Technical Analysis

Technical analysis is a way of predicting the future forex market movements based on previous market movement patterns and trends. From a Technical Analyst’s viewpoint all fundamental aspects are already a part of the previous market movements and therefore needs no special consideration. The main tool by which to analyse the forex market is forex charts.

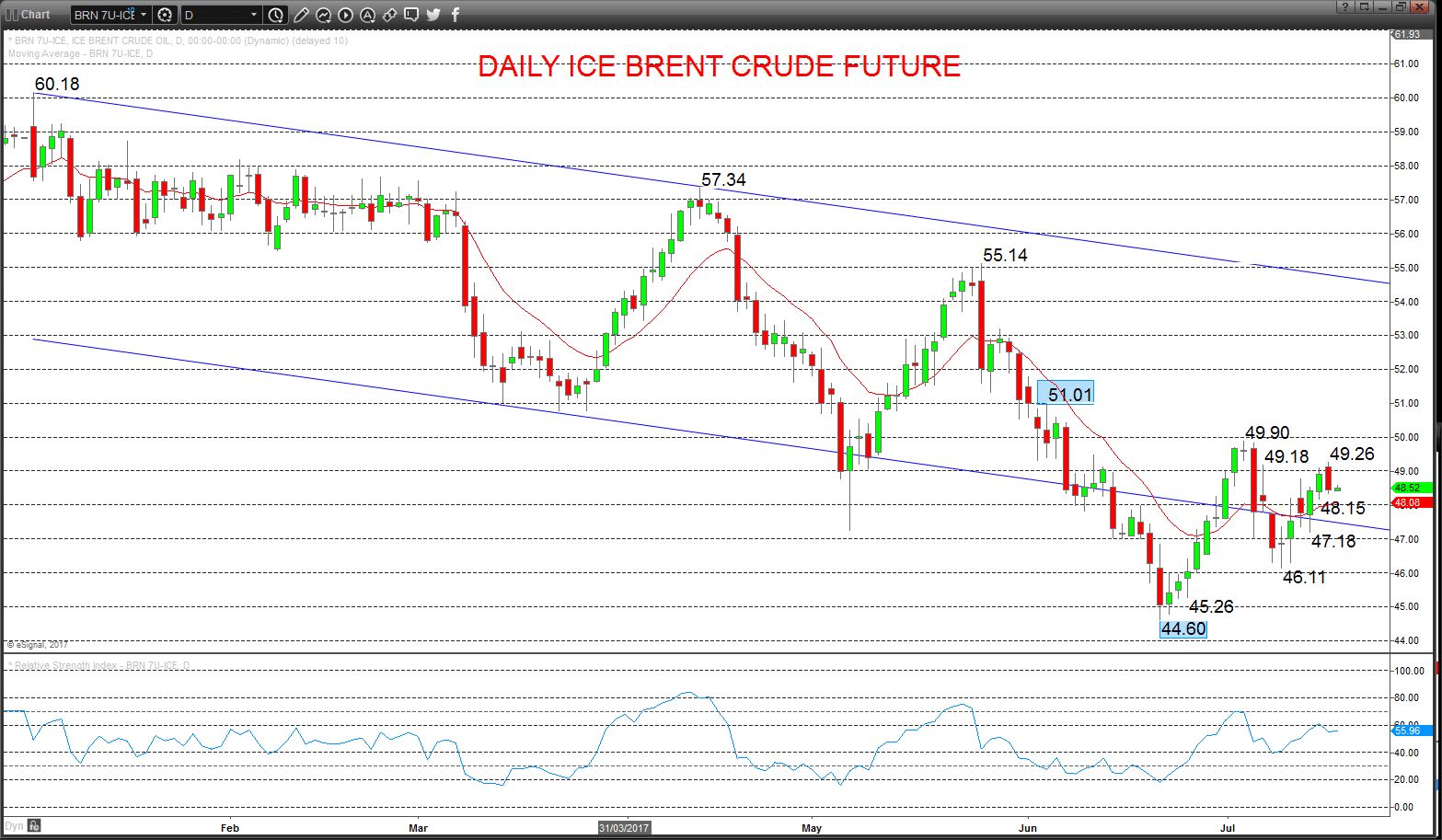

A Hawkish Bank of Canada Plus Higher Oil Sees USDCAD Lower

A July Oil price rebound has reinforced the positive tone for the Canadian Dollar. The Bank of Canada rate hike in early July…

