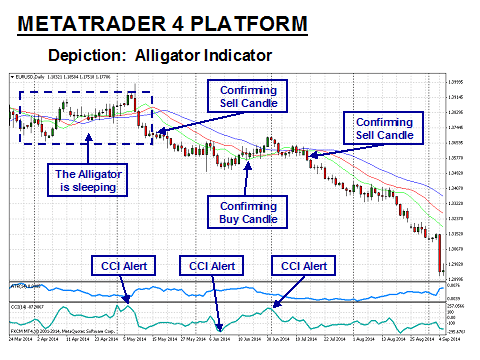

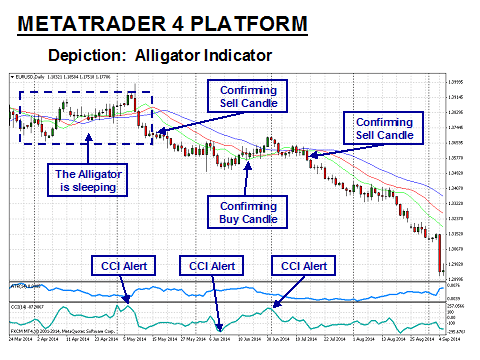

The actual calculations specify the totaling of closing prices over the representative periods, noted above as 13, 8, and 5, which are then shifted forward on the chart between 3 to 8 time periods. The results are alternated over varying timeframes to produce the Jaw, Teeth, and Lips. Software programs perform the necessary computational work and produce an Alligator indicator as displayed in the following annotated chart:

In the example above, the “Jaw”, “Teeth”, and “Lips” are shown for both downtrend and uptrend movements, as the EUR gyrates versus the USD. When the green and red lines above cross the blue line, it is regarded as a sell signal, and vice-versa. Note the two downtrend occurrences of this crossing signal, each preceding a downward fall in price behavior. The Alligator is shifted forward to anticipate a change in direction and visually appears a few bars beyond current price movements. The confirmations from the CCI, in these examples, occur in the current time period.

The weakness in the indicator is that timing may lag due to its future positioning, the reason for attaching a momentum indicator to anticipate the Alligator’s signal. The CCI alerts signaled overbought or oversold conditions for each occasion. Candlesticks also provide additional insights into what the expectations of the market might be going forward.

How to use the Alligator Indicator in forex trading

Statistics have shown that forex markets tend to be stuck in tight ranging periods from 70% to 80% of the time, but the objective of the trader is to profit when prices break out of those tight boundary conditions and form a new trend. The trend is always your friend, and the way to consistently win in this venue is to be patient and then ride a trend for all it is worth. In other words, patience is required until opportunities arise during the 20% to 30% trending periods. [F]

The Alligator is one technical tool that metaphorically “sleeps” during ranging periods, and then awakens quickly to feed voraciously, as per the example depicted above. The Alligator indicator, with a period settings of “13, 8, 5” and shift settings of “8, 5, 3”, is presented in combination with the candlesticks on the above “Daily” chart for the “EUR/USD” currency pair.

Combining the Alligator With Other Indicators

In the example above, the “Blue” line is the Alligator’s jaw, the “Red”, his teeth, and the “Green”, his lips. The “CCI” indicator, or “Aqua” line, has been added to assist in reading the signals generated. One must remember that the Alligator, since it consists of moving average crossovers and is shifted ahead, will lag more than the CCI. The CCI will send the first alert, followed by the Alligator crossover and a closing candle above or below the three moving averages (See the various annotations in the diagram).

The key points of reference are when the lines are entwined, when they are “open”, and when the lines cross. When entwined, the Alligator is said to be sleeping. Patience is the message given here. When the lines are apart, the Alligator is eating. Stay in the trade as long as the candlesticks ride above or below the Alligator. When the lines converge or cross, it is time to consider entering or exiting, although a momentum indicator will fix a better exit point. Traders are also attentive to closing Candles. In the above example, an exit signal occurs when a Candle closes above the center Red line or teeth of the Alligator. During the second downward move, the Alligator, for this reason, would have kept you in the trade a little while longer for more profit.

Related Articles

Using the Alligator In forex trading

As for how the alligator indicator works for a sample forex trading strategy, focus your attention once more on the diagram, re-presented below, especially on the last downward move:

The following trading system is for educational purposes only. Technical analysis takes previous pricing behaviour and attempts to forecast future prices, but, as history has shown, past results are no guarantee of future performance. With that disclaimer in mind, the optimal entry and exit points that can be discerned from using Alligator analysis in combination with the “CCI” momentum indicator, which has been added in Aqua, and significant Candle closing prices that are positioned at key points related to the three-line set. Over time with practice, you may also develop more helpful hints to enhance these alerts.

