Reading forex charts is a vital skill every aspiring forex trader should learn. Live forex charts are available for free from many sources, including the popular MetaTrader platform and right here at ForexTraders. Forex charts show the exchange rate for two currencies and how that changes over time. These currency pairs are referred to with their respective 3-letter codes. The most popular currency pair, the Euro versus the US Dollar is reffered to as EUR/USD.

The International Organization for Standardization (ISO) is responsible for assigning a three-letter code or symbol to every recognized global currency. The first two letters of the code are typically the two letters of ISO country codes. They are also used as the basis for national top-level domains on the Internet, and the third is usually the initial for the respective currency.

Currency pairs are classified as Major, Minor, and Exotic. In the following article, you will learn about these classifications, how to access a free live chart for a chosen pairing, where to find more information on each forex pair and, lastly, what the basics are when it comes to reading live forex charts.

Reading forex charts is a vital skill every aspiring forex trader should learn. Live forex charts are available for free from many sources, including the popular MetaTrader platform and right here at ForexTraders. Forex charts show the exchange rate for two currencies and how that changes over time. These currency pairs are referred to with their respective 3-letter codes. The most popular currency pair, the Euro versus the US Dollar is reffered to as EUR/USD.

The International Organization for Standardization (ISO) is responsible for assigning a three-letter code or symbol to every recognized global currency. The first two letters of the code are typically the two letters of ISO country codes. They are also used as the basis for national top-level domains on the Internet, and the third is usually the initial for the respective currency.

Currency pairs are classified as Major, Minor, and Exotic. In the following article, you will learn about these classifications, how to access a free live chart for a chosen pairing, where to find more information on each forex pair and, lastly, what the basics are when it comes to reading live forex charts.

Major Currency Pairs

Major currency pairings involve the US Dollar with each of the other major currencies in the world – the EUR, GBP, JPY, CAD, AUD, NZD, and CHF (Swiss Franc). Over 50% of the daily trades in the forex market involve the USD, and the EUR/USD pairing accounts for 30% of daily turnover. The AUD, NZD, and CAD are commodity currencies since each nation's economy heavily depends on its export trade. The JPY is also regarded as a commodity currency since Japan must import nearly all raw materials. Liquidity tends to be high for these pairings, but Bid/Ask spreads can vary to a degree. You can find explanations on each of the major currency pairs in forex, along with links to free forex charts and in-depth guides, below:- EUR/USD: Most popular major pair, highest daily turnover, best for beginners

- USD/JPY: Very stable over time. Yen resembles commodity currency due to imports

- GBP/USD: Sometimes called "Cable", heavy volume but more erratic than EUR/USD

- USD/CHF: The pairing of two Reserve currencies, the Swiss Franc is known for its stability

- AUD/USD: The "Aussie" is a commodity currency, heavily dependent on trade with China

- USD/CAD: The "Loonie" is a commodity currency, heavily reliant on oil prices

- NZD/USD: The "Kiwi" is a commodity currency, heavily dependent on agriculture exports

Minor Currency Pairs

Minor currency pairs are any pairing of the major currencies without the USD. These pairs are also sometimes referred to as Cross Pairs, but there is a noticeable drop in market liquidity for these parings since volume turnover is much less than for major pairings. Lists of minor currency pairs often only include pairings with the JPY, GBP, or EUR, but globalization and its impact on international trade have broadened the definition. A list of popular minor currency forex pairs, along with links to live forex charts, and more in-depth information can be found below:- EUR/GBP

- EUR/AUD

- EUR/NZD

- EUR/CAD

- EUR/CHF

- EUR/JPY

- GBP/JPY

- GBP/CHF

- GBP/NZD

- GBP/AUD

- GBP/CAD

- AUD/JPY

- AUD/CHF

- AUD/NZD

- AUD/CAD

- NZD/JPY

- NZD/CHF

- NZD/CAD

- CAD/JPY

- CAD/CHF

Exotic Currency Pairs

All other potential currency pairings are given the Exotic classification and are more commonly known as Exotic Forex Pairs. These pairs are typically thinly traded and have wide Bid/Ask spreads if one is even given by a market maker. The more popular ones come from commodity-rich developing countries, where banking infrastructure is weak and political and economic stability is always in question. A list of popular exotic currency forex pairs, along with links to live forex charts and more in-depth information, can be found below:- AUD/SGD