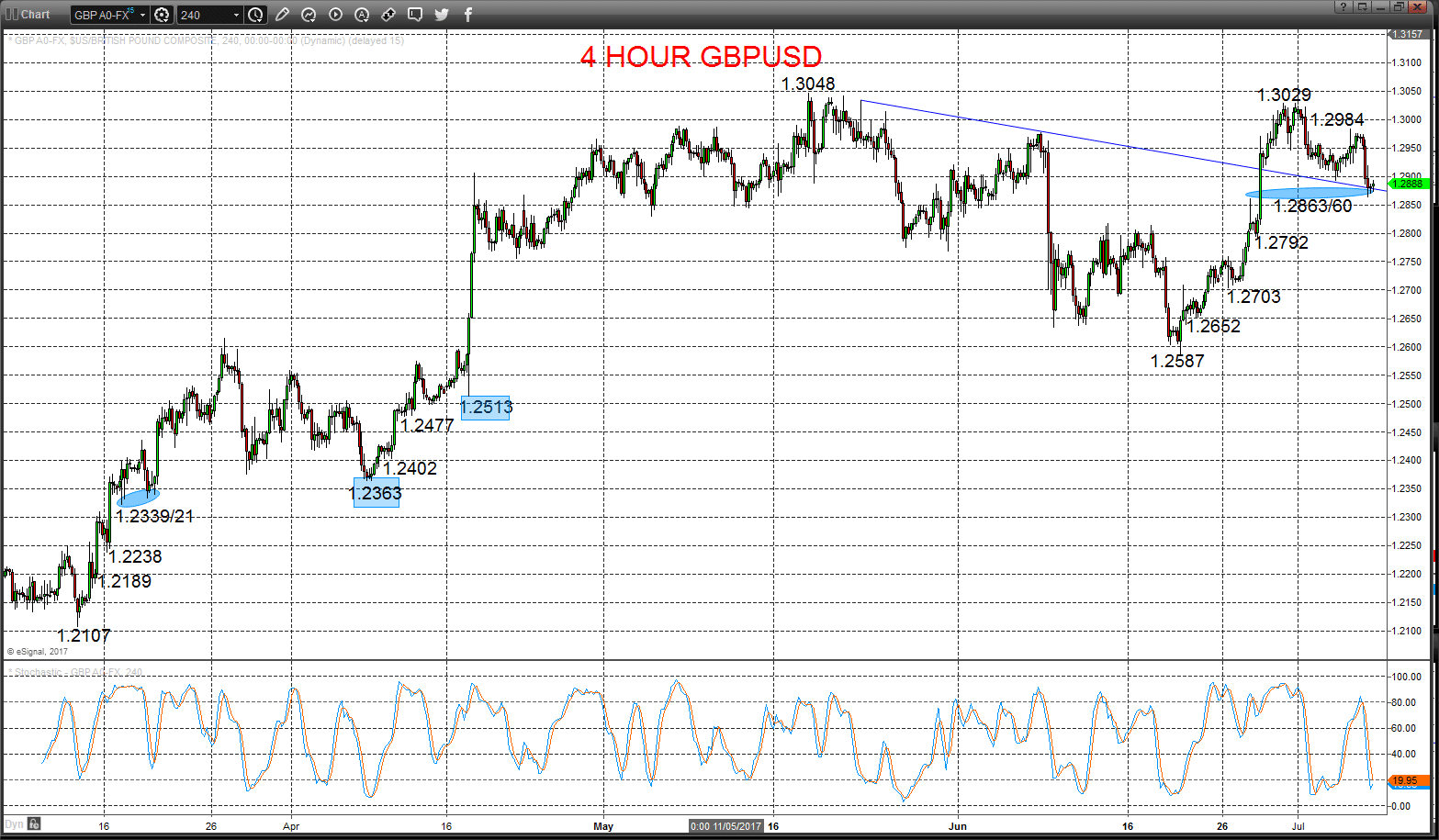

EURUSD and GBPUSD Stay Bullish for July

Both EURUSD and GBPUSD retain a bullish outlook on an intermediate-term timeframe into July. In particular, EURUSD continues to threaten significant higher price…