A Simple Alligator Indicator Strategy

A simple Alligator strategy for the above example would then be:

- Anticipate your entry point when the Alligator lines are entwined (“sleeping”) and the “CCI” indicator is signalling an overbought condition.

- Execute a “Sell” order after the Green line crosses the other lines and a Candle closes below the three-line set, making sure that your position size is no more than 2% to 3% of your account, per risk management guidelines.

- Place a stop-loss order at 20 “pips” above your entry point. Traders also tend to use the various lines as places to put their stop-loss order, depending upon their risk tolerance. Practice on a demo system to find what works for you.

- Determine your exit point after the “CCI” warns of an oversold condition and a candlestick closes above the Red middle line. It is wise to hold while the three lines are far apart.

Steps “2” and “3” represent prudent risk and money management principles that should be employed. Also take note that the Alligator is a lagging indicator that works best after a long period of sleep. It is not effective in choppy markets, but, when a strong impulse wave occurs, it will tend to keep you riding the wave a little longer than most other trend type measuring gauges. At the end of the trading day, consistency is your primary objective, and, hopefully over time, Alligator Technical Analysis will help you gain an “edge”.

The Best Forex Demo Accounts

To master the Alligator trading strategy it is important that you practice it. Reading the signals the indicator correctly timing your entry and exit points are skills that need to be mastered in order to maximise your profits. This is where a forex demo account comes in: It allows you to practice your new strategy without risking any of your hard-won capital. Below we have picked out some of our favourite forex demo accounts to help you out.

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

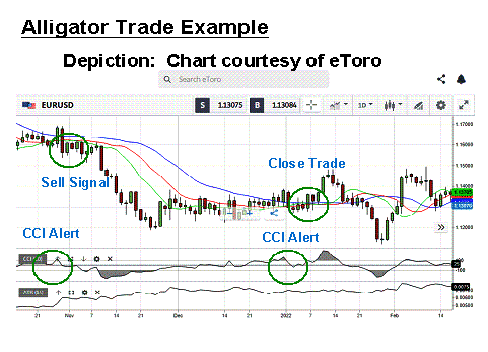

Example of an Alligator Indicator strategy trade

Once you become accustomed to the various signals provided by the Alligator, applying a related strategy in real time follows a predictable pattern. First, the Alligator sleeps, begins to wake when the ranging period concludes, and then persuades you to hold on while it feeds. The latter point is one more rule to follow – stay in the trade while the three lines are apart. If the Green line goes flat for a period, it is also time to consider closing the position. On the front end, it is also considered overly aggressive to open a position after the Green line only crosses the Red one. In this example, a downtrend continues, thereby suggesting that a single cross is the signal.

The above diagram illustrates just such an ideal trading example. The Alligator is sleeping, as indicated in the upper left of the chart. When the first CCI Alert occurs, it is time to take aim. Remember that the Alligator indicator is shifted from 3 to 8 daily periods forward. The single crossing is your signal to enter a trade, after the closing candle is registered below the Green line. When the Green line flattens or crosses again, it is time to exit. The second CCI alert is your confirmation.

In this example, there was a severe downtrend, which slowed when traders took profits. The trend commenced once again, but still had room to run before recovering. This simple trading system could have yielded a profitable trade of 250 “pips” or more on the front end. The Alligator was hungry early on, i.e., the 3 lines remained separated for an extended period of time. If this indicator appeals to you, develop a strategy around it and then practice and fine-tune that strategy on a demo system until it is routine.

Concluding Remarks

The Alligator indicator has become a popular technical tool that can help traders improve their entry and exit points in the chaotic forex market. More importantly, it can also help you hold onto a position until the trend has run its course. Beginners, as a rule, typically hold onto losses too long and close winning positions far too early. The Alligator can help in both situations.

As with any technical indicator, however, an Alligator’s signals will never be 100% correct. False signals can occur, but the positive signals are consistent enough to give a forex trader an “edge”. Skill in interpreting and understanding Alligator signals must be developed over time, and it is always recommended to complement the Alligator tool with another indicator or by observing a predictable pattern of pricing behaviour as confirmation of potential trend changes.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Continue Learning

- More Forex Indicators Explained

- RSI Indicator Explained

- ATR Indicator Explained

- Simple Moving Average Strategy

- Stochastics Indicator Explained

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.