- EUR/HUF

- EUR/NOK

- EUR/PLN

- EUR/SEK

- EUR/SGD

- EUR/TRY

- GBP/INR

- GBP/SGD

- NZD/SGD

- SGD/JPY

- SGD/MYR

- SGD/PHP

- SGD/THB

- USD/TRY

- USD/DKK

- USD/HUF

- USD/MXN

- USD/NOK

- USD/PLN

- USD/SEK

- USD/SGD

- USD/ZAR

- BTC/USD

How to Read Forex Charts

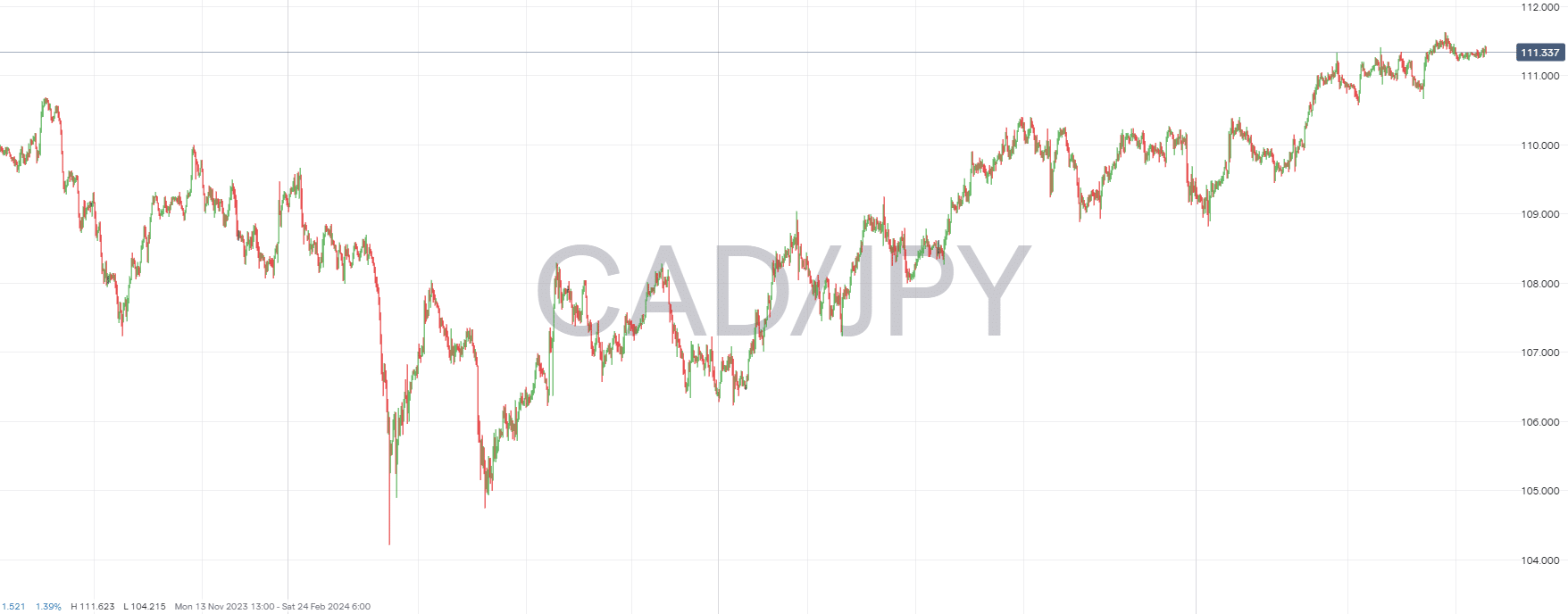

To trade forex currency pairs effectively, one of the first things traders need to learn is how to read a forex chart effectively. These charts are graphical representations of your chosen pair's previous and ongoing pricing behaviour. The vertical axis on the right of the chart displays the exchange rate, and the horizontal axis represents time. You may adjust the timeframe as you choose. Popular timeframes are Daily, Hourly, 4-Hours, 15 minutes, and even Weekly. For example, let's choose the minor pair of the Canadian Dollar versus the Japanese Yen, depicted as CAD/JPY. The first currency listed, CAD in this example, is always known as the "Base" currency, and the second 3-letter code, JPY in this case, is known as the "Counter" currency. The price on the right axis depicts the amount of Counter currency that can be purchased with one unit of the Base currency. An example of a forex chart for the CAD/JPY pairing is presented below: There are three ways pricing information is displayed on a live forex chart. During a specific time period, it is important to know the opening price, the closing price, and the high and low for the period. One method for presenting this data involves "Candlesticks", as depicted in the above chart, where the "bar" reflects opening and closing values, and the "wicks", high and low values. A green candle indicates that prices rose for the period, and red indicates a decline.

The second type is an HLOC or Bar chart. A line is used with notches for the open and close values. Lastly, there is a standard line chart, which connects closing prices over the period covered by the chart. This chart is handy for reviewing longer-termed trends, and occasionally, the area below the line is shaded, sometimes referred to as a Mountain chart.

Learning to read a live forex chart is vital to be successful at the trading of major, minor, or exotic forex pairs. The entire field of Technical Analysis is built around these charts, including the use of special indicators, pattern recognition, and establishing levels of support and resistance. If you would like more information in this technical area, Read our free guide to Technical Analysis.

There are three ways pricing information is displayed on a live forex chart. During a specific time period, it is important to know the opening price, the closing price, and the high and low for the period. One method for presenting this data involves "Candlesticks", as depicted in the above chart, where the "bar" reflects opening and closing values, and the "wicks", high and low values. A green candle indicates that prices rose for the period, and red indicates a decline.

The second type is an HLOC or Bar chart. A line is used with notches for the open and close values. Lastly, there is a standard line chart, which connects closing prices over the period covered by the chart. This chart is handy for reviewing longer-termed trends, and occasionally, the area below the line is shaded, sometimes referred to as a Mountain chart.

Learning to read a live forex chart is vital to be successful at the trading of major, minor, or exotic forex pairs. The entire field of Technical Analysis is built around these charts, including the use of special indicators, pattern recognition, and establishing levels of support and resistance. If you would like more information in this technical area, Read our free guide to Technical Analysis.

Don't Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading. These tips could help make you a better trader - and we're giving them away for free! Click here to get your copyTrade Forex with the Top Brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||