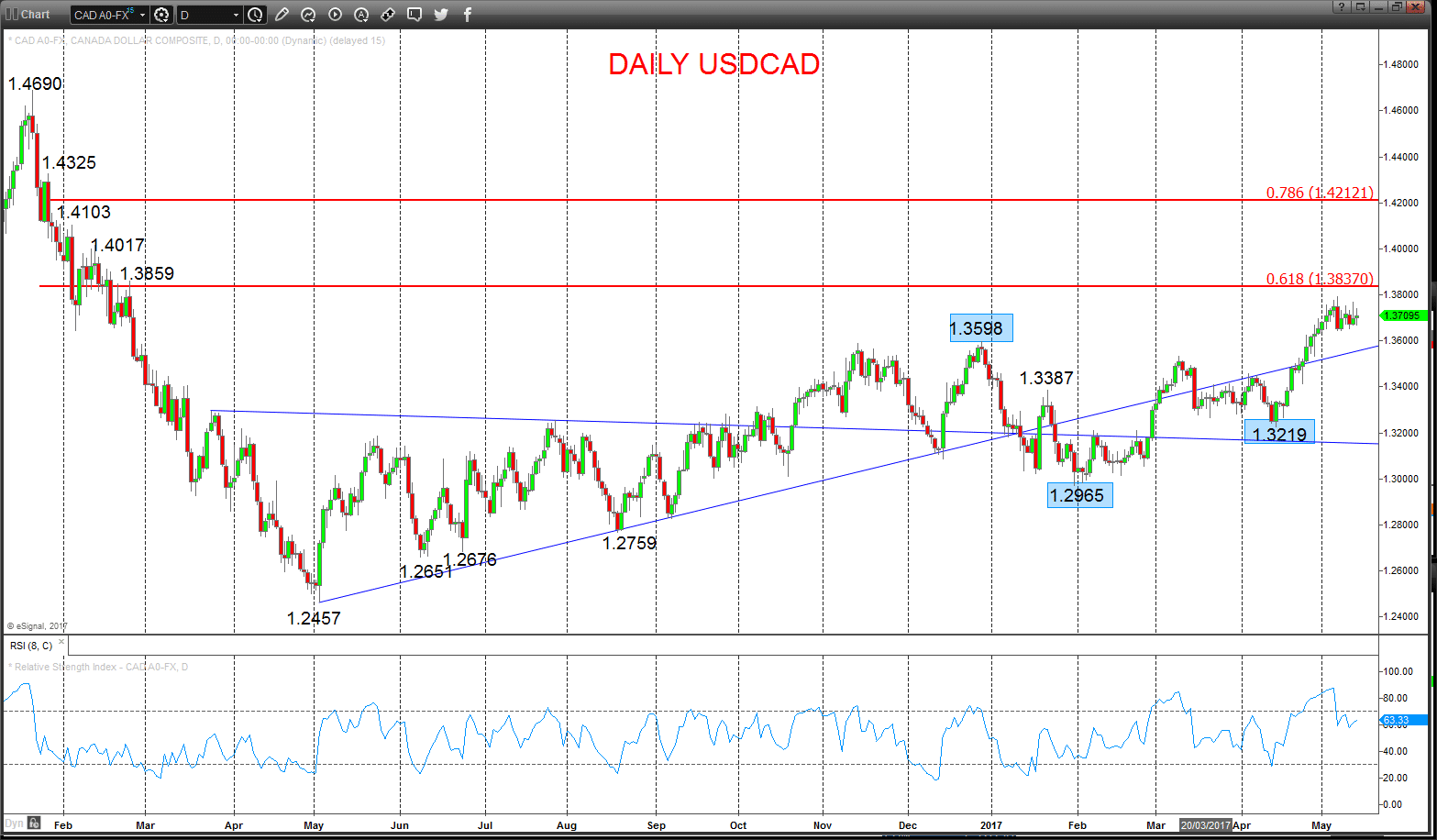

USDCAD Stays Bullish; USDJPY Solid Consolidation

A resilient consolidation tone for the US Dollar versus both the Canadian Dollar and the Japanese Yen moving into mid-May. For USDCAD the…

EURUSD Joins GBPUSD in Bullish Shift

A surge higher by EURUSD on Monday in reaction to the French Presidential election result has created an intermediate-term shift and sets the…

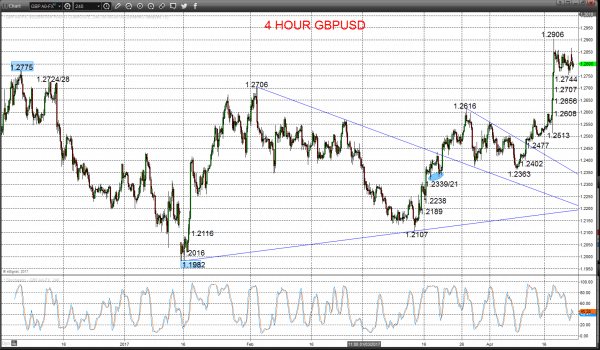

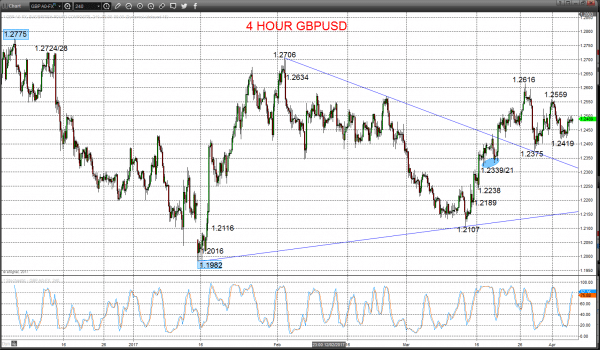

GBPUSD Aiming Higher, but EURUSD Downside Risks

GBPUSD has proved resilient in early April and has a positive bias within an intermediate-term range. The threat is for bullish shift, but…

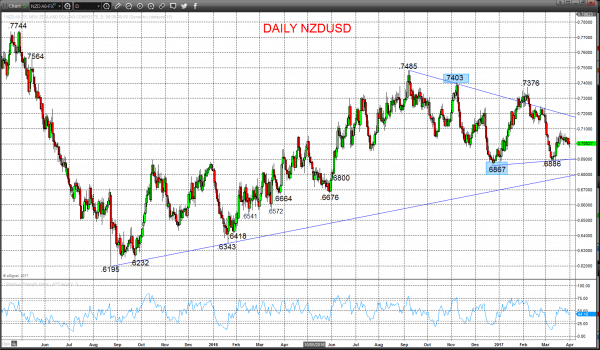

NZDUSD and AUDUSD Intermediate-Term and Short-Term Range Themes

AUDUSD and NZDUSD remain within broader range environments on an intermediate-term basis, but erratic activity into the end of March also leaves a…

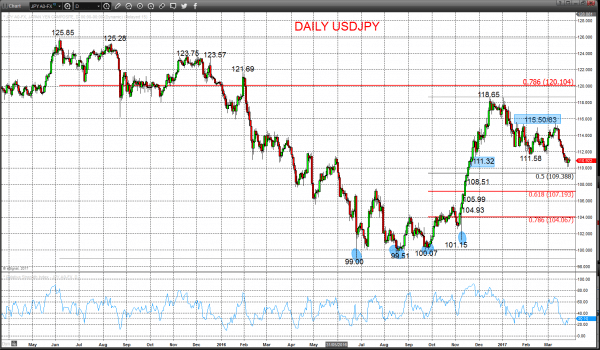

Mixed US Dollar Tone: USDJPY Stays Bearish with USDCAD Positive

Shifts in the outlook for the US$ have been frequent in Q1 2017, with switches in views for how hawkish or dovish the…

AUDUSD and NZDUSD Downside Risks

A shift in tone from various members of the FOMC since late February has produced a more positive tone for the US Dollar…

USDCAD Stays Bearish as USDJPY Threat Shifts Back to the Downside

The US$ has attempted to rebound in February against some of the major global currencies (versus the Euro for example) and ease the…

AUDUSD Upside Threats, whilst NZDUSD Corrects Lower

A bull tone still for AUDUSD into mid-February, echoing the bull trend for this year, leaving the bias for further gains into the…

US Dollar Strengthening Against the GB Pound and Canadian Dollar

Of the major global currencies, the British Pound and Canadian Dollar have displayed a more resilient tone against the US currency since the…

EURUSD Bear Threat to Parity (1.0000) After Italian Referendum

A lacklustre Euro rebound versus the US dollar since late November has simply been pause in the underlying bearish theme. Recovery activity has…

US Dollar Asserts a Bullish Theme Within G3, Post-Election Result

Extremely erratic price action across asset classes on Wednesday through the US election result, with an initial “risk off” move. This saw equity…

US Dollar Stays Vulnerable into US Election, but Outlook Remains Dollar Positive for Q4

A more bearish shift for US equity indices (and in turn for European and global equity markets) since late October into early November…

EUR and GBP Still Vulnerable Versus the US Dollar

Both the Euro and the GB Pound suffered significant losses into late October against the US Dollar, reinforcing intermediate-term bearish themes and also…

Between 74-89% of CFD traders lose

Between 74-89 % of retail investor accounts lose money when trading CFDs Between 74-89% of CFD traders lose

Between 74-89 % of retail investor accounts lose money when trading CFDs

|

|

||||

Your capital is at risk

Europe* CFDs ar... Your capital is at risk

Europe* CFDs ar...

|

|

||||

Your capital is at risk Your capital is at risk

|

|

||||

Your capital is at risk Your capital is at risk

|

|

